Murrey Math Lines 18.02.2021 (USDCHF, GOLD)

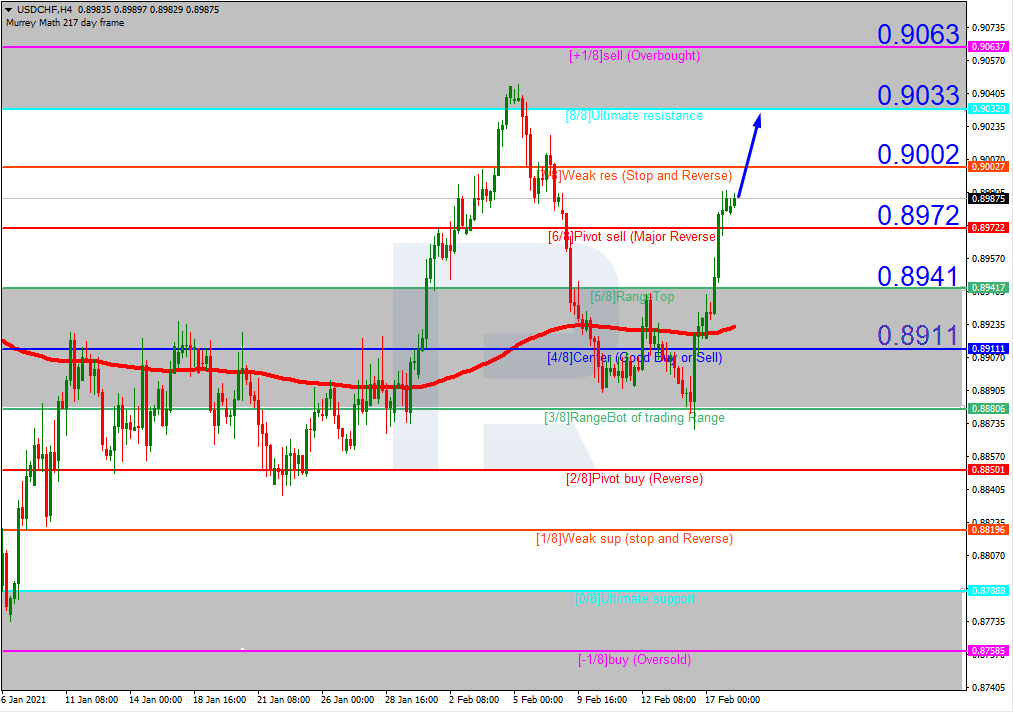

USDCHF, “US Dollar vs Swiss Franc”

In the H4 chart, after breaking the 200-day Moving Average, USDCHF is trading above it, thus indicating an ascending tendency. In this case, the price is expected to break 7/8 and then continue growing to reach the resistance at 8/8. Still, this scenario may no longer be valid if the price breaks 6/8 to the downside. After that, the instrument may fall to reach the support at 5/8.

![]()

As we can see in the M15 chart, the pair has broken the upside line of the VoltyChannel indicator and, as a result, may continue the ascending tendency.

![]()

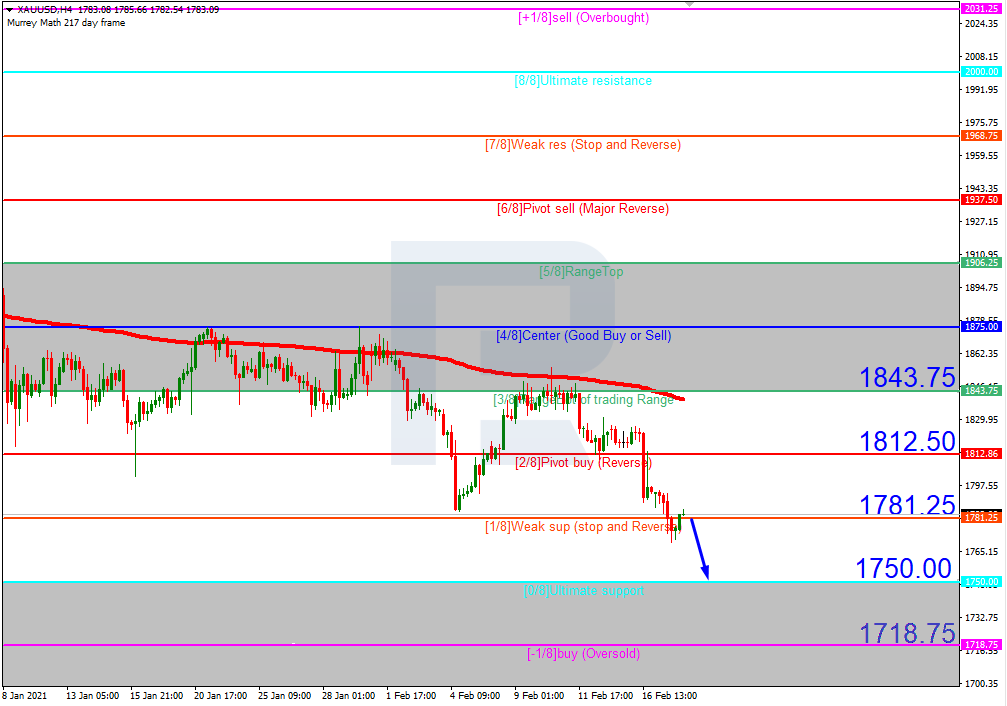

XAUUSD, “Gold vs US Dollar”

In the H4 chart, XAUUSD is trading below the 200-day Moving Averageб thus indicating a descending tendency. In this case, the price is expected to break 1/8 and then continue falling to reach the closest support at 0/8. However, this scenario may no longer be valid if the price breaks the resistance at 2/8 to the upside. After that, the instrument may correct to the upside towards 3/8.

![]()

As we can see in the M15 chart, the price has broken the downside line of the VoltyChannel indicator and, as a result, may continue falling to reach 0/8 from the H4 chart.

![]()