Fibonacci Retracements Analysis 09.12.2019 (GOLD, USDCHF)

XAUUSD, “Gold vs US Dollar”

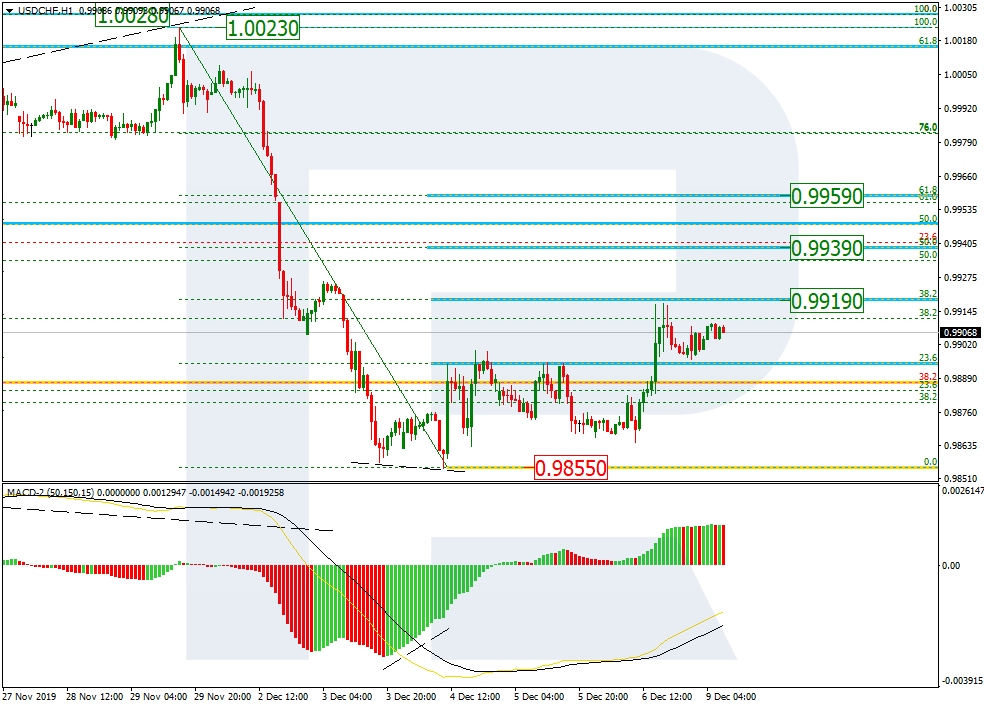

As we can see in the H4 chart, after finishing the descending wave at 38.2% fibo, XAUUSD is correcting. The first correctional wave reached 23.6% fibo, while the second one tried to reach 38.2% fibo at 1488.16, but failed and the pair fell instead. The next wave may break the above-mentioned level and then continue growing towards 50.0% and 61.8% fibo at 1501.30 and 1514.30 respectively. After completing the correctional uptrend, the instrument may break the local low at 1445.60 and continue falling towards its mid-term target, which is 50.0% fibo at 1413.85.

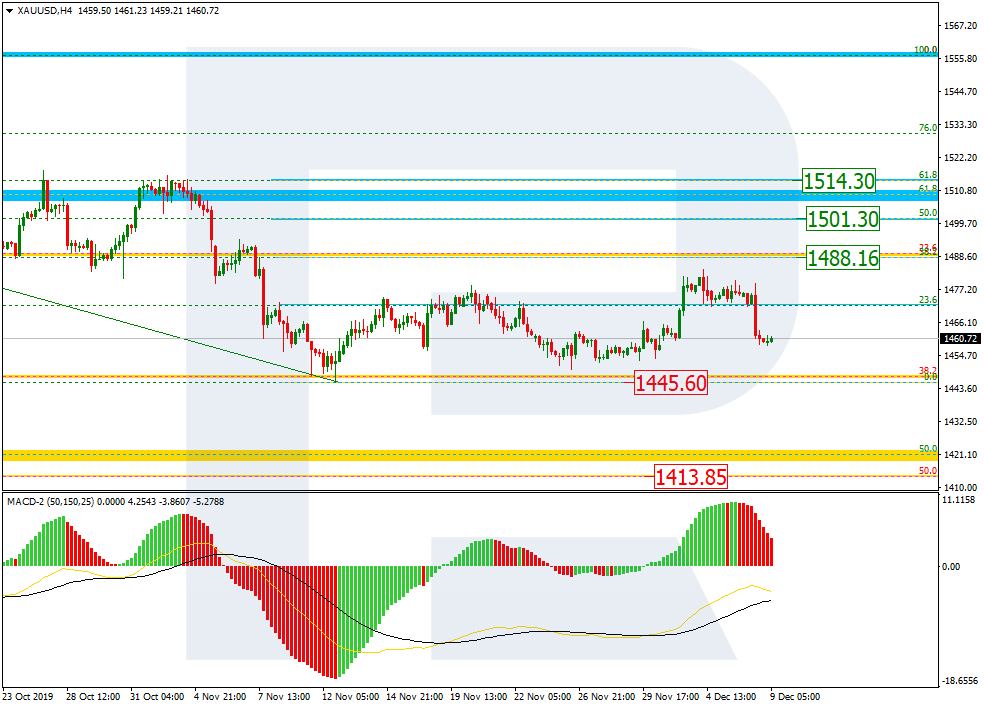

In the H1 chart, the divergence made the pair start a new descending correctional wave, which has reached 76.0% fibo, thus indicating a new wave to the upside to reach the local high at 1486.05.

USDCHF, “US Dollar vs Swiss Franc”

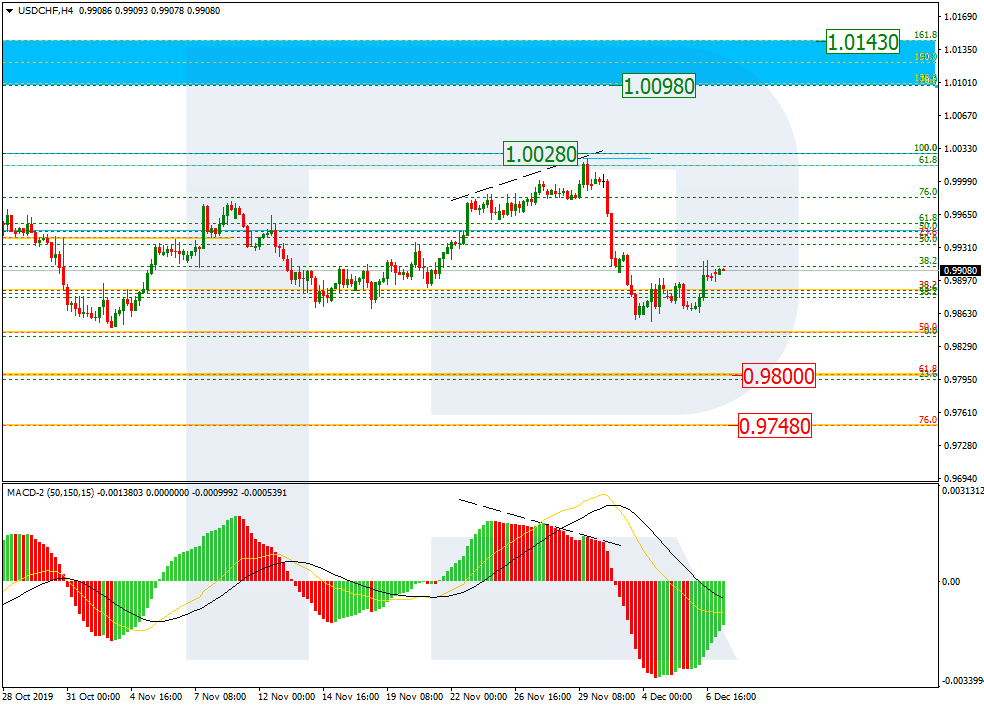

As we can see in the H4 chart, the divergence made the pair stop growing at the mid-term high at start a new descending wave, which has almost reached 50.0% fibo. After breaking this level and fixing below it, the price may continue falling towards 61.8% and 76.0% fibo at 0.9800 and 0.9748 respectively.

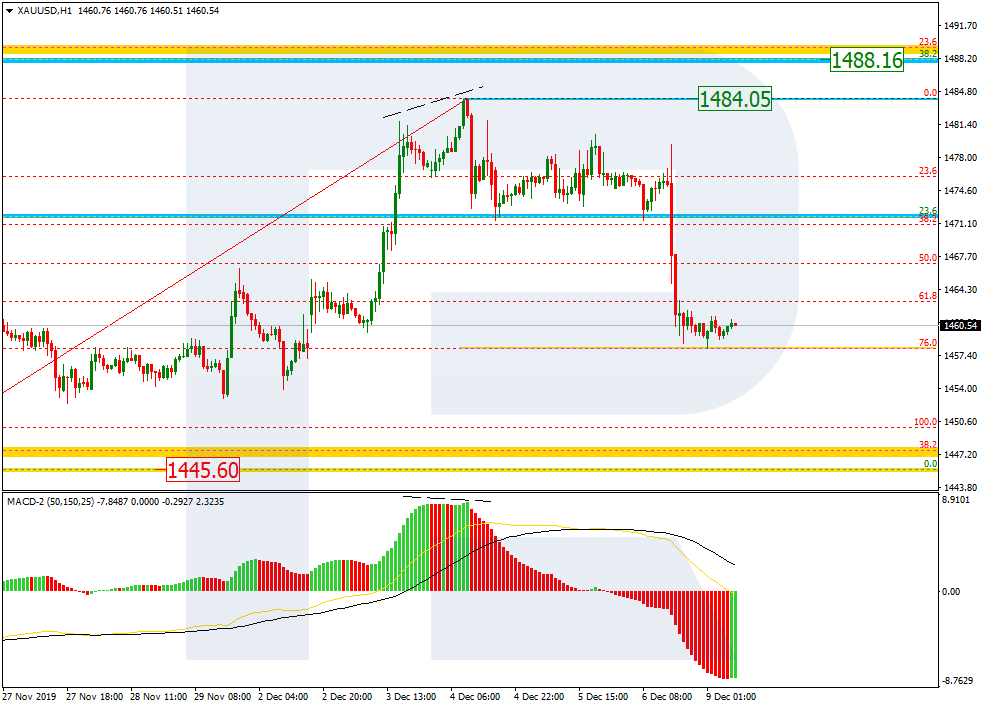

In the H1 chart, after finishing a quick descending wave, USDCHF is correcting and has almost reached 38.2% fibo at 0.9919. The next correctional targets may be 50.0% and 61.8% fibo at 0.9939 and 0.9959 respectively. The support is the low at 0.9855.