Fibonacci Retracements Analysis 08.01.2020 (GBPUSD, EURJPY)

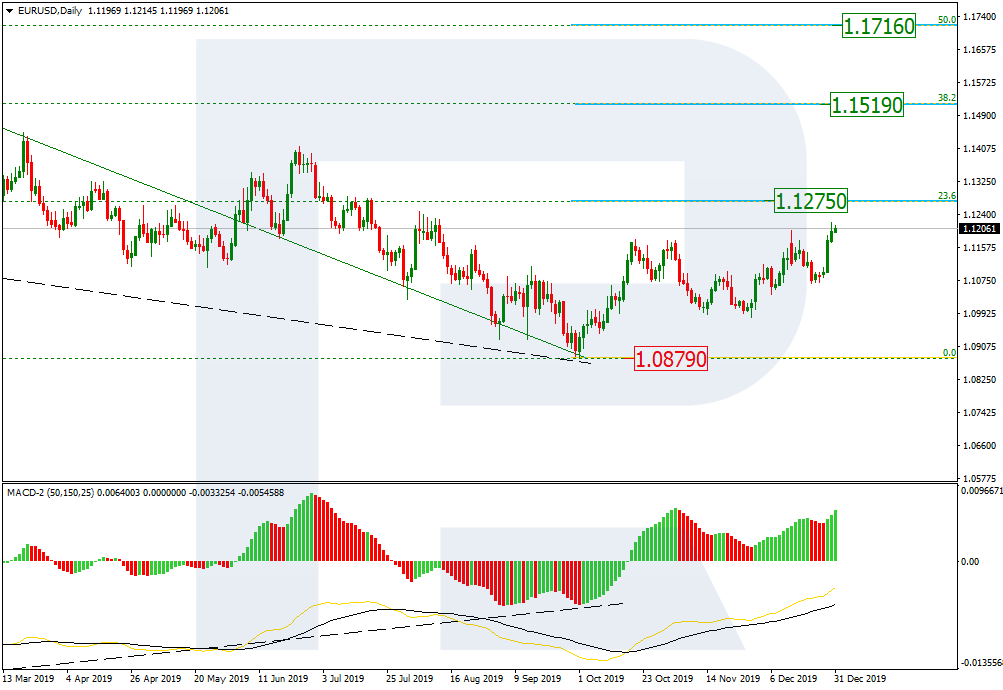

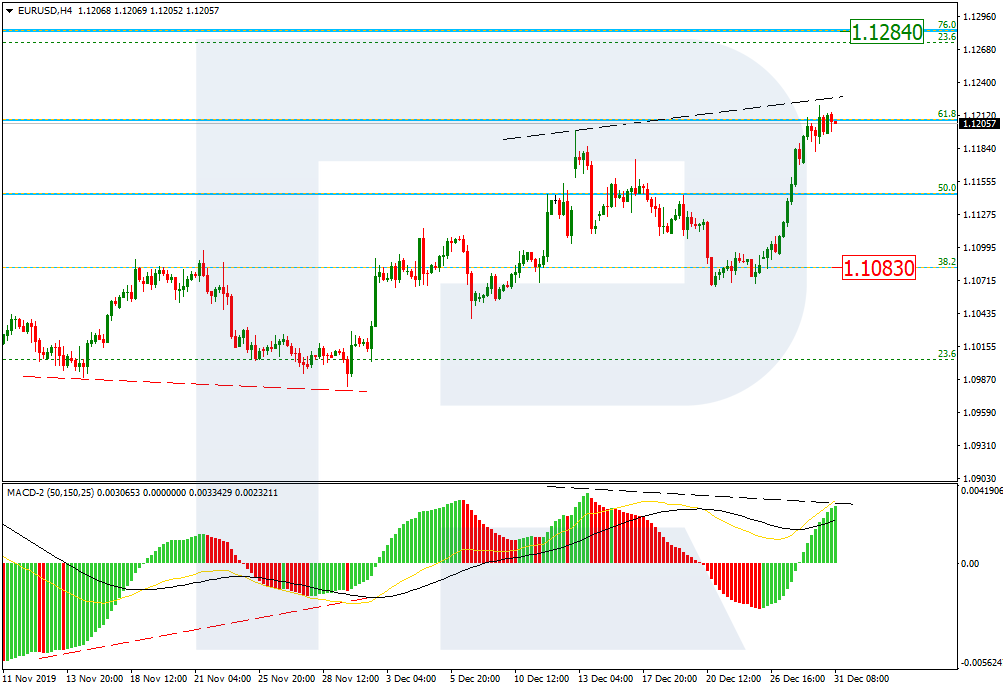

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the daily chart, there was a divergence on MACD, which made the pair reverse downwards after reaching 61.8% fibo. GBPUSD got very close to the support at 38.2% fibo (1.2883), but couldn’t test it. The current growth may be considered as a correction. However, taking into account a divergence on MACD, we may assume that the next descending impulse may break the support. Still, we shouldn’t exclude an opposite scenario: the instrument may start another rising wave towards 76.0% fibo at 1.3794.

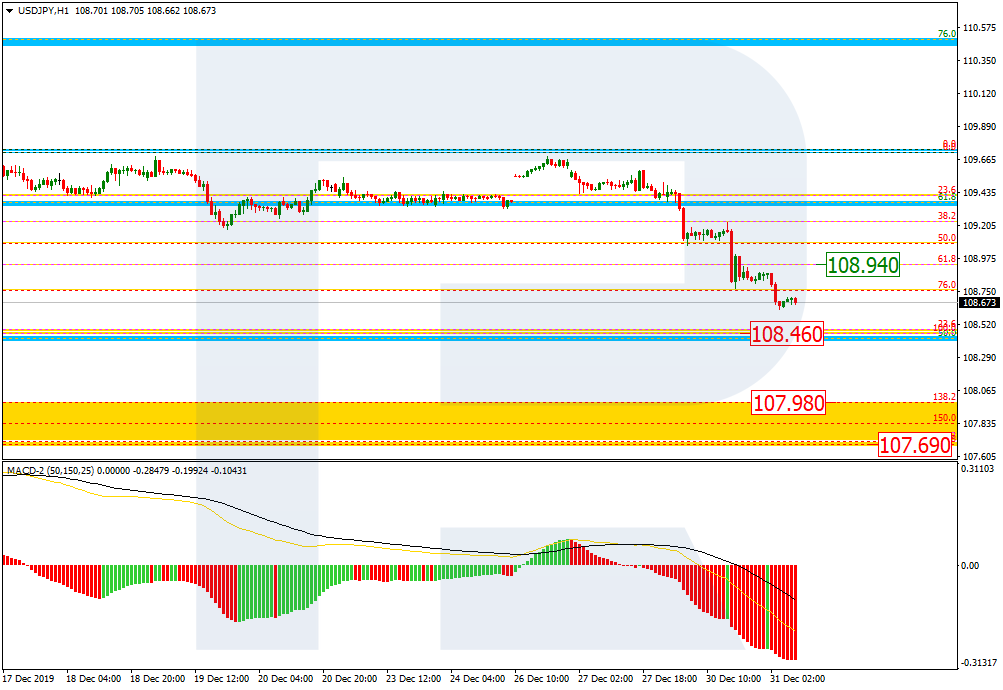

The H4 chart shows that the descending wave has corrected the previous uptrend by 38.2% fibo; the current growth may be considered as a correction, which has already reached 61.8% fibo and may continue towards 76.0% fibo at 1.3368 and the high at 1.3514. However, right now the price is falling to break the low at 1.2904. if it succeeds, the instrument may continue its mid-term decline towards 50.0% and 61.8% fibo at 1.2856 and 1.2700 respectively.

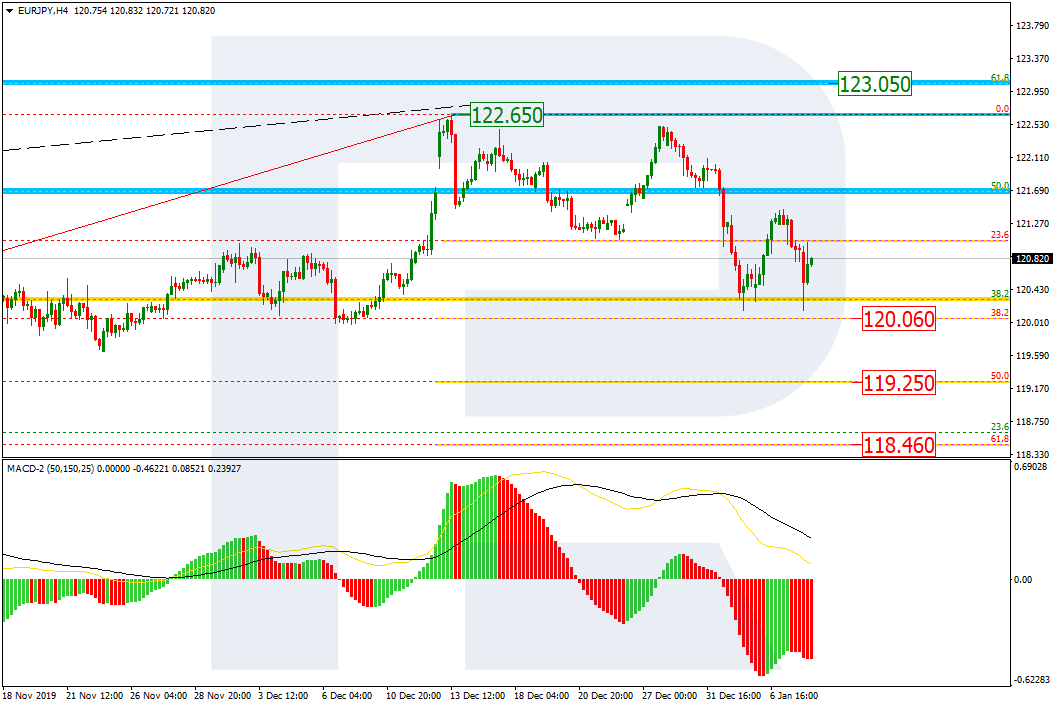

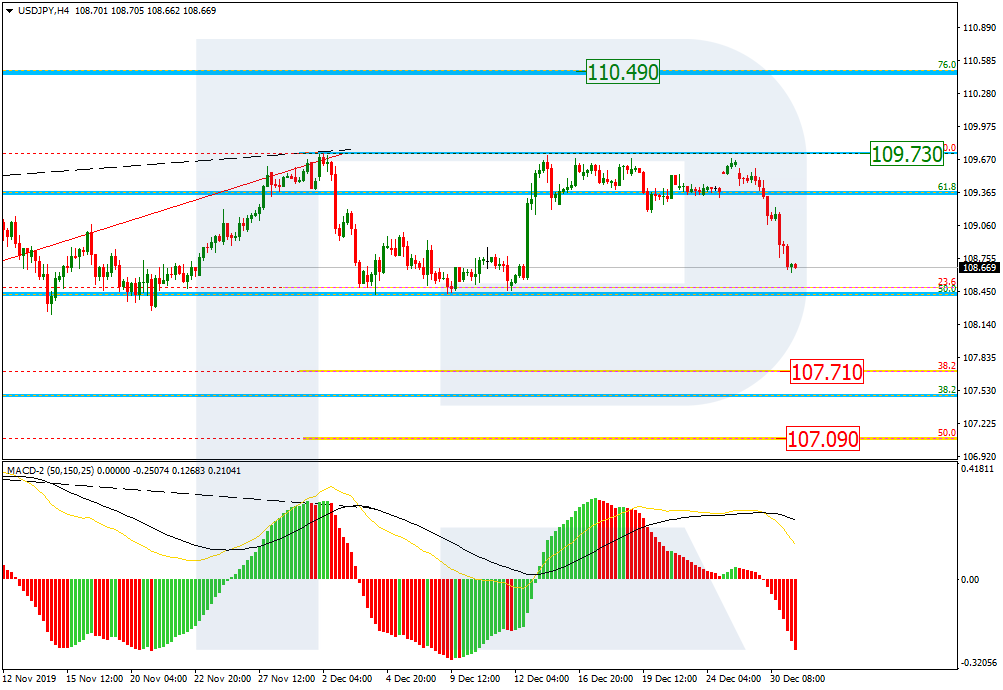

EURJPY, “Euro vs. Japanese Yen”

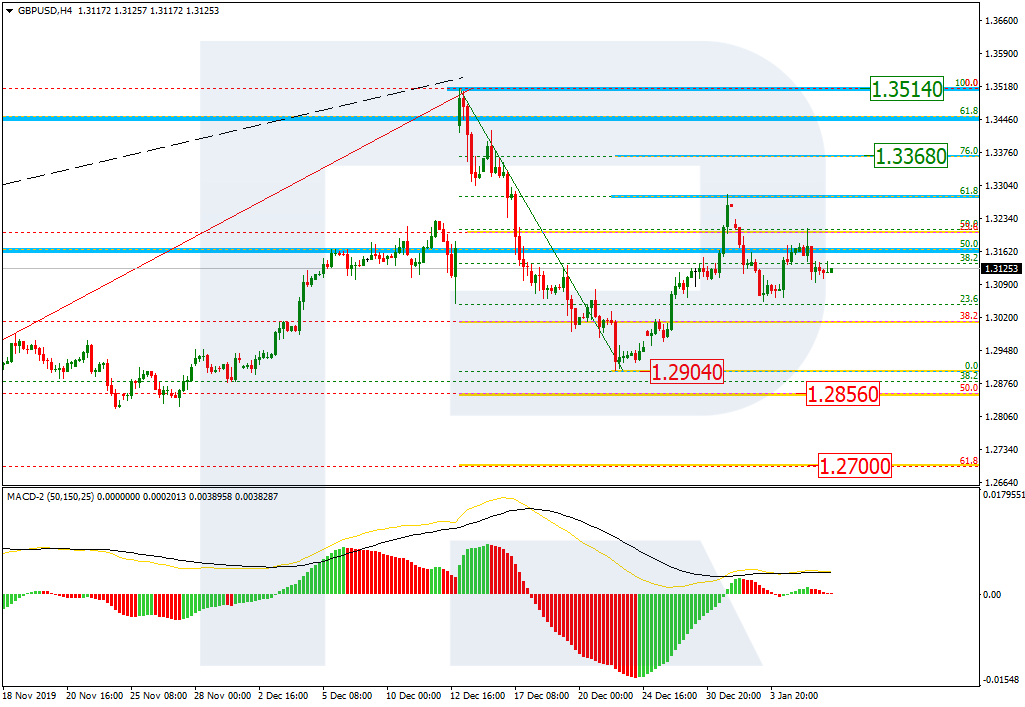

In the daily chart, there was a divergence on MACD, which made the pair reverse downwards after reaching 50.0% fibo. Right now, EURJPY is testing the mid-term local support. If the price breaks 38.2 fibo and fixes below it, the instrument will continue falling towards the low at 115.86. An alternative scenario implies that the price may rebound from the support and resume trading upwards to reach 61.8% and 76.0% fibo at 123.05 and 124.69 respectively.

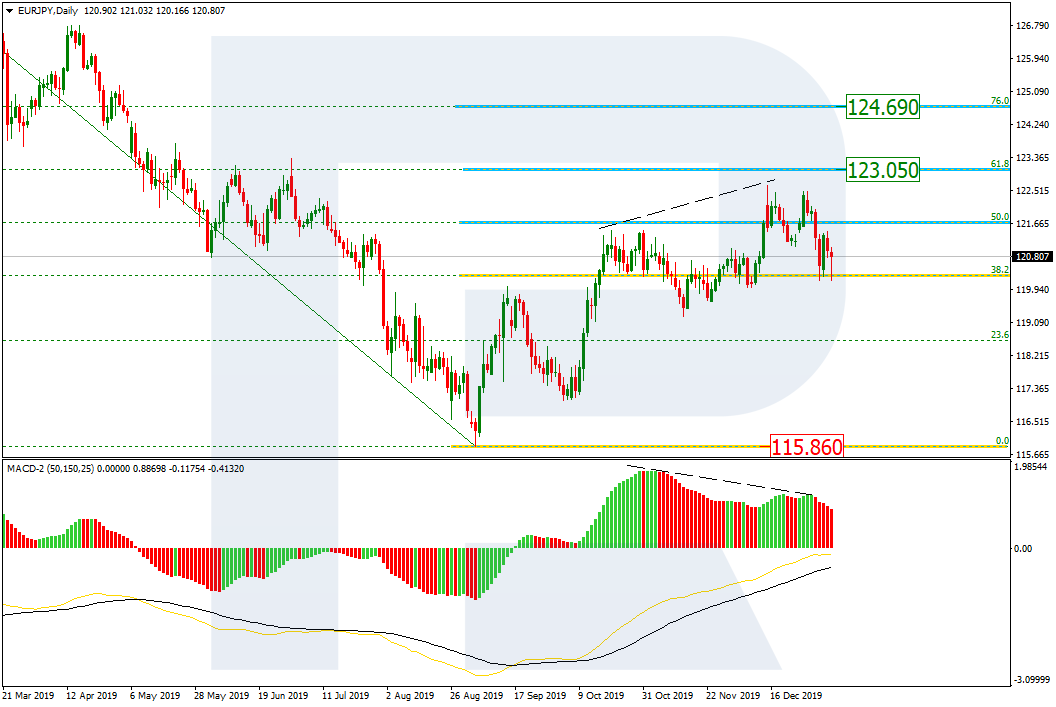

The H4 chart shows more detailed structure of the current descending correction. The pair is getting close to 38.2% fibo at 120.06. The next downside targets may be 50.0% and 61.8% fibo at 119.25 and 118.46 respectively. The resistance is the high at 122.65.