Fibonacci Retracements Analysis 19.05.2020 (EURUSD, USDJPY)

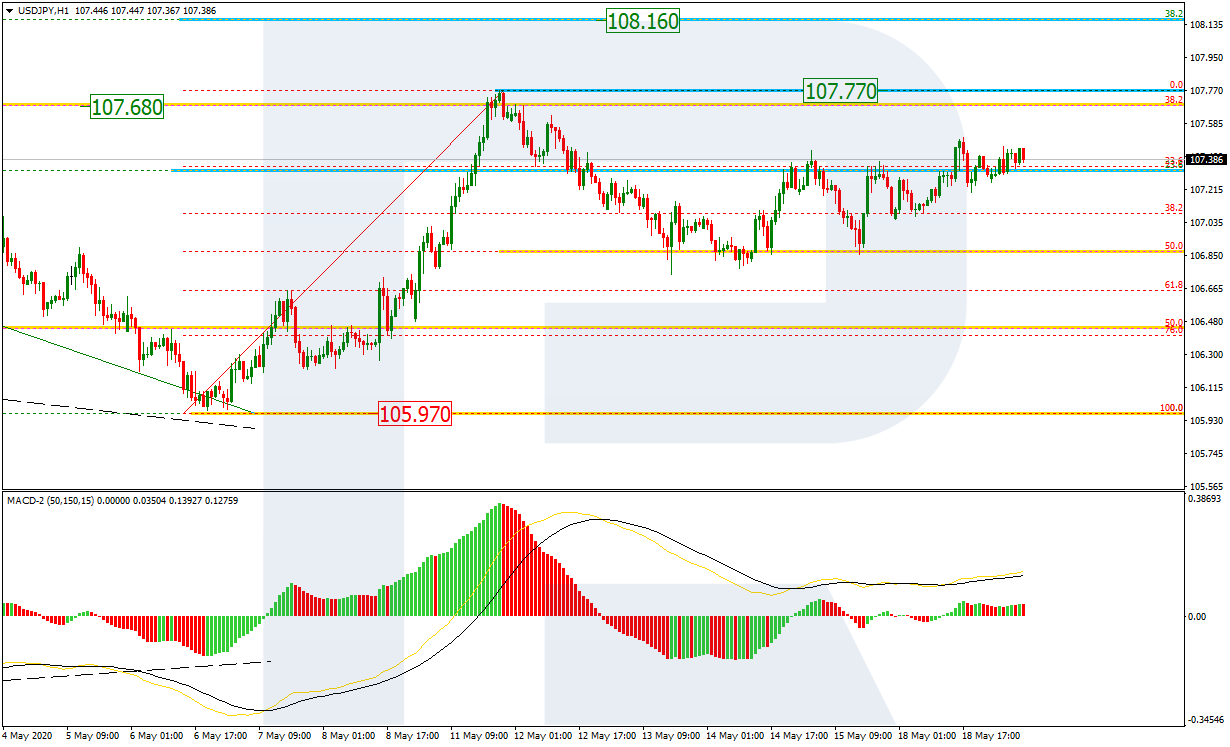

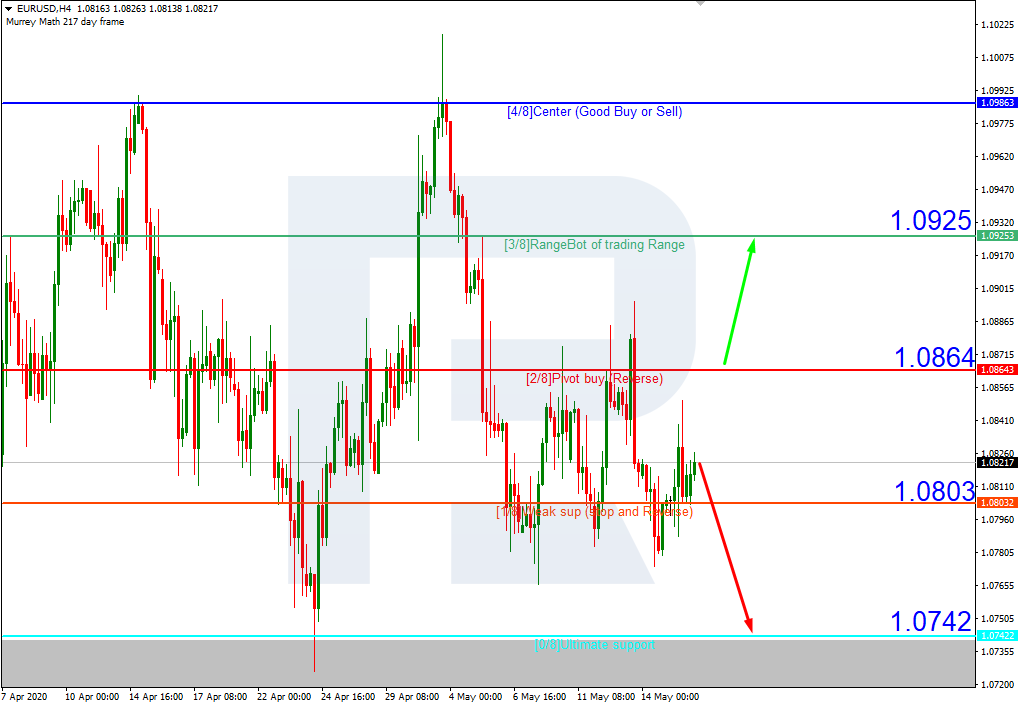

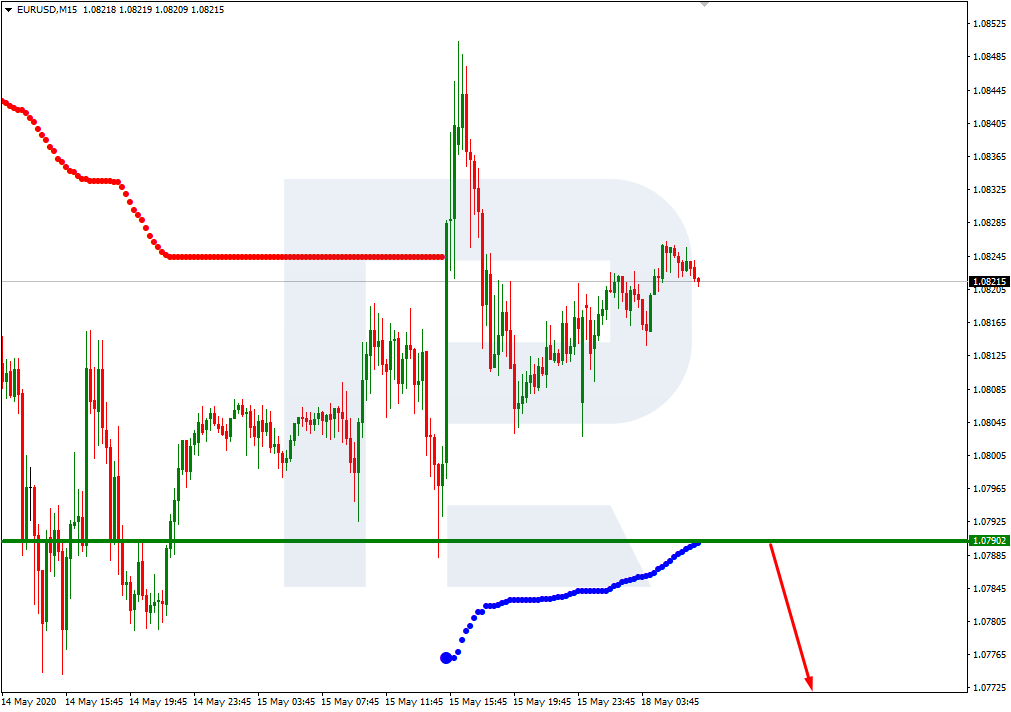

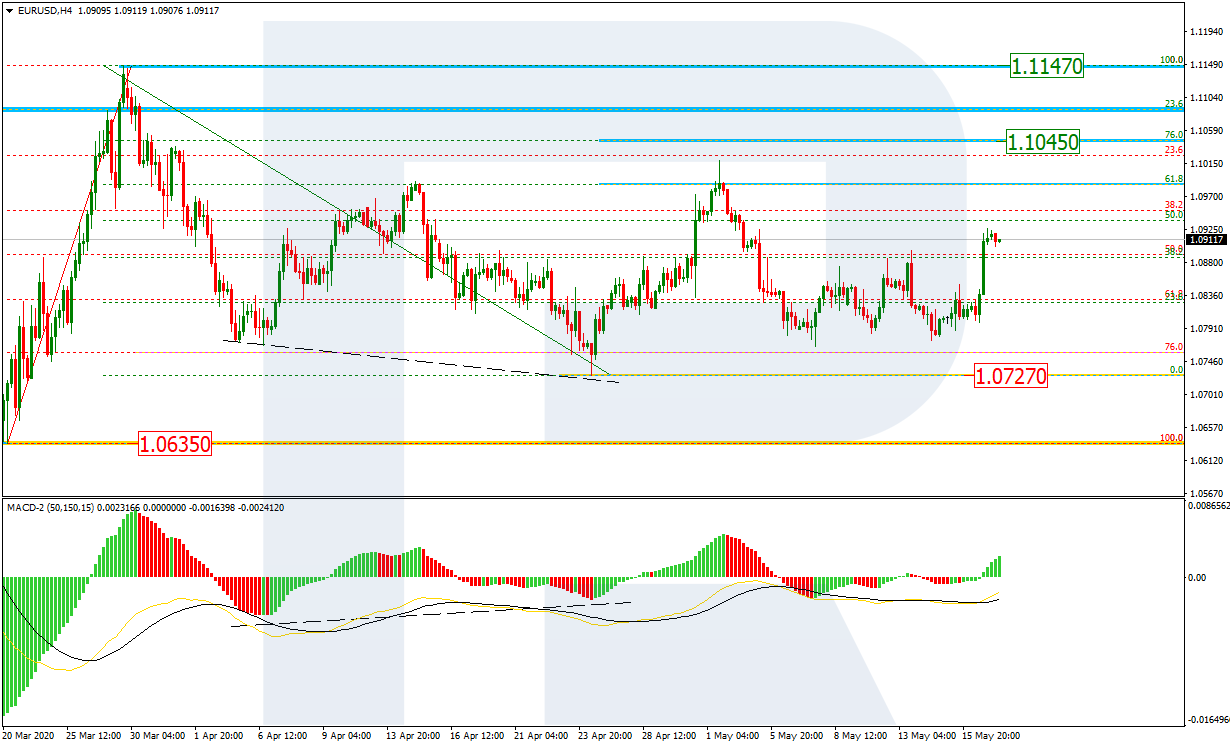

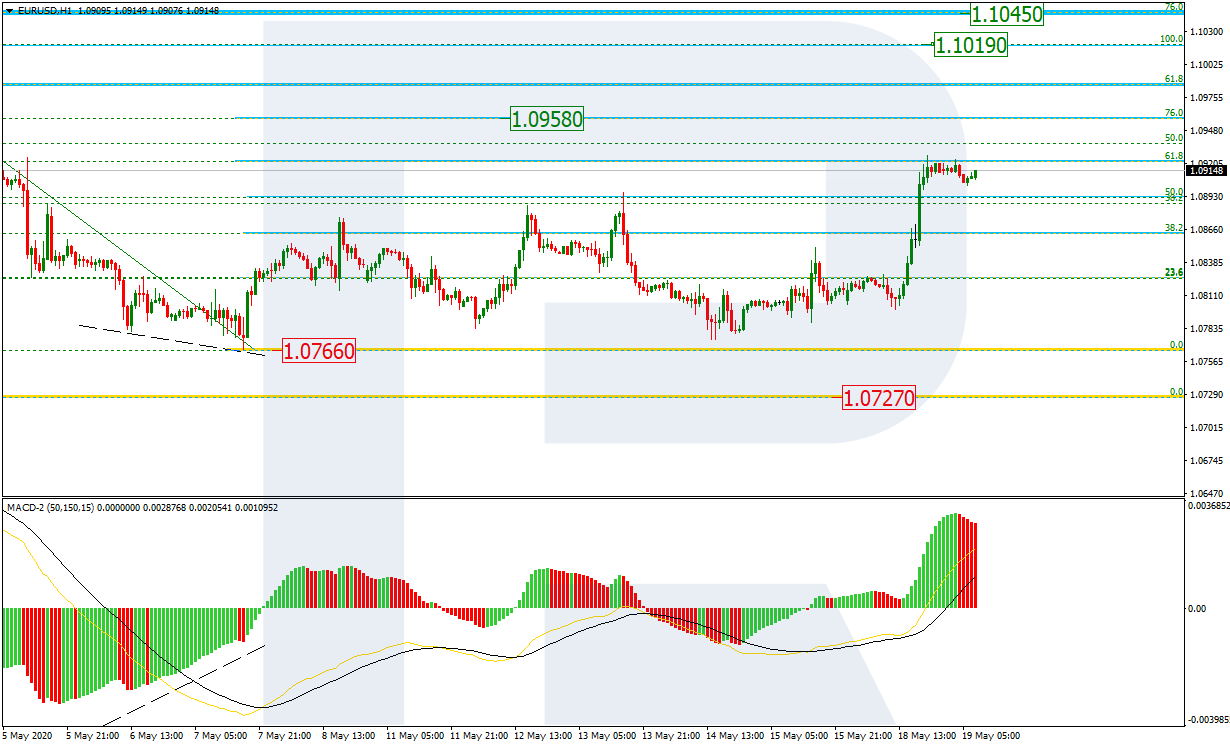

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after making several attempts to test the support level not far from the low at 1.0727, EURUSD has started a new rising impulse with the closest target at 76.0% fibo (1.1045). the key upside target is the high at 1.1147. If the price breaks the high, it may continue the mid-term rising tendency towards 38.2% at 1.1370.

In the H1 chart, the pair tested the low several times, thus forming a local support at 1.0766. The first two rising impulses reached 38.2% and 50.0% fibo respectively; while the current one – 61.8% fibo. Later, the price may continue growing to reach 76.0% fibo at 1.0958. However, a more significant local target will be the high at 1.1019.

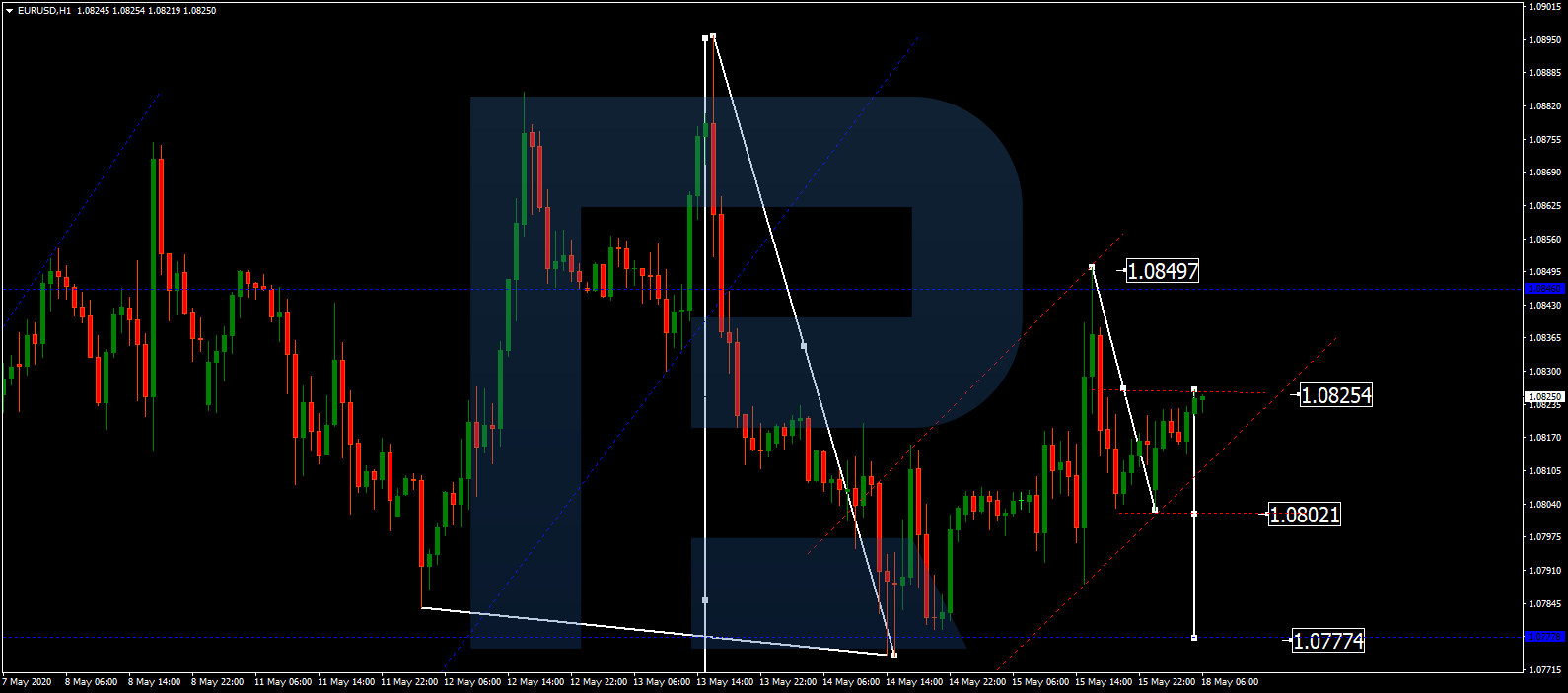

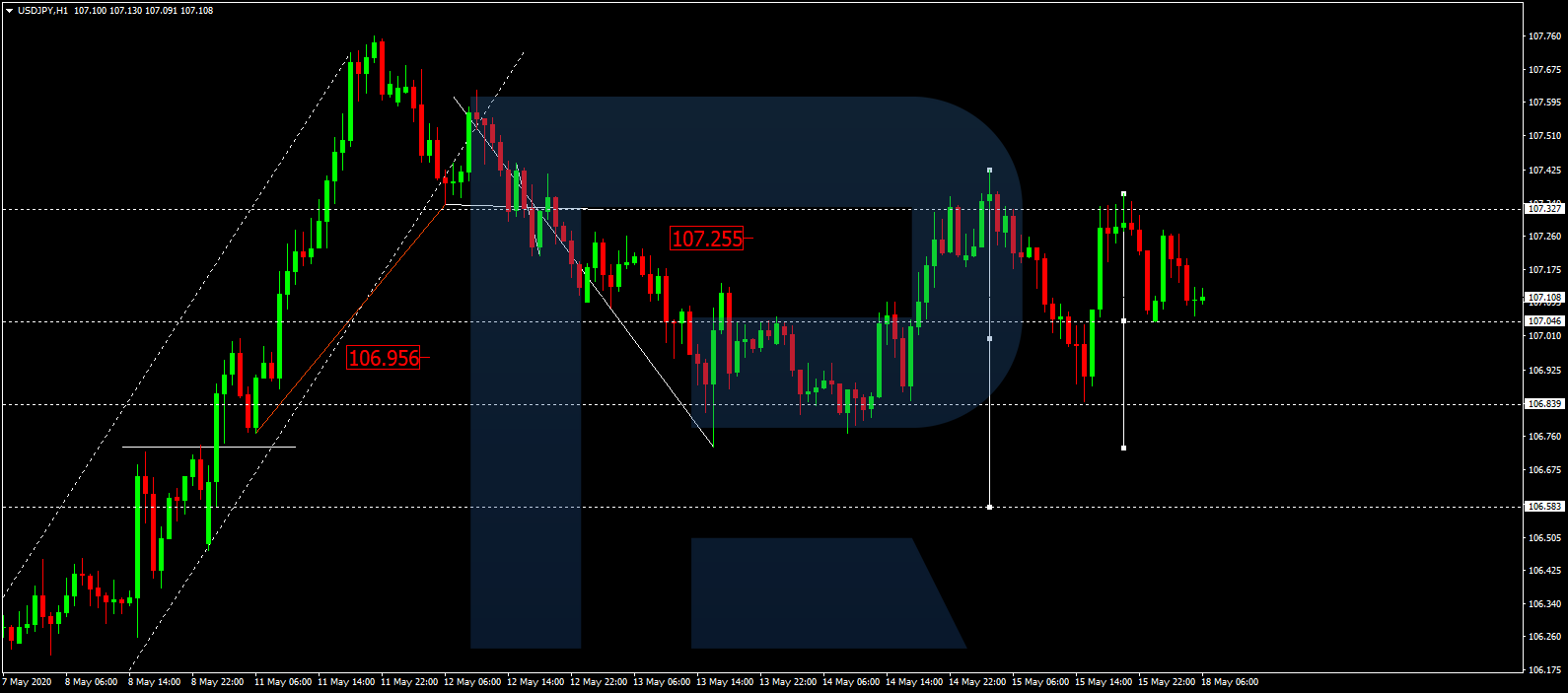

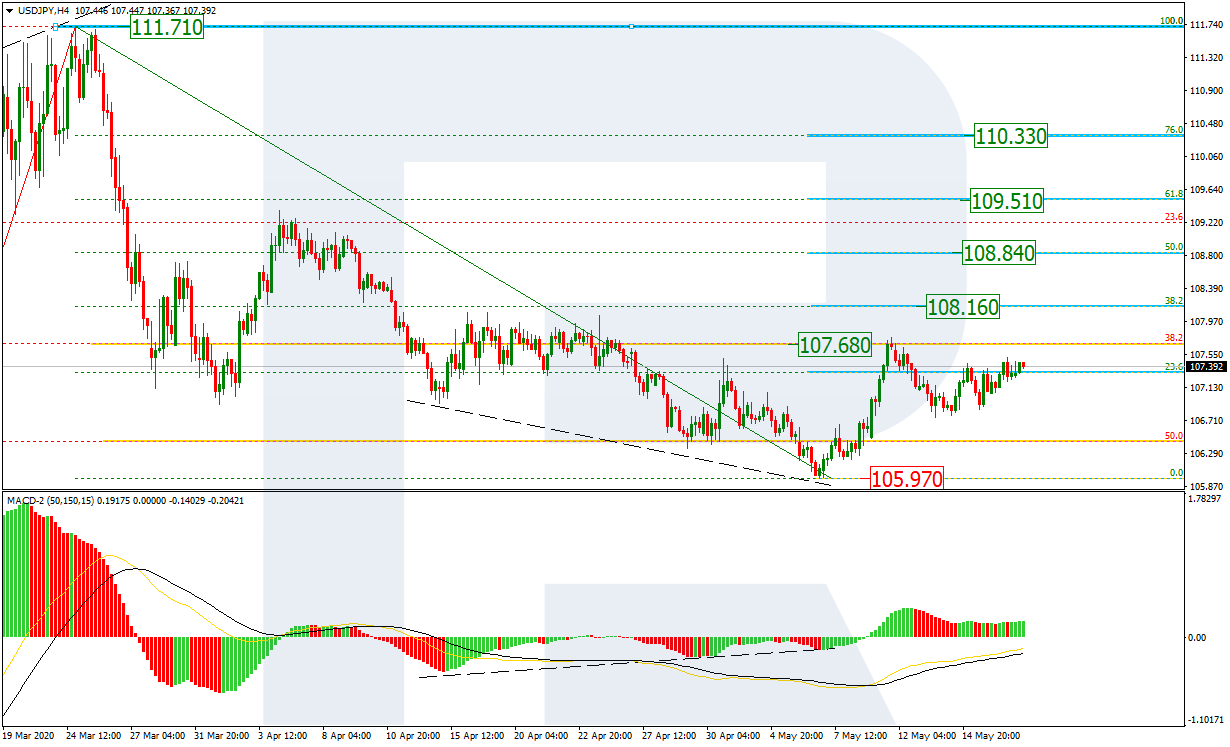

USDJPY, “US Dollar vs. Japanese Yen”

In the H4 chart, after the convergence, the pair tested the resistance at 107.68 and then formed one more ascending structure to reach 23.6% fibo, which was followed by a new short-term pullback. By now, the pullback might have been over. In the future, the price is expected to test the resistance and break it. Later, the market may continue moving towards 38.2%, 50.0%, 61.8%, and 76.0% fibo at 108.16, 108.84, 109.51, and 110.33 respectively. The support is the low at 105.97.

As we can see in the H1 chart, USDJPY has finished the local pullback at 50.0% fibo; right now, it is forming a new rising structure. The closest upside target is the high at 107.77. After breaking it, the market may continue growing to reach 38.2% fibo at 108.16.