How the Forex Market Works: Explained Simply

Published by: RFXSignals

The forex market can seem complicated for beginners, but once you break it down, it’s surprisingly straightforward. In this guide, we’ll explain how the forex market works, why it matters, how trades are executed, and how RFXSignals can support your trading journey with accurate signals.

🔹 What is the Forex Market?

The forex (foreign exchange) market is where global currencies are traded. It is the largest financial market in the world, with a daily trading volume of over $7.5 trillion. Unlike the stock market, forex is decentralized, meaning it’s not tied to a single exchange. Instead, transactions occur electronically between banks, brokers, institutions, and individual traders.

🔹 How the Forex Market Works in Simple Terms

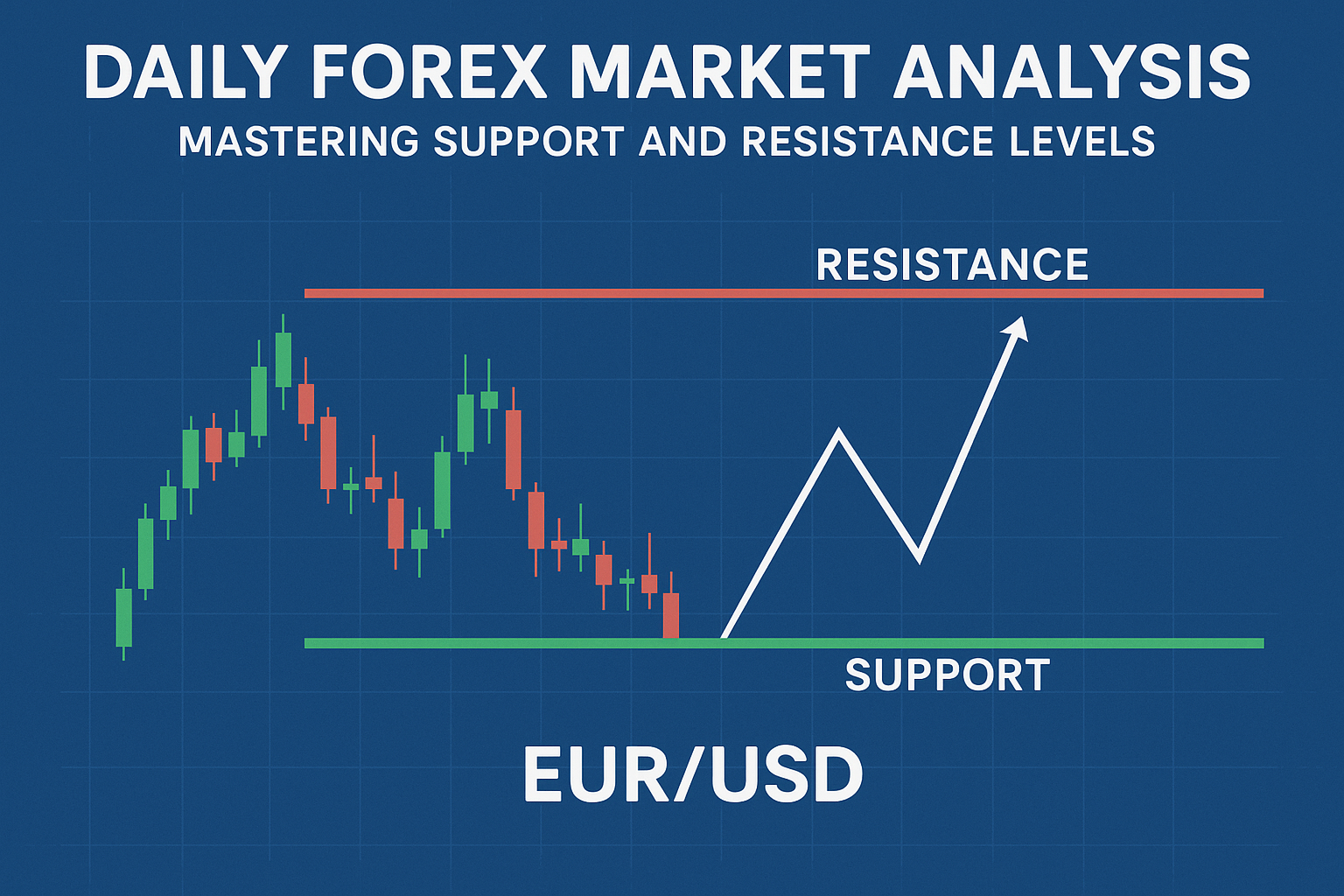

Forex trading always involves buying one currency while selling another. This is why trades are always quoted in currency pairs, such as EUR/USD or GBP/JPY.

Example:

If EUR/USD is 1.1000, this means 1 Euro is worth 1.10 US Dollars. If you believe the Euro will rise against the Dollar, you buy the pair. If you think it will fall, you sell it.

🔹 Who Participates in the Forex Market?

- Banks & Financial Institutions: The largest players providing liquidity.

- Central Banks: Influence currency values with monetary policy.

- Corporations: Engage in forex to facilitate international trade.

- Retail Traders: Individuals trading via brokers, like you.

🔹 The Role of Brokers

To access the forex market, retail traders use brokers. Brokers provide platforms (like MetaTrader 4/5) where traders can buy and sell currencies. They make money from the spread (the difference between buying and selling price) and sometimes from commissions.

📈 Trade Smarter with RFXSignals Forex Signals🔹 Key Elements of Forex Trading

- Pips: The smallest unit of price change in forex.

- Lots: The size of your trade (micro, mini, standard).

- Leverage: Borrowing power to trade larger positions.

- Margin: The collateral required to open leveraged trades.

- Spread: The broker’s fee built into buy/sell prices.

🔹 Why the Forex Market is Unique

Forex differs from other markets in several ways:

- Accessibility: Anyone can trade with as little as $100.

- Liquidity: Trillions traded daily ensure easy entry and exit.

- 24/5 Trading: Open across global time zones.

- Two-Way Market: You can profit in both rising and falling markets.

🔹 How Trades Are Made

When you place a trade, your broker routes your order to liquidity providers or directly to the interbank market. Trades are executed instantly in most cases. The goal is to buy low and sell high (or sell high and buy low).

🔹 Forex Market Sessions

The forex market is divided into four main trading sessions:

- Sydney Session: Opens the market week.

- Tokyo Session: Active Asian markets.

- London Session: Largest trading volume.

- New York Session: Overlaps with London, creating high volatility.

🔹 Risks of Forex Trading

- High leverage can increase losses as much as profits.

- Market volatility may lead to unexpected price swings.

- Emotional trading often results in poor decision-making.

To minimize risks, beginners should practice on demo accounts and use forex signals to guide real trades.

🔹 How Forex Signals Help Traders

Forex signals are trade recommendations sent in real-time. At RFXSignals, experts analyze the market and send signals to help traders make profitable decisions without needing years of experience.

🚀 Get Started with RFXSignals Today🔹 Frequently Asked Questions (FAQ)

1. Is forex trading safe?

Yes, if you use regulated brokers and manage risks effectively.

2. Do I need a lot of money to start?

No. Many brokers allow you to start with as little as $100.

3. Can beginners make money trading forex?

Yes, but success depends on education, discipline, and risk management.

🔹 Conclusion

The forex market works through a global network of buyers and sellers exchanging currencies around the clock. By understanding the basics—currency pairs, leverage, trading sessions, and risks—you’ll be better equipped to navigate the market. Using expert guidance like RFXSignals forex signals can significantly increase your chances of success.

📊 Start Trading Smarter with RFXSignals