03.10.2019

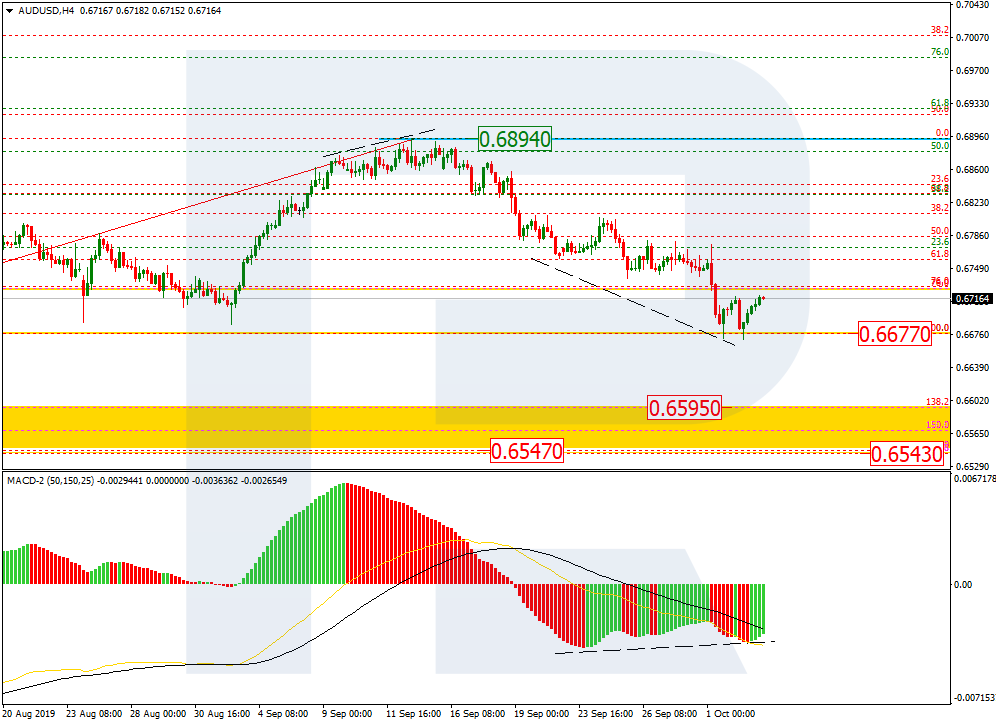

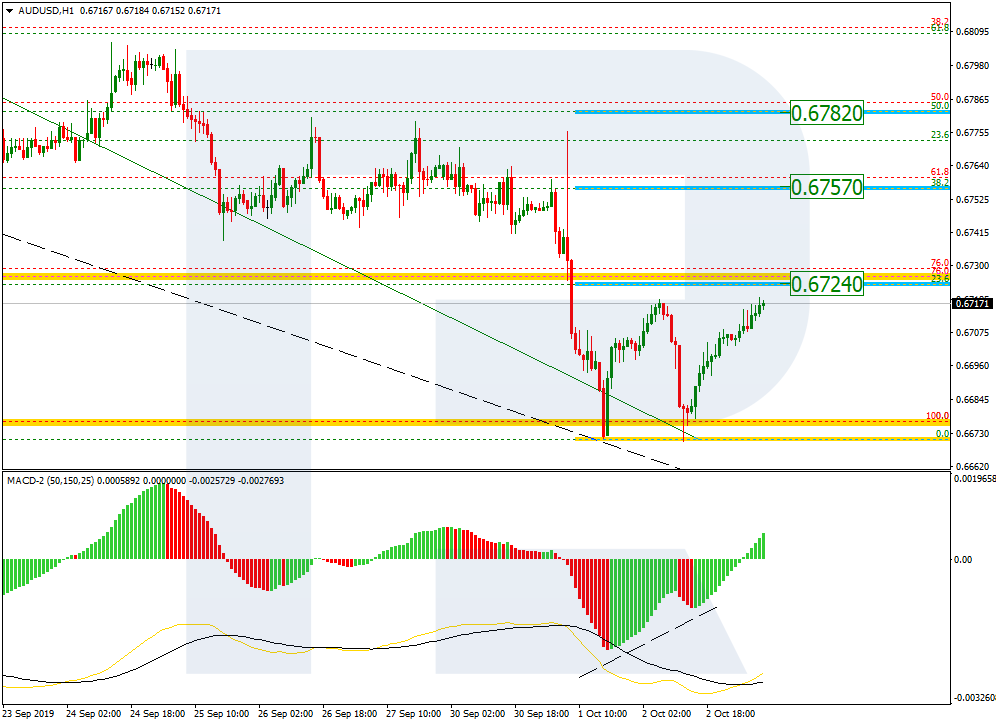

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the descending wave tested the mid-term low at 0.6677 and then there was a convergence, which may indicate a new pullback in the nearest future. After the pullback, the price may continue falling towards the post-correctional extension area between 138.2% and 161.8% fibo at 0.6595 and 0.6543 respectively.

Taking into account the convergence on MACD in the H1 chart, we may assume that AUDUSD may correct towards 23.6%, 38.2%, and 50.0% fibo at 0.6724, 0.6757, and 0.6782 respectively.

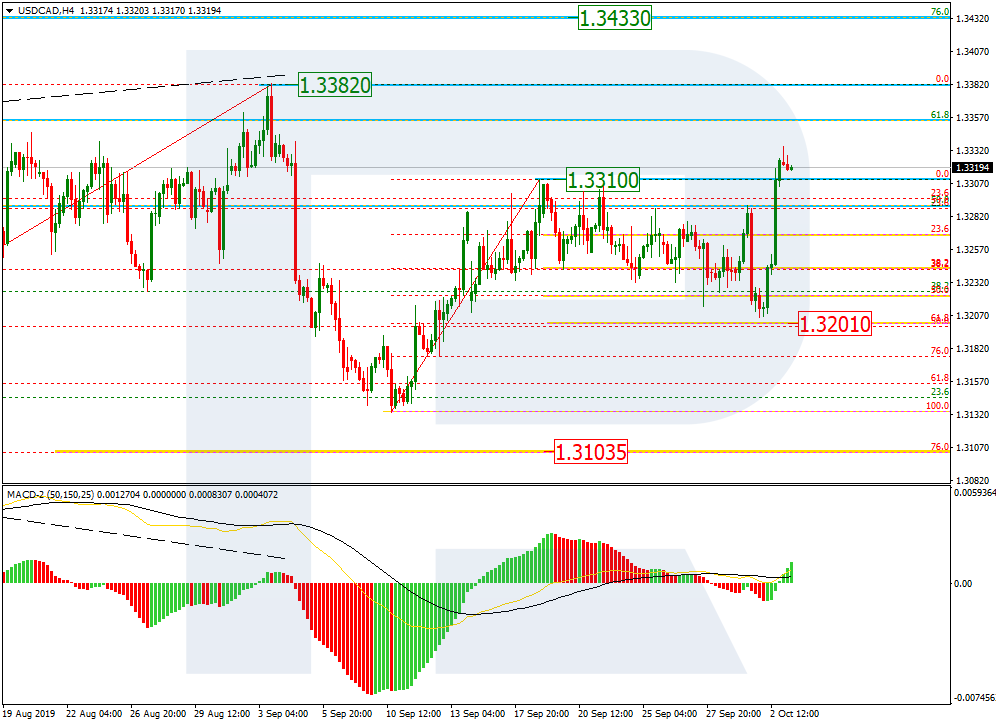

USDCAD, “US Dollar vs Canadian Dollar”

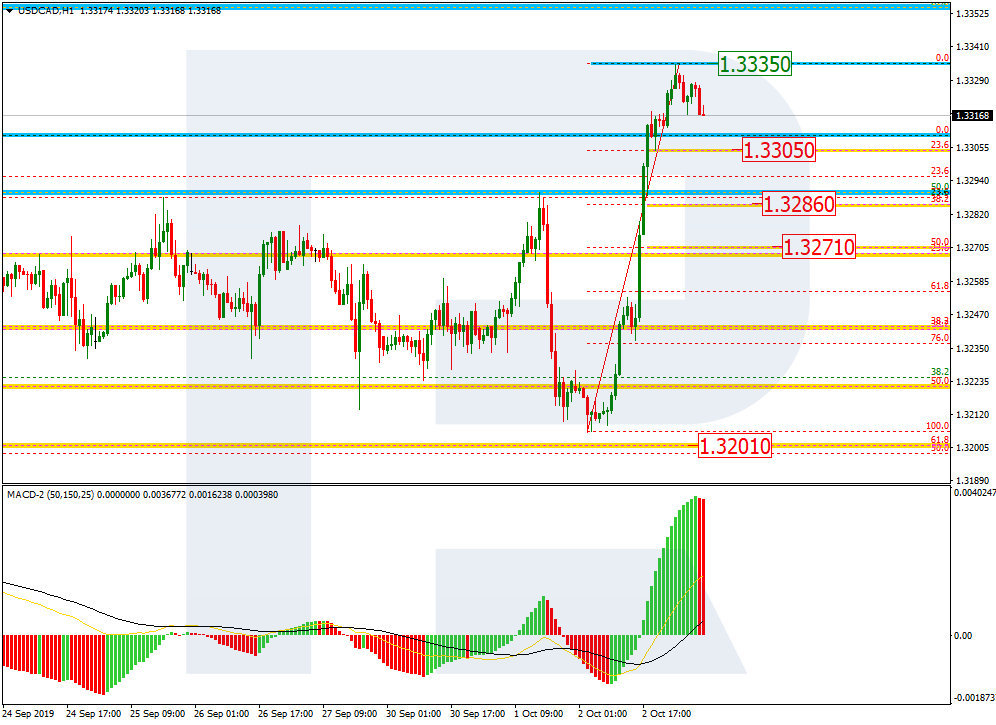

As we can see in the H4 chart, after failing to reach 50.0% fibo at 1.3201, USDCAD started a new rising impulse, which has already broken the local high and may reach the high at 1.3328. After breaking it, the instrument may continue the ascending tendency towards 76.0% fibo at 1.3433.

In the H1 chart, after finishing the ascending impulse, the pair is correcting. The target may be 23.6%, 38.2%, and 50.0%, fibo at 1.3305, 1.3286, and 1.3271 respectively. After breaking the resistance at 1.3335, the price may continue growing.