Sthree Sakthi (SS-160) 04/06/2019

DAILY FREE FOREX SIGNALS FOR 07-06-2019 сигнал форекс ежедневно

GBPUSD BUY -1.27372

SL-1.26759

TP1-1.27561

EURUSD BUY -1.13159

SL-1.12728

TP1-1.13405

TP2-1.13646

USDJPY SELL-108.130

SL-108.550

TP1-107.952

TP2-107.761

USDCHF SELL-0.98833

SL-0.99367

TP1-0.98504

TP2-0.98136

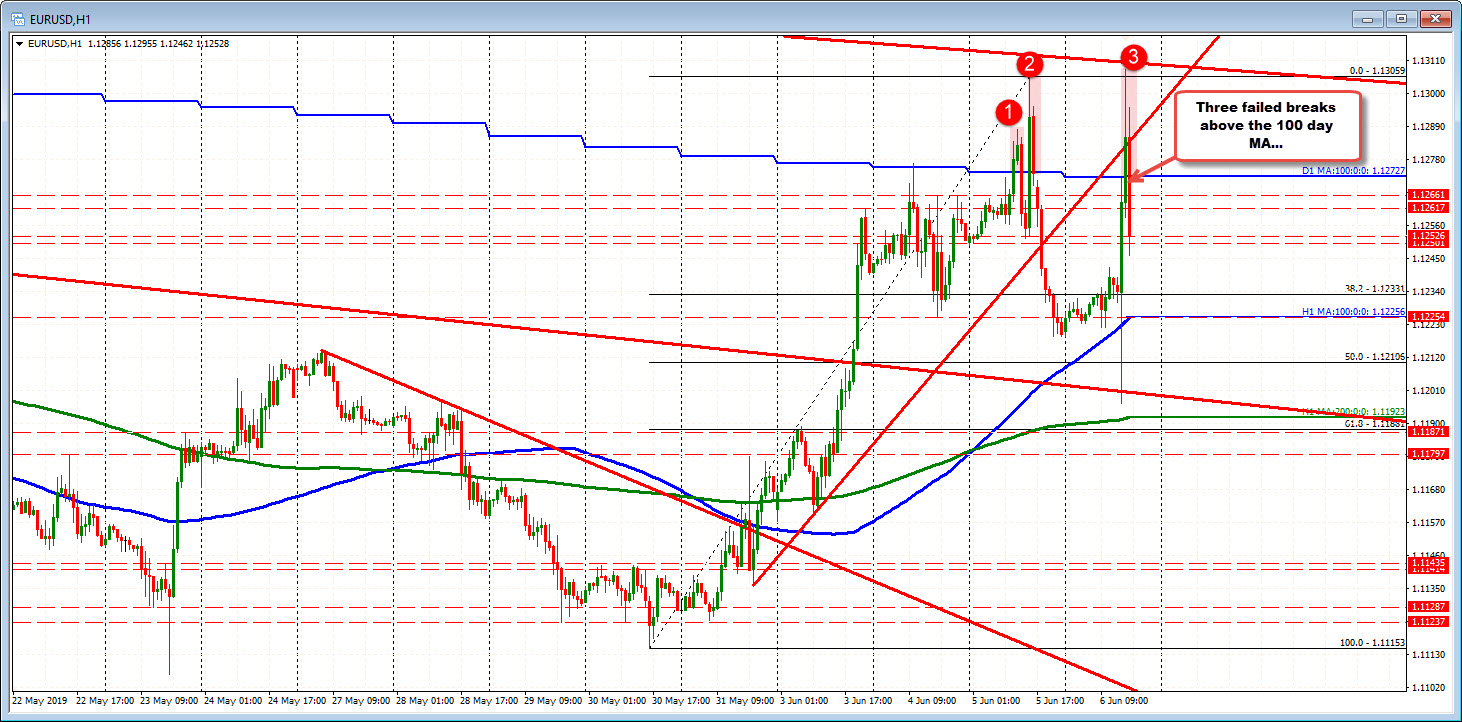

EURUSD backs off as markets digest Draghi

Another failed run above the 100 day MA?

The EURUSD moved above the 100 day MA on disappointment that the TLTRO rate was not as low as it could have been (I guess). However, comments in the presser had a little for bulls, but also bears.

The price is digesting the comments and have now moved back below the 100 day MA (again). Recall yesterday, there were two runs above, but each failed.

On the daily chart, the pair also tested a topside trend line and that line held at 1.1308 area (see chart below).

The stall at the trend line. The fall back below the 100 day MA are both bearish. Until the price action can get – and stay above – the 100 day MA AND break that trend line after that, can the buyers be taking control? No. Sellers are still in control.

The couple things working in the buyers favor is that the market is short EUR. That could lead to a squeeze higher. Also, USD may weaken too on expectations of Fed easing.

Also technically, the low today did test the underside of a broken trend line at 1.1202 (call it 1.1200 -see daily chart). So there is some hope that buyers hold that 1.1200 area (risk for bulls), and the 100 day MA is broken for good (or at least for a little while).

DAILY FREE FOREX SIGNALS FOR 06-06-2019 сигнал форекс ежедневно

EURUSD SELL-1.12225

SL-1.12569

TP1-1.12053

TP2-1.11906

GBPUSD SELL-1.26678

SL-1.27168

TP1-1.26480

TP2-1.26259

USDJPY SELL-108.184

SL-108.640

TP1-107.971

TP2-107.719

NZDUSD SELL-0.66257

SL-0.66607

TP1-0.66091

TP2-0.65907

GBPCHF SELL-1.25999

SL-1.26313

TP1-1.25810

TP2-1.25623

EURAUD SELL-1.61006

SL-1.61358

TP1-1.60825

TP2-1.60643

NZDJPY SELL-71.700

SL-72.095

TP1-71.516

TP2-71.250

EURCAD SELL-1.50564

SL-1.50857

TP1-1.50393

TP2-1.50207

GBPAUD SELL-1.81812

SL-1.82215

TP1-1.81563

TP2-1.81326

GBPCAD SELL-1.70074

SL-1.70387

TP1-1.69883

TP2-1.69651

cryptocurrency #bitcoin #news #fx #education

business #today #btc #blockchain #ethereum #ico

love #tech #rating #oil #daytrading #rfxsignals

DDay75thAnniversary

Euro Year-long Trend Nearing Decision Point

The long slow bearish channel in the euro is getting close to breakout decision, notes Al Brooks.

The EURUSD currency pair has been in a bear channel for a year. Protracted bear channels often end with a sharp break below the channel and then a reversal up. There is no sign yet that the pattern of two- to three-week rallies and two- to three-week selloffs is about to end.

The EURUSD weekly chart has been forming lower highs and lows for a year. This is a bear channel and there is no sign that it is about to end. Consequently, traders continue to buy reversals up from every new low and sell reversals down from rallies to above the 20-day exponential moving average. The legs up and down have lasted two to three weeks.

The daily chart has been in a tight trading range for a month. Every trading range has both buy and sell setups. The bears have a double top with the May 1 and May 13 highs. The bulls have a double bottom with the April 26 and May 23 low.

Because the chart is now near the 52-week low, traders are expecting a reversal up. The reversal can come from above or below the May 23 low. But, a two- to three-week reversal up is more likely that a strong break below the May low.

Possible sell climax below yearlong bear channel

When a bear channel lasts a long time, it often ends with a sell climax. There can be a strong break below the bear channel, but 75% of the time, a bear break below a bear channel reverses up within five bars.

Five bars, but on what time frame? It is the highest time frame that shows the channel. That is the weekly chart.

If traders see a strong selloff over the next few weeks that breaks strongly below the 52-week low and the bear channel, they should be ready for a reversal up. If there is a reversal up, it usually leads to a swing up. The minimum goal would be 10 bars and two legs. It could last longer and go much higher.

Since the weekly chart is in a Spike and Channel bear trend, traders will expect a reversal up to test the start of the bear channel. That is the June 14, 2018 high of 1.1851. Since that is far above, any rally would take many months to get there.

Bear channels usually evolve into trading ranges. Therefore, even if the bulls get a strong reversal up, it will probably be a bull leg in a trading range that will last a year or more.

Trading Room

kerala lottery result -POURNAMI (RN-394)- 02/06/2019

KERALA STATE LOTTERIES – RESULT

www.keralalotteries.com PHONE:- DIRECTOR OFFICE FAX

www.kerala.gov.in 0471-2305230 0471-2305193 0471-2301740

POURNAMI LOTTERY NO. RN-394th DRAW held on 02/06/2019 AT GORKYBHAVAN NEAR BAKERY

JUNCTION, THIRUVANANTHAPURAM

1st Prize- Rs :7,000,000/- RY 360244 (KASARGODE)

Consolation Prize- Rs. 8,000/- RN 360244 RO 360244 RP 360244 RR 360244

RS 360244 RT 360244 RU 360244 RV 360244

RW 360244 RX 360244 RZ 360244

2nd Prize- Rs :500,000/- RR 299912 (MALAPPURAM)

3rd Prize- Rs :200,000/- RN 600012 (ERNAKULAM)

FOR THE TICKETS ENDING WITH THE FOLLOWING NUMBERS

4th Prize- Rs. 5,000/- 0140 0601 1846 3241 5434

5464 5481 5738 7272 7538

8920 9260

5th Prize- Rs. 2,000/- 1007 1426 2273 3560 8654

9378 9479

6th Prize- Rs. 1,000/- 0196 1553 1880 2011 2921

3141 3335 3871 3952 4558

4873 5180 6325 6518 6819

7059 7398 7425 7986 8354

8999 9142 9168 9214 9251

9765

7th Prize- Rs. 500/- 0061 0092 0142 0220 0887

0911 0941 1002 1220 1327

1494 1569 1949 2225 2251

2271 2406 2623 2722 2831

2844 3280 3386 3462 3600

3807 4364 4410 5000 5296

5344 5502 6104 7343 7384

8055 8442 8624 9024 9112

9668 9954

8th Prize- Rs. 100/- 0075 0094 0128 0163 0260

0434 0485 0534 0662 0714

0726 0832 0848 0850 0889

0926 1473 1897 1927 1935

2080 2086 2193 2203 2285

2333 2336 2546 2690 2733

2739 2835 2855 2861 2906

3034 3069 3071 3079 3152

3260 3429 3499 3518 3555

3608 3761 3820 3980 4087

4146 4278 4289 4533 4757

4781 4935 4984 5085 5159

5216 5342 5433 5468 5556

5577 5623 5710 5899 5951

5957 5977 6175 6374 6420

6429 6472 6504 6563 6672

7018 7249 7291 7315 7374

7452 7501 7679 7697 7713

7823 8565 8653 8707 8894

9088 9206 9515 9524 9584

9675 9784 9878 9902

The prize winners are advised to verify the winning numbers with the results published in the Kerala Government

Gazatte and surrender the winning tickets within 30 days.

Next POURNAMI Lottery Draw will be held on 09/06/2019 at GORKY

BHAVAN NEAR BAKERY JUNCTION THIRUVANANTHAPURAM

Sd/-

T.A PADMAKUMAR

Deputy Director

Directorate Of State Lotteries , Vikas Bhavan,tvm

DAILY FREE FOREX SIGNALS FOR 04-06-2019 сигнал форекс ежедневно

NZDUSD SELL-0.65851

SL-0.66257

TP1-0.65692

TP2-0.65528

GBPUSD SELL-1.26648

SL-1.26953

TP1-1.26453

TP2-1.26260

NZDJPY SELL-71.055

SL-71.410

TP1-70.844

TP2-70.617

GOLD SELL-1323.45

SL-1329.79

TP1-1320.87

TP2-1317.65

GBPAUD SELL-1.81428

SL-1.81812

TP1-1.81209

TP2-1.80945

GBPCAD SELL-1.69968

SL-1.70387

TP1-1.69729

TP2-1.69439

GBPNZD SELL-1.92014

SL-1.92436

TP1-1.91776

TP2-1.91537

GBPJPY SELL-136.675

SL-137.019

TP1-136.518

TP2-136.381

GBPCHF SELL-1.25613

SL-1.25999

TP1-1.25432

TP2-1.25212

USDJPY BUY -108.084

SL-107.719

TP1-108.312

TP2-108.530

USDCHF BUY -0.99377

SL-0.99054

TP1-0.99604

TP2-0.99847

EidMubarak

HayırlıBayramlar

ByJinIsComing #cryptocurrency #bitcoin #news #fx #education

business #today #btc #blockchain #ethereum #ico

love #tech #rating #oil #daytrading #rfxsignals

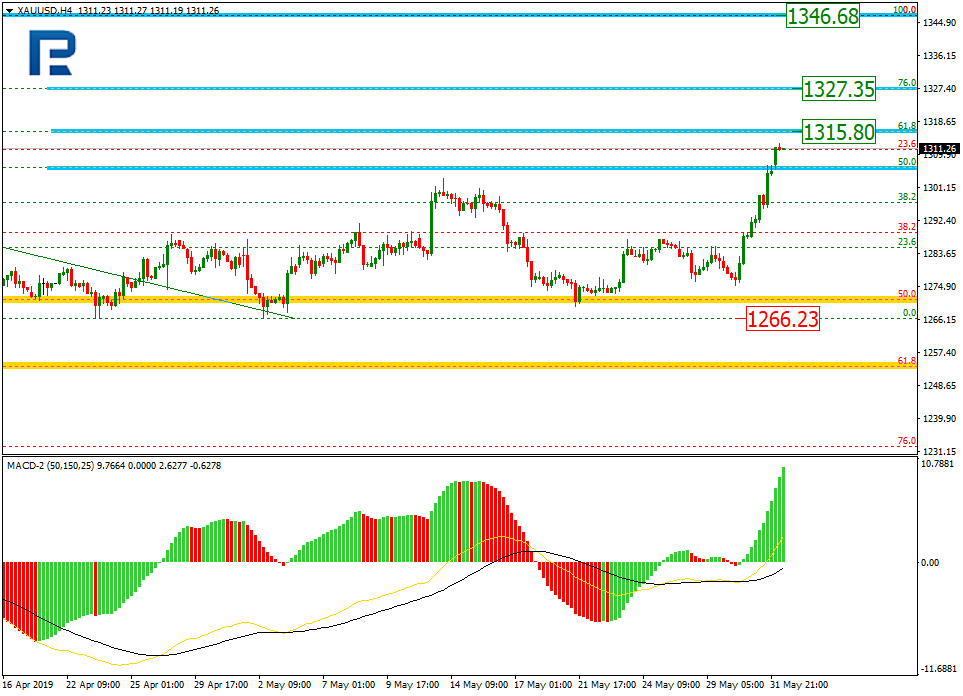

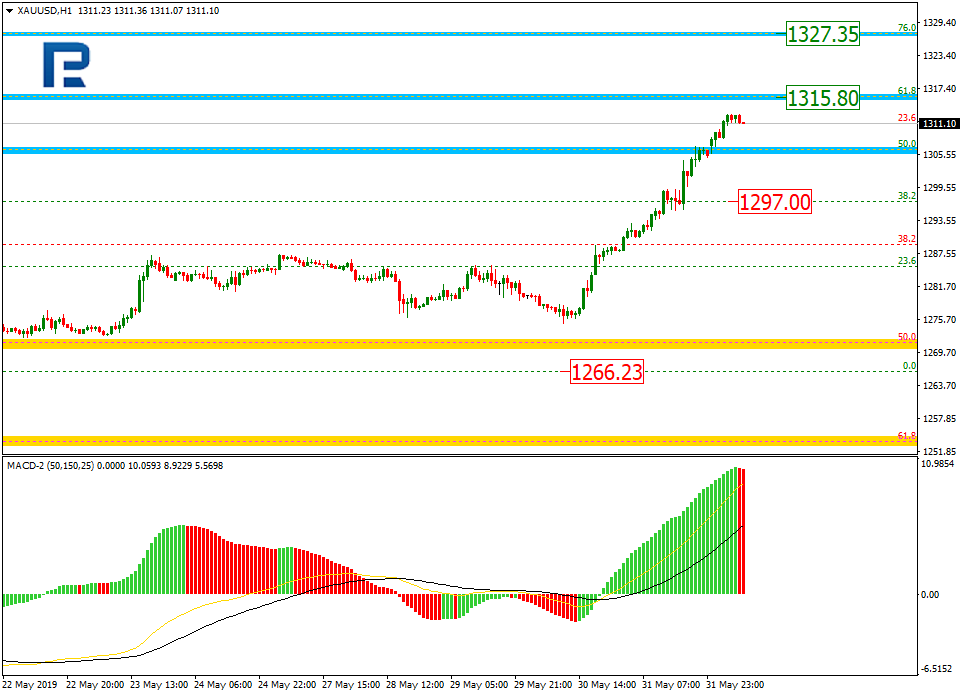

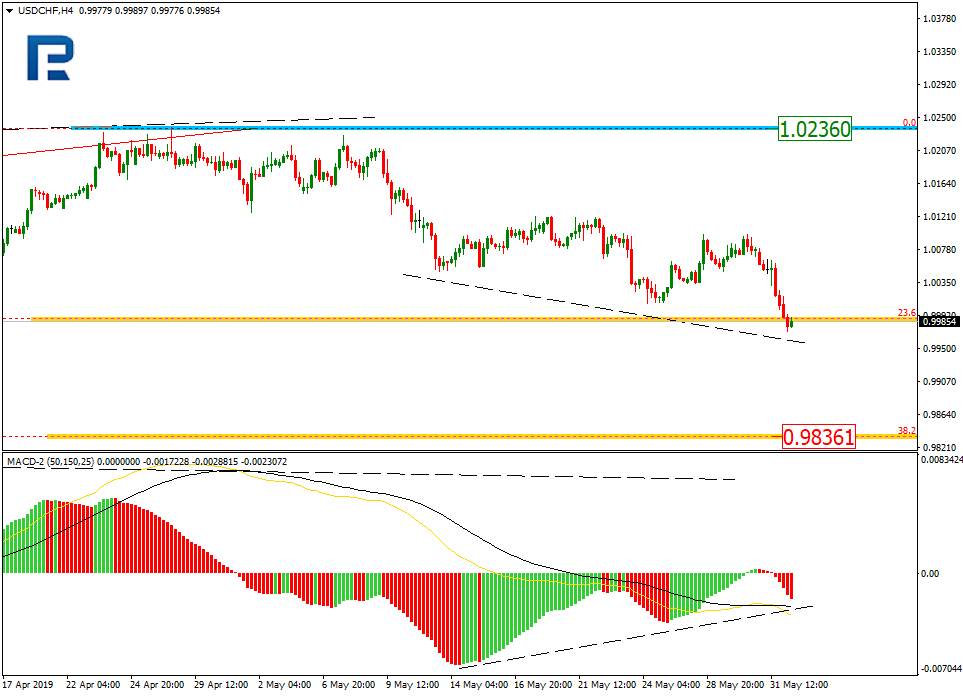

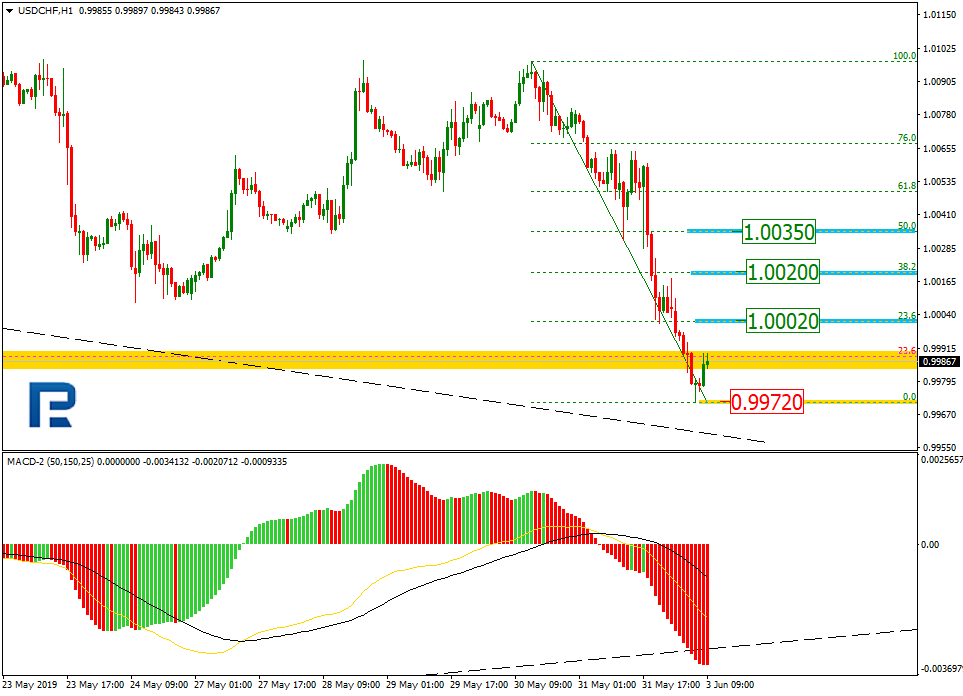

Fibonacci Retracements Analysis 04.06.2019 (GOLD, USDCHF)

Fibonacci Retracements Analysis 04.06.2019 (GOLD, USDCHF)

03.06.2019

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the pair is quickly trading upwards to update the high at 1346.68. Right now, XAUUSD is getting closer to the retracements of 61.8% at 1315.80.the next upside target may be the retracement of 76.0% at 1327.35. The support is at 1266.23.

In the H1 chart, the pair is rising steadily. The closest target is the retracement of 61.8% at 1315.80. The support level is the retracement of 38.2% at 1297.00.

USDCHF, “US Dollar vs Swiss Franc”

In case of the USDCHF, the after reaching the long-term retracement of 23.6%, USDCHF is trading close to 1.0000. The next downside target may be the retracement of 38.2% at 0.9836. At the same time, there is a convergence on MACD, which may indicate a possible pullback.

In the H1 chart, the pair is starting a new short-term rising correction. The upside targets may be the retracements of 23.6%, 38.2%, and 50.0% at 1.0002, 1.0020, and 1.0035 respectively. The local support is the low at 0.9972.

DAILY FREE FOREX SIGNALS FOR 03-06-2019 сигнал форекс ежедневно

GBPAUD SELL-1.82054

SL-1.82519

TP1-1.81812

TP2-1.81581

GBPNZD SELL-1.92967

SL-1.93377

TP1-1.92717

TP2-1.92481

EURNZD SELL-1.70408

SL-1.70707

TP1-1.70233

TP2-1.70040

AUDNZD SELL-1.05954

SL-1.06300

TP1-1.05629

EURAUD SELL-1.60737

SL-1.61168

TP1-1.60563

TP2-1.60377

CADJPY SELL-80.035

SL-80.496

TP1-79.835

TP2-79.596

NZDJPY BUY -70.960

SL-70.617

TP1-71.133

TP2-71.343

GBPUSD SELL-1.26384

SL-1.26766

TP1-1.26189