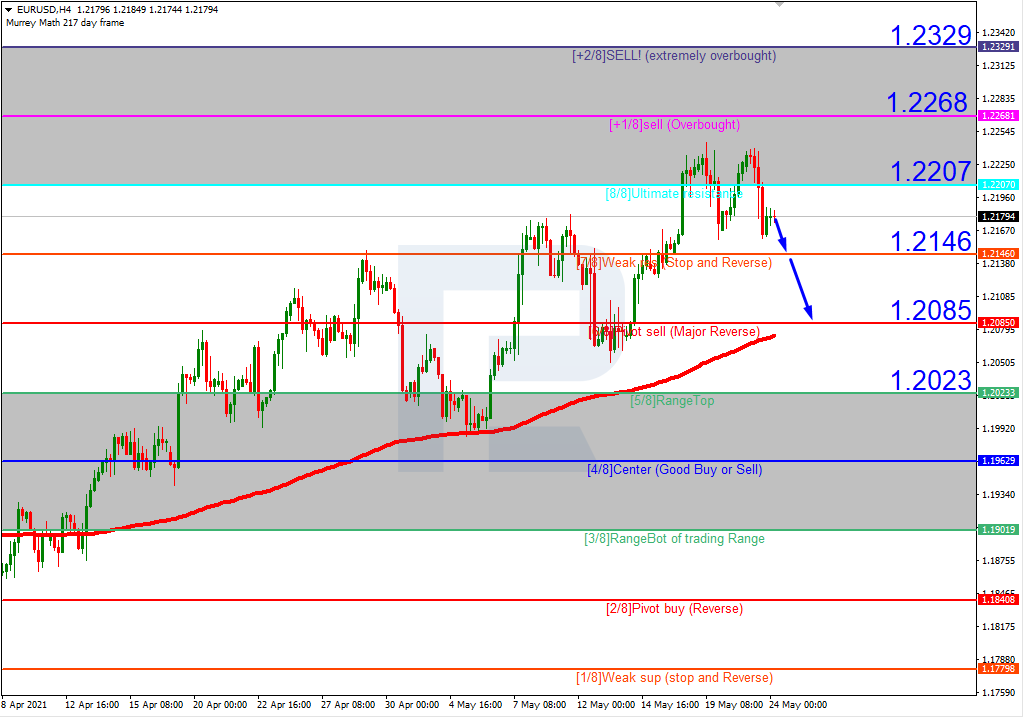

EURUSD, “Euro vs US Dollar”

In the H4 chart, EURUSD is trading outside the “overbought area”. In this case, the price is expected to correct downwards and reach the support at 6/8. Still, this scenario may no longer be valid if the price breaks 8/8 to the downside. After that, the instrument may continue growing towards the resistance at +2/8.

![]()

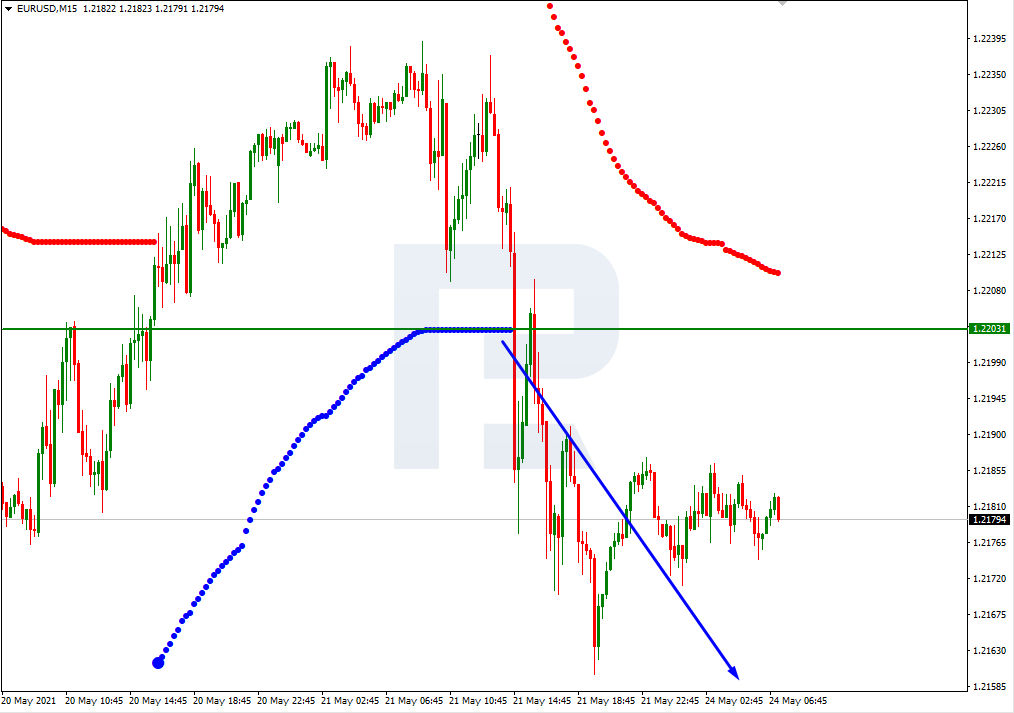

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue its decline.

![]()

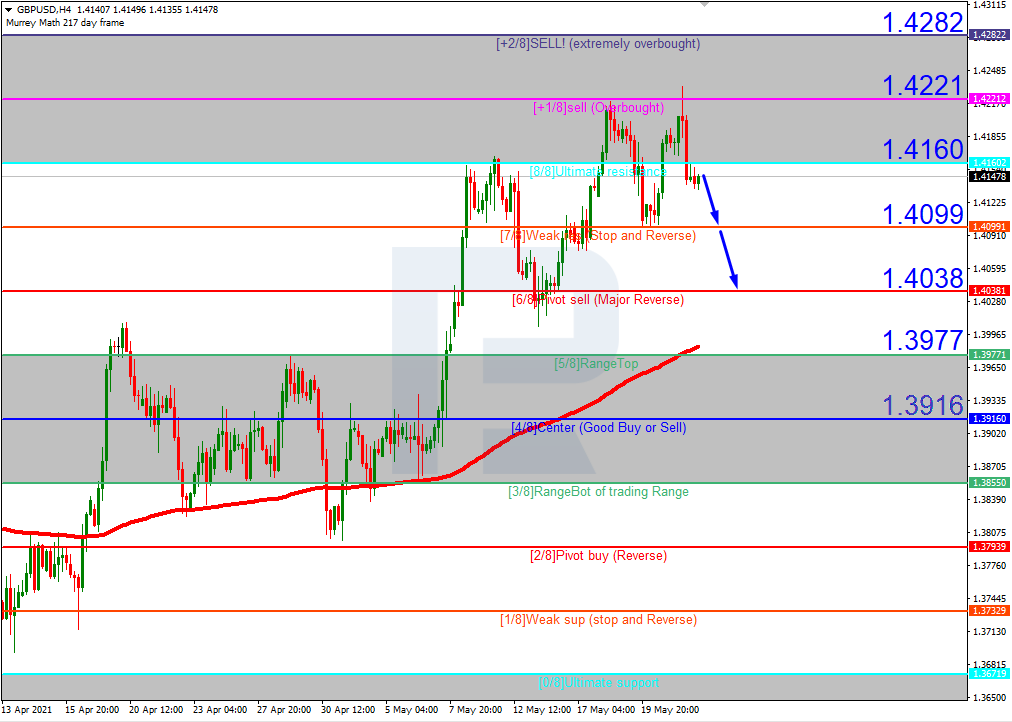

GBPUSD, “Great Britain Pound vs US Dollar”

In the H4 chart of GBPUSD, the situation is quite alike. After breaking 8/8, the pair is trading below it. In this case, the asset is expected to test 7/8, break it, and then continue falling towards the support at 6/8. However, this scenario may no longer be valid if the price breaks 8/8 to the upside. After that, the instrument may continue trading upwards to reach the resistance at +2/8.

![]()

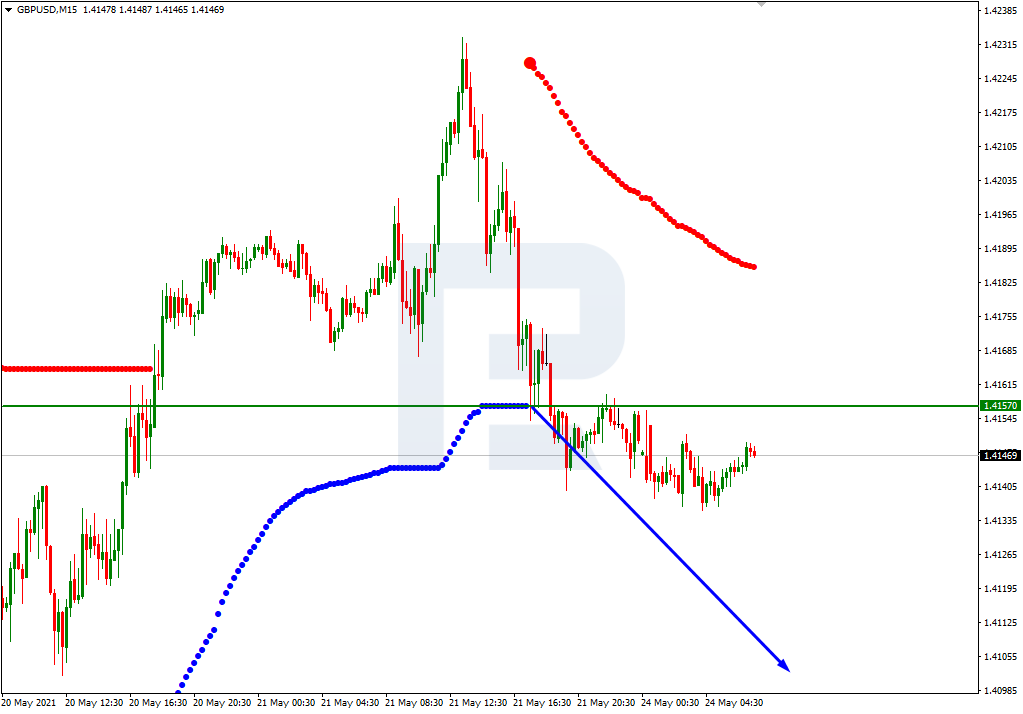

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue the descending tendency towards 6/8 from the H4 chart.

![]()