Characteristics of EURCHF

The Swiss Franc also has the desirable characteristics of a safe haven asset or currency like the Japanese Yen and the US Dollar. Any CHF currency pair in the Fx market, therefore, has a strong relationship with the general risk sentiment across markets. The typical behavior is a depreciating Swiss Franc (CHF pairs rising) in a risk appetite environment and a strengthening Swiss Franc (CHF pairs falling) in a risk-averse (risk-off) market environment.

As a result, EURCHF, to some degree, also behaves as a proxy currency pair for risk in the markets. The EURCHF pair tends to rise more gradually when risk appetite dominates and it tends to decline at a more aggressive pace when risk aversion is in the driving seat. When trading safe haven currencies this a usual behavior that one can expect and although there can be long periods of risk appetite and rising markets, traders should not be complacent because risk aversion can kick in suddenly.

When we talk about EURCHF we also have to note that we are talking about a currency pair comprised of two correlated currencies. The Euro and the Swiss Franc, being the currencies of two neighboring economies tend to be naturally correlated as their economies are closely linked to each other.

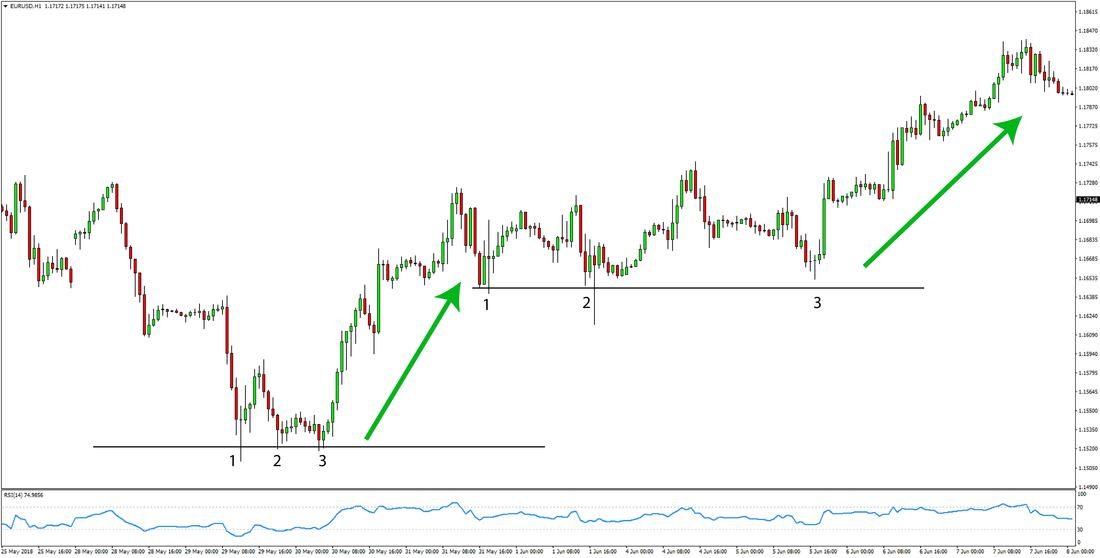

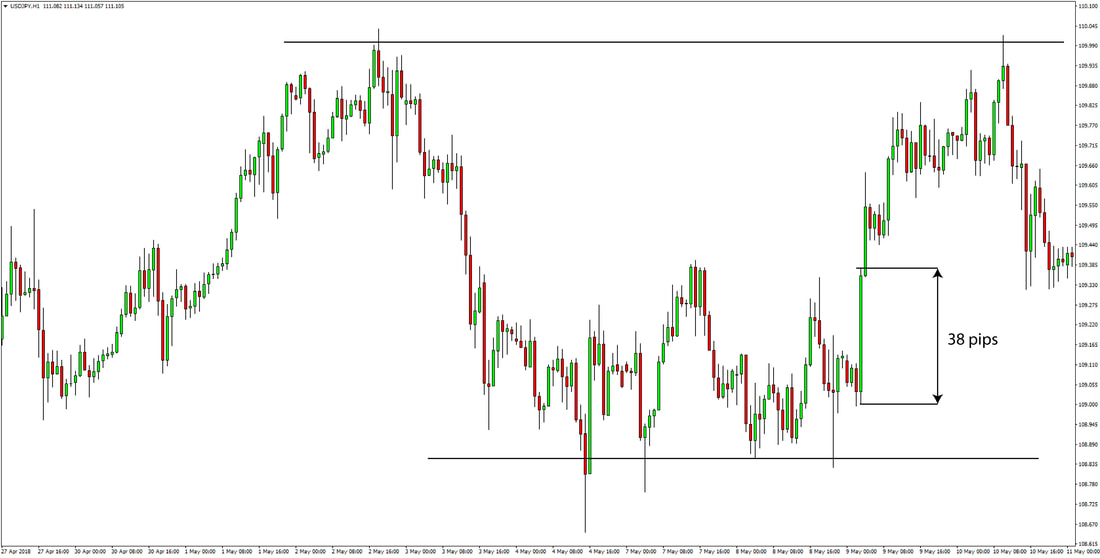

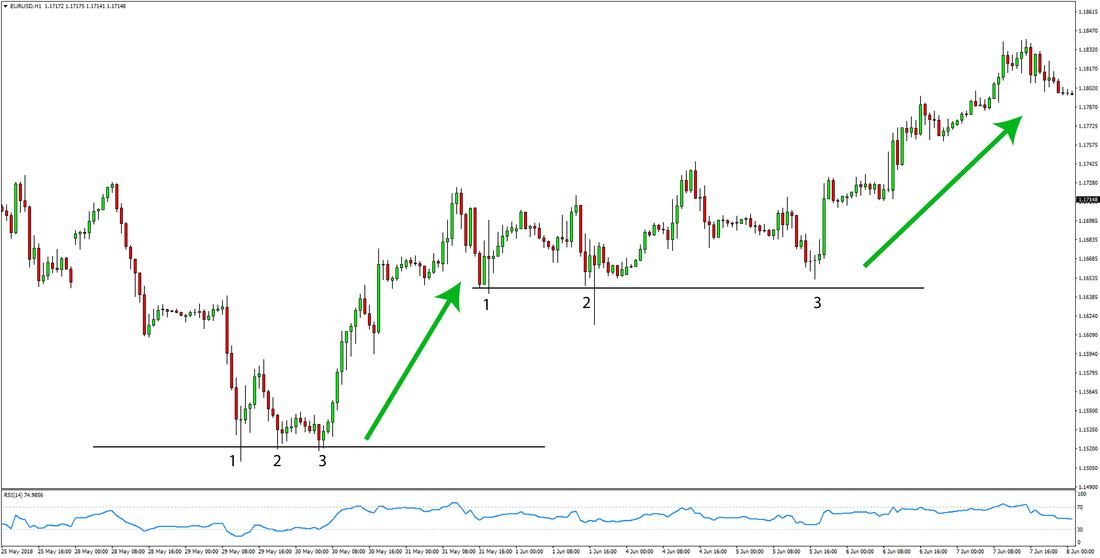

As is often the case for Fx pairs comprised of two correlated currencies (with neighboring linked economies), the Euro/Franc exchange rate can also stay in ranges for prolonged periods of time. By the same token, the pair also tends to thoroughly test a certain technical area multiple times before moving on either higher or lower.

Support and resistance areas such as horizontal highs and lows as well as sloping rising or falling trendlines work well on EURCHF overall. Breakouts of such support/resistance zones normally result in continuation and fadeouts are not a common thing. Hence, trades taken based on a clear-cut trendline or a distinct horizontal support or resistance zone are likely to provide good results when trading the EURCHF currency pair.

Another common pattern on EURCHF is that the pair can often reach round numbers and reverse at the exact round numbers, such as for example, 1.2000 or 1.1500. That’s not to say that necessarily a sharp and complete reversal will occur at round numbers, but EURCHF often respects them at least in the shorter-term, like the daily and intra-day timeframes.

Round numbers commonly act as support or resistance across the different Forex pairs, but still, there are enough instances supporting the notion that this is more pronounced on the charts of the EURCHF pair compared to other currency pairs which have a smaller consistency of this effect.

Trading conditions:

- Look to enter on bullish patterns or signals at important technical areas including horizontal and trendline support. Rising support trendlines usually provide good entry points and EURCHF can often trade in rising channels.

- Channels provide excellent trading opportunities as technical entries, stop loss and profit target levels are clearly known in advance.

Long trade stop loss:

- Look to place the stops behind key support areas. Although support levels may be tested frequently by the price before a push higher, if the bullish move will continue support will probably hold, so it’s a prudent place to put a stop at.

Long trade exits and targets:

- Target important technical (resistance) areas higher. Pivotal resistance highs are also normally respected on EURCHF, so taking profits at such points is likely to prove a profitable strategy.

- Breakouts below key support areas usually precede quick and fast declines in the price, so these instances should be considered for entering potential short positions. A break of a rising support trendline is also normally a solid bearish signal for EURCHF.

- Analyzing the market with core concepts of technical analysis in this way is a solid approach to find good trading opportunities on this pair.

Short trade stop loss:

- Place stops above the bearish breakout points and distinct resistance areas on the charts. Additionally, EURCHF can commonly come back to a broken support level to retest it and that can provide a second chance to enter or even a better opportunity to sell and place a better stop loss order.

Short trade exits and targets:

- Targets toward key support areas and round number psychological levels are generally good technical points to take profits.

Don’t forget about SNB interventions

Leaving the fundamental reasons aside, when it comes to technical analysis and price action trading, the SNB interventions caused massive disruptions in the charts on the EURCHF pair. Such instances when authorities directly intervene in the Forex market can make it harder to apply and make sense of the regular technical analysis tools and price action trading methods. For these reasons, many Forex traders completely abandoned the EURCHF pair (and other CHF pairs also) during the years when the SNB controlled the EURCHF exchange rate through the implementation of the 1.2000 floor.

Although in recent times the pair has reestablished its old “more normal” behavior to a large degree, still the possibility of interventions and the large spikes in the price action that the SNB can cause are still in the back of all CHF Forex traders.