|

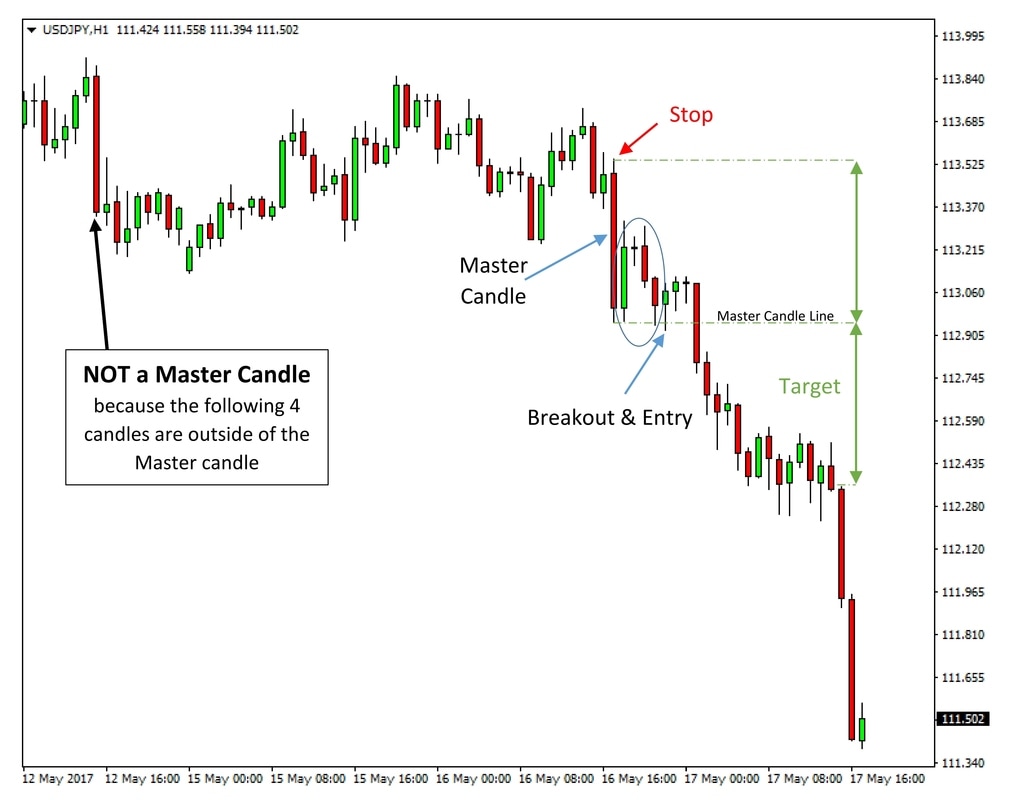

The concept of the Master Candle is very popular in FOREX trading. There are different ways of looking at this trading strategy, but in its simplest form, a Master Candle is a candle which contains the highs and lows of at least the next four candles after it.

The formation of a true Master Candle can be seen on a chart if the next four candles are consolidating inside of the tall Master Candle. |

- You should not try to trade near a Support / Resistance (SR) zone.

- There should be no trade against a Support / Resistance zone that is closer than the Master Candle’s height.

- Only take a trade when a candle breaks the Master Candle’s High or Low.

- For Great British Pound / Japanese Yen (GBP/JPY) and Great British Pound / United States Dollar (GBP/ USD), the range of 40 to 105 pips is the most likely daily trading range and therefore it should be used as a general guide when day-trading the Master Candle strategy on these pairs.

- You should not be looking to trade if the size of the Master Candle is outside the above-mentioned pip range.

- When considering to enter a long position, use the formula, “Place buy stop pending order five pips above High of Master Candle + the Spread”.

- When considering to enter a short position, use the formula, “Place sell stop pending order five pips below low of Master Candle”.

- Profits will vary in pips and are dependent on the chosen currency pair and its volatility.

- It is recommended to always target the Master Candle size when exiting the trade. So, for example, if the Master Candle size is 40 pips, consider setting your profit target at 40 pips.

- Place your Stop-Loss order in the opposite direction of the entry at the other end of the Master Candle. So, in a long trade, the stop should be at the Master Candle’s low, while in a short trade the stop should be at the Master Candle’s high.

These are the candles which get reversed after breaking through the Master Candle which can, of course, lead to failed and losing trades. For this reason, some professional traders avoid entering on the first break of Master Candle. Instead, they wait till the formation of a scouting party and then enter after price breaks out of the scouting party.

It is true that the Master Candle is considered to be one of the simplest trading strategies and it is widely used because of this. Moreover, it is also known to provide favorable results.

However, the fact of the matter is that the results are not identical everywhere. Each trader trading in the FOREX market has his own style of decision-making and trading, hence, it is expected for results to differ even when following the same strategy.

Therefore, it is strongly recommended to develop your own understanding of the Master Candle trading strategy and master it with a trial and error approach. Take real life scenarios and make your decisions according to your experiences. Slowly, your knowledge and skills will be refined and you will be in a better position to make use of the Master Candle trading strategy.