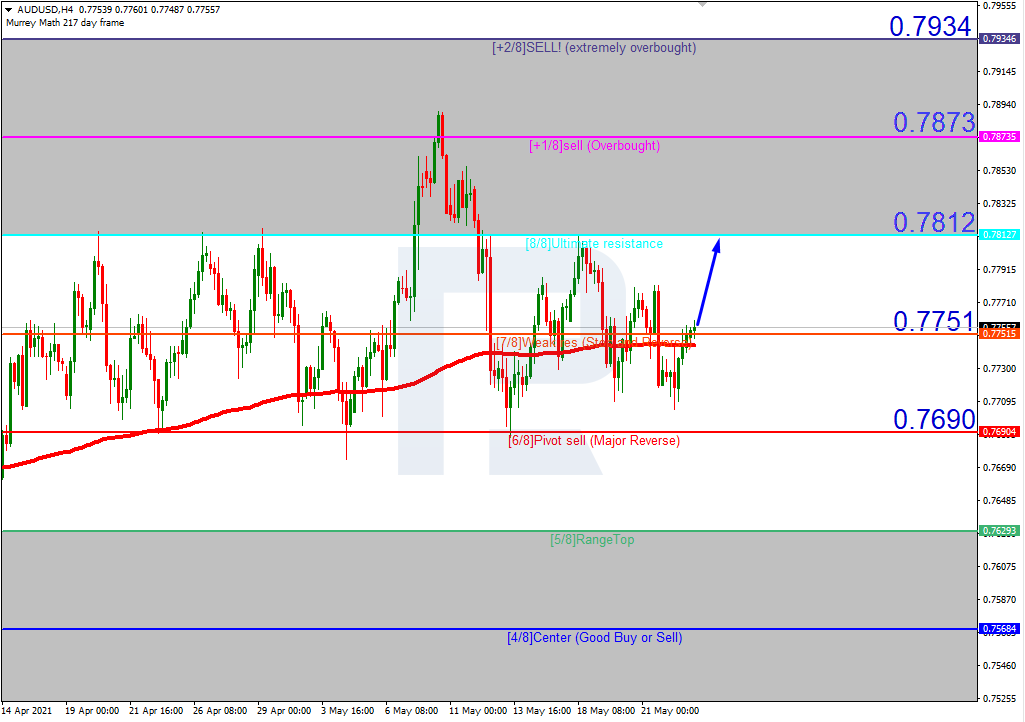

AUDUSD, “Australian Dollar vs US Dollar”

In the H4 chart, after breaking the 200-day Moving Average, AUDUSD is trading above it to indicate a possible ascending tendency. In this case, the price is expected to continue moving upwards and reach the resistance at 8/8. However, this scenario may be canceled if the price breaks 7/8 to the downside. After that, the instrument may continue falling towards the support at 6/8.

![]()

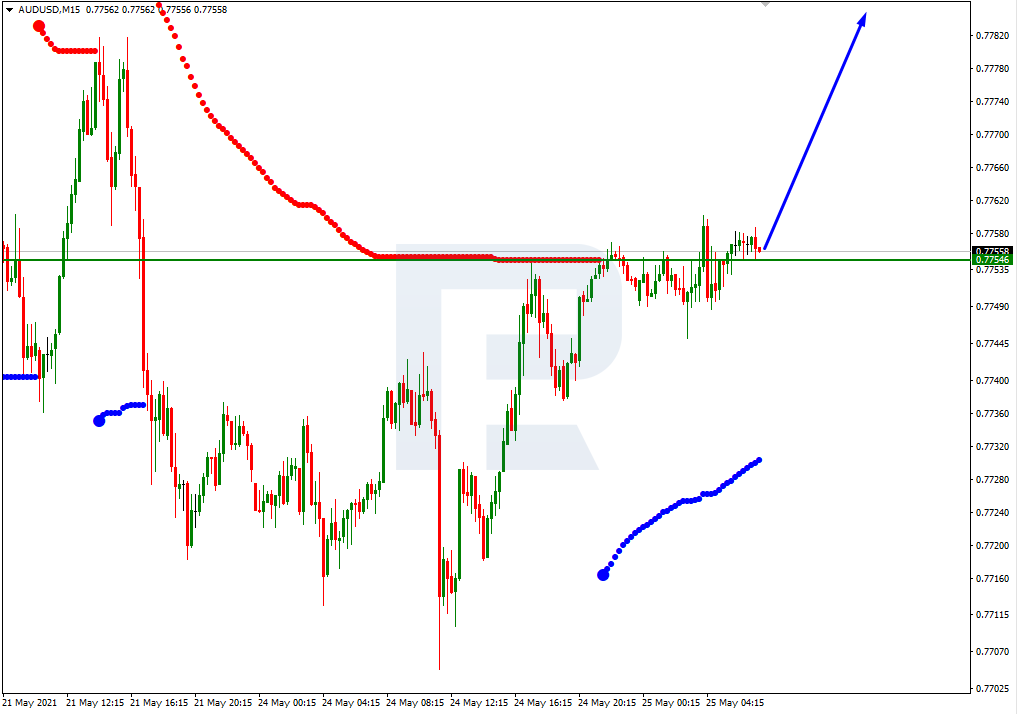

As we can see in the M15 chart, the pair has broken the upside line of the VoltyChannel indicator and, as a result, may continue trading upwards to reach 8/8 from the H4 chart.

![]()

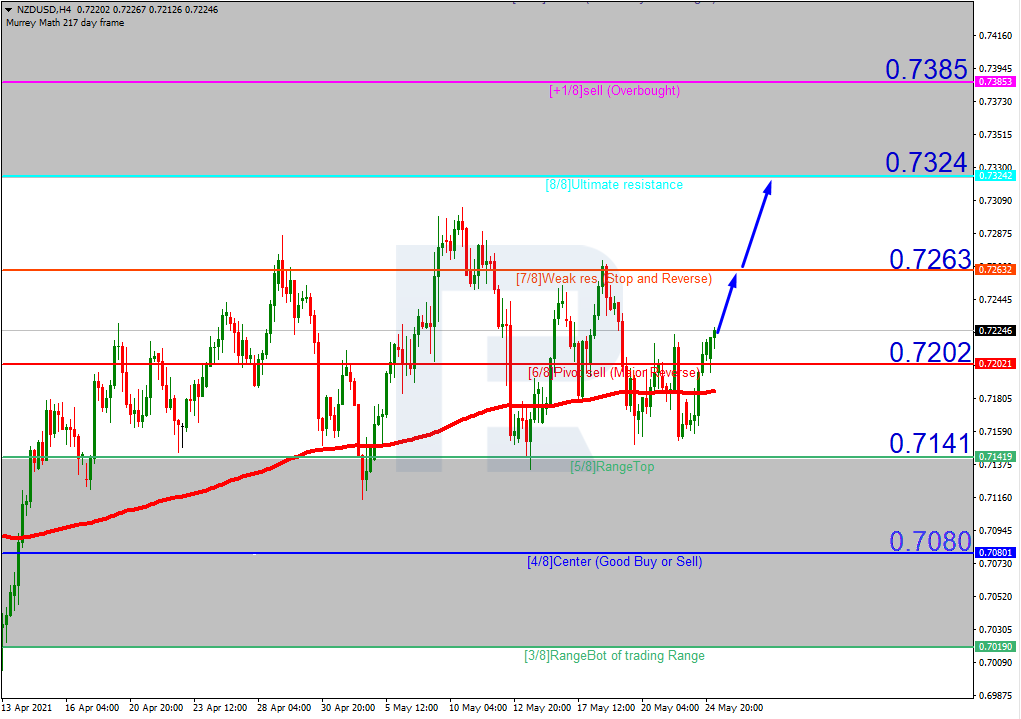

NZDUSD, “New Zealand Dollar vs US Dollar”

In the H4 chart, NZDUSD is trading above the 200-day Moving Average to indicate an ascending tendency. In this case, the price is expected to test 7/8, break it, and then continue growing to reach the resistance at 8/8. However, this scenario may no longer be valid if the price breaks 6/8 to the downside. In this case, the instrument may fall towards the support at 5/8.

![]()

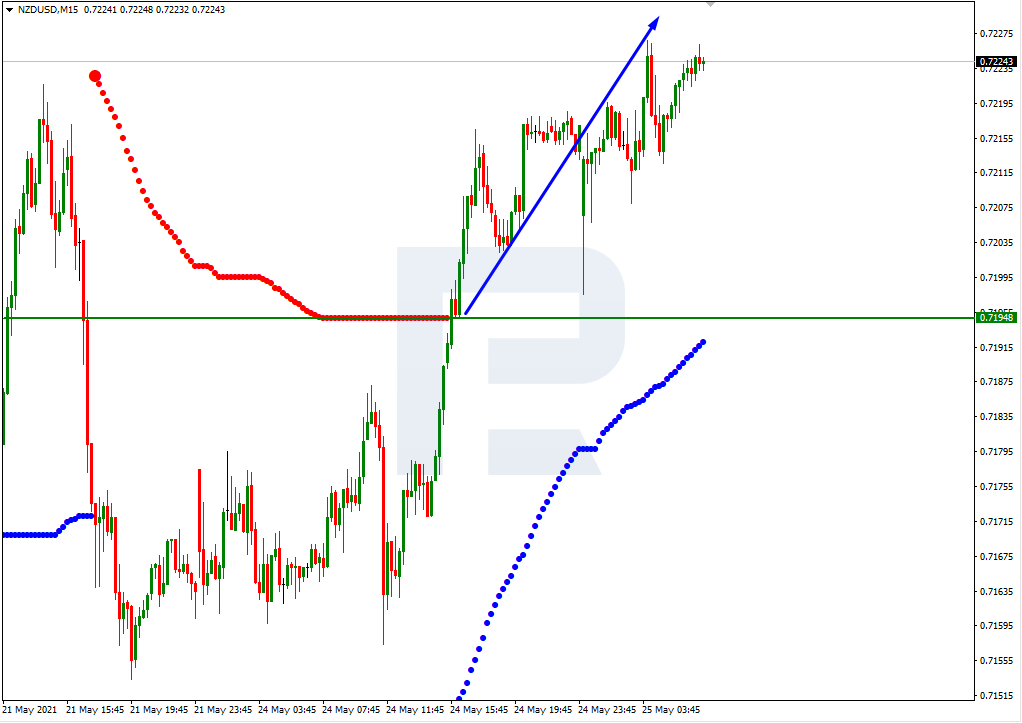

As we can see in the M15 chart, the pair has broken the upside line of the VoltyChannel indicator and, as a result, may continue its growth.

![]()