RFXSignals Gold King AI Review: Unmasking the “Guaranteed Profit” Myth

The allure of “guaranteed profits” with minimal effort, especially through sophisticated-sounding AI trading systems, can be incredibly tempting for both new and experienced traders. One such system making bold claims is RFXSignals Gold King AI. But does it live up to the hype, or is it another pitfall for unsuspecting investors? We dive deep into its mechanics based on available trade analysis.

The Seductive Promise vs. Cold Hard Reality

RFXSignals Gold King AI reportedly promises high returns, often with claims of “no experience needed” and “zero cost.” However, a closer look at its purported trading strategy reveals significant red flags that every trader should be aware of.

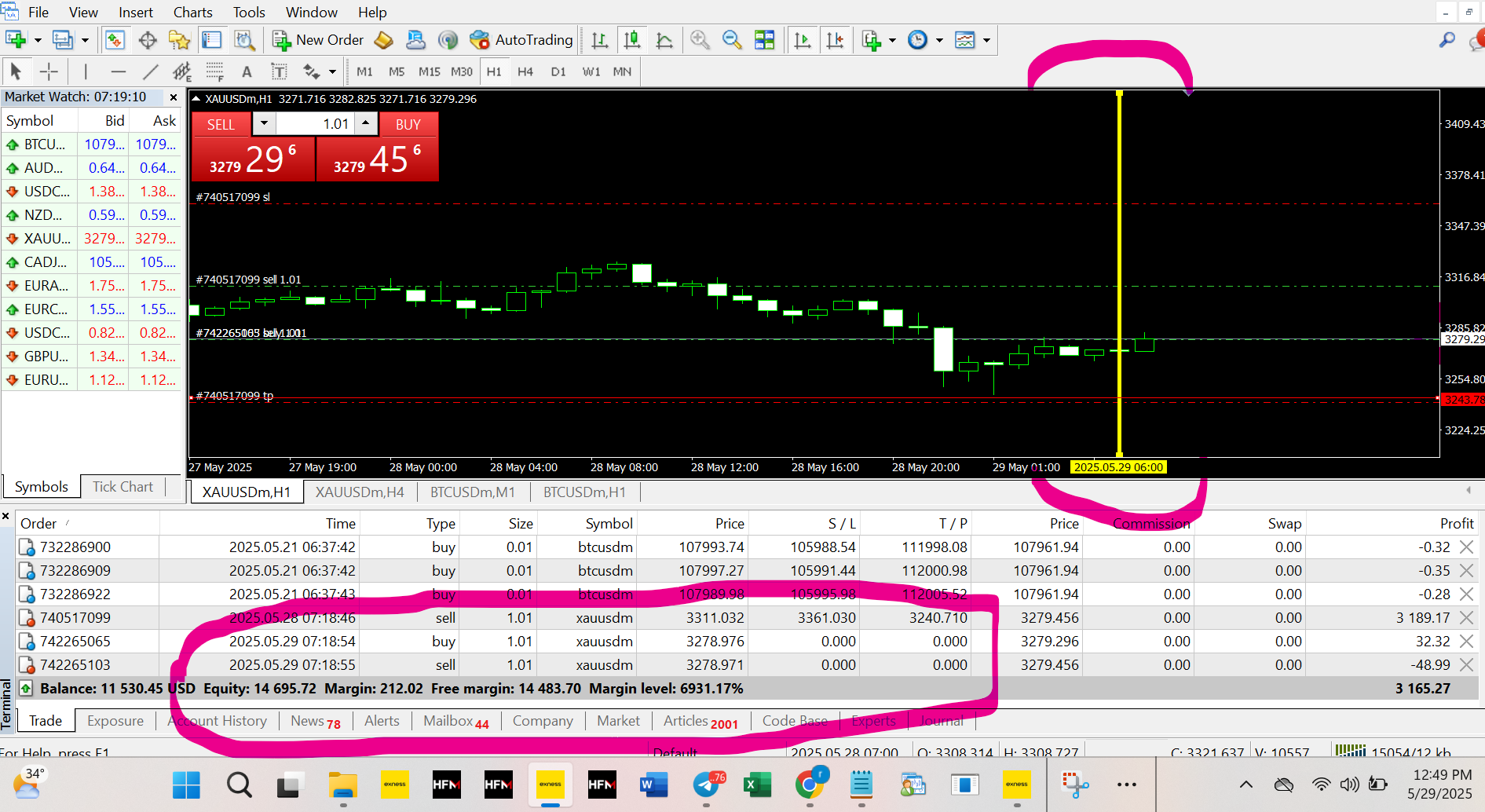

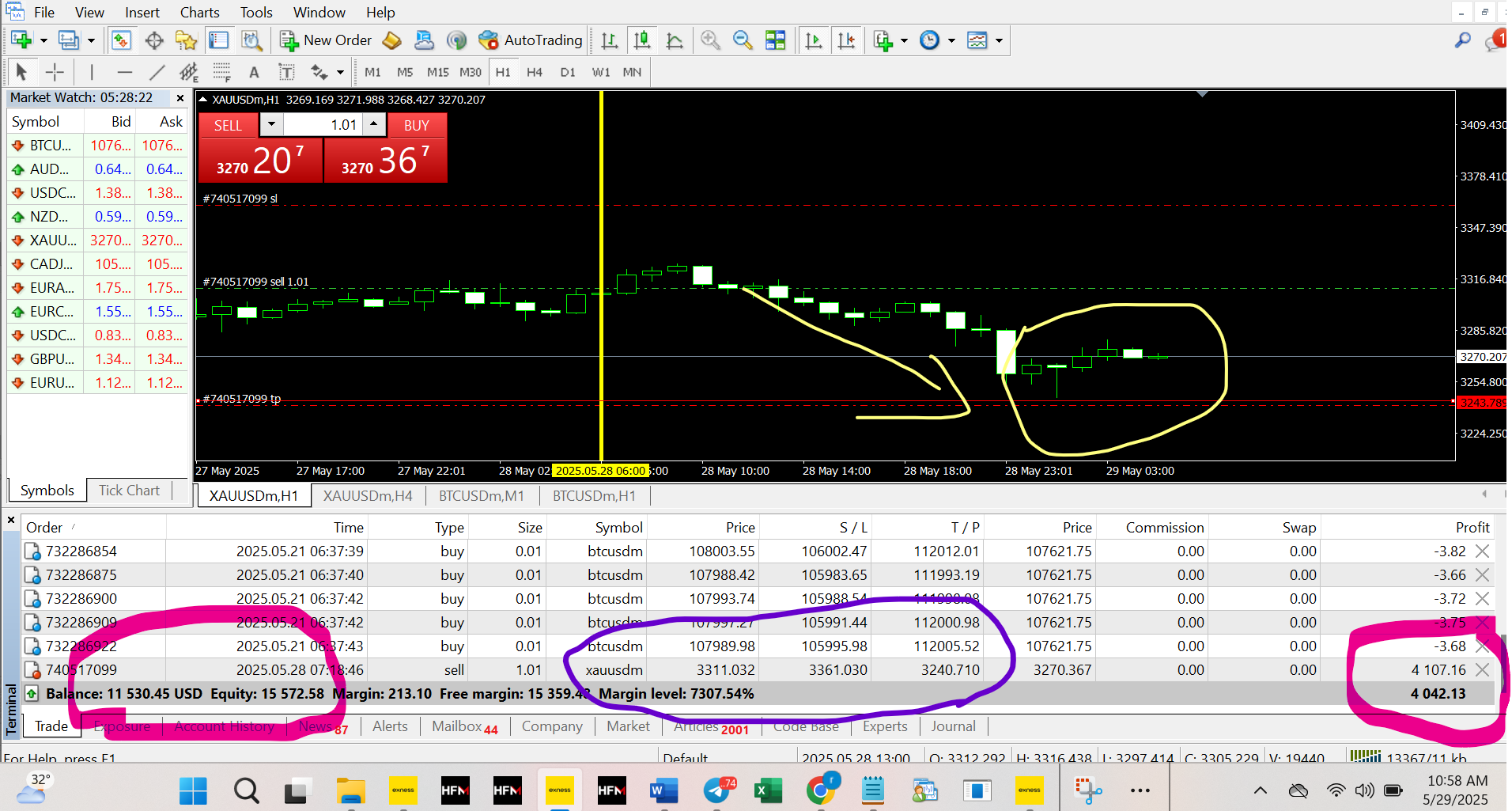

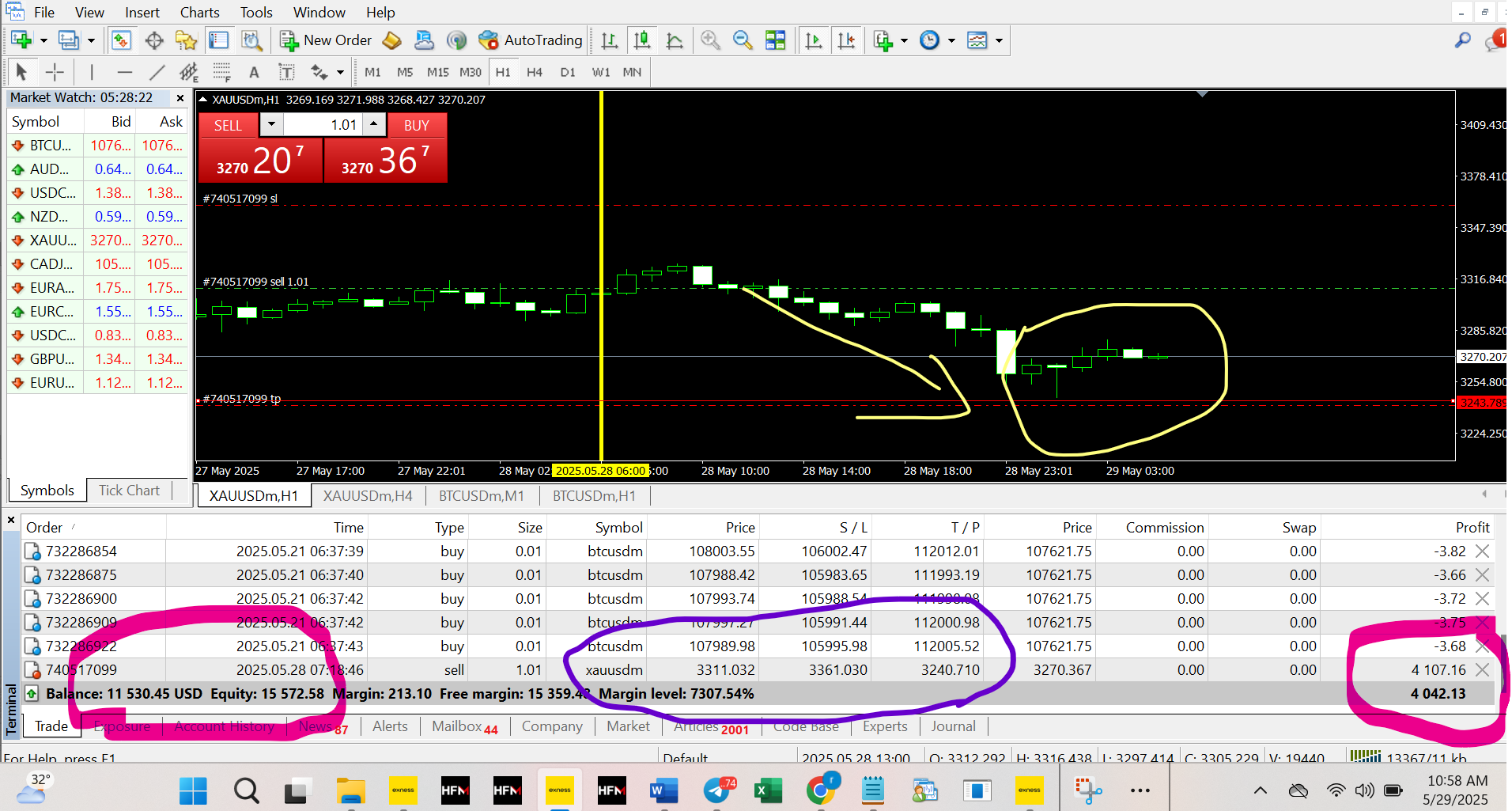

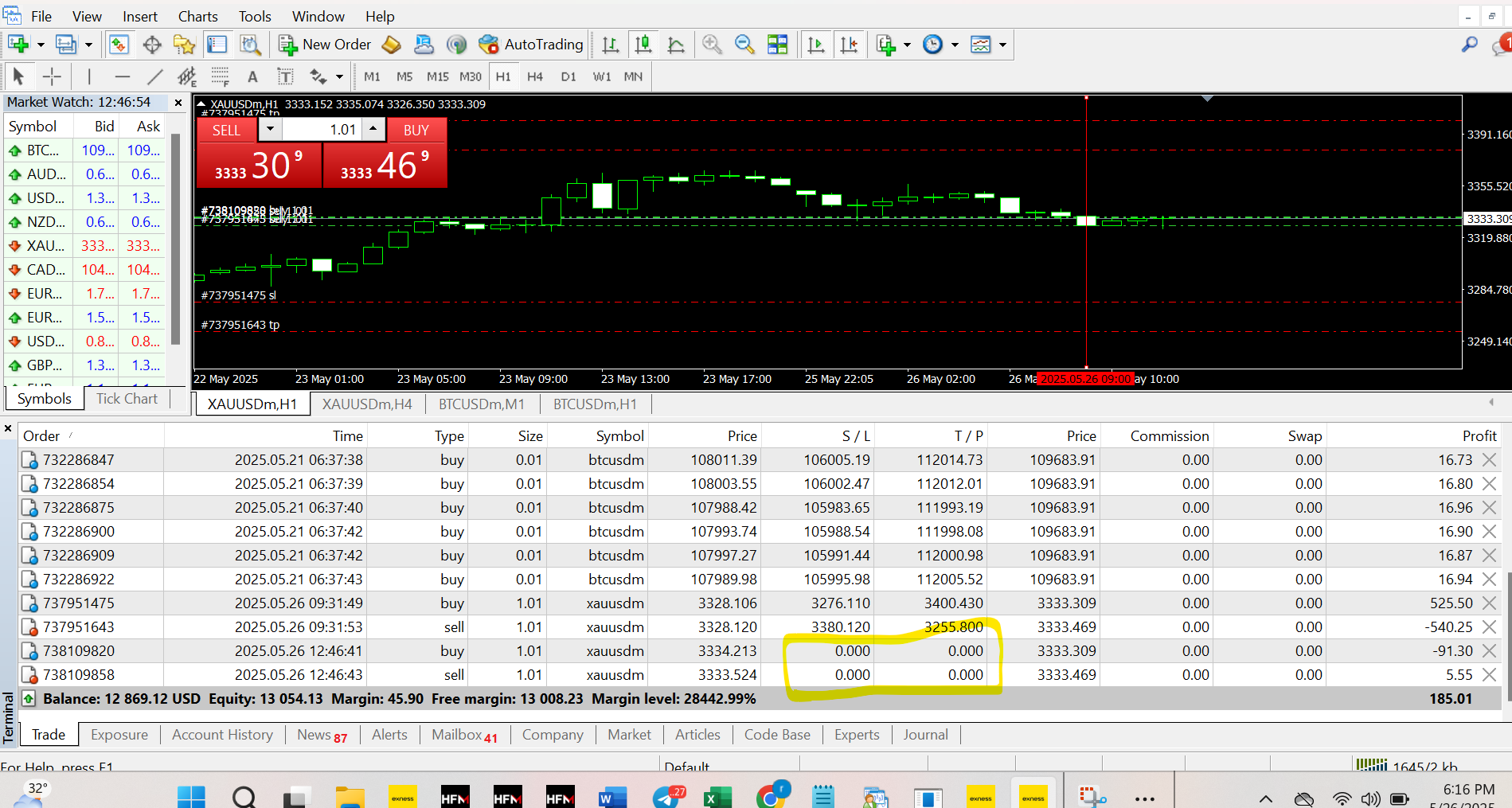

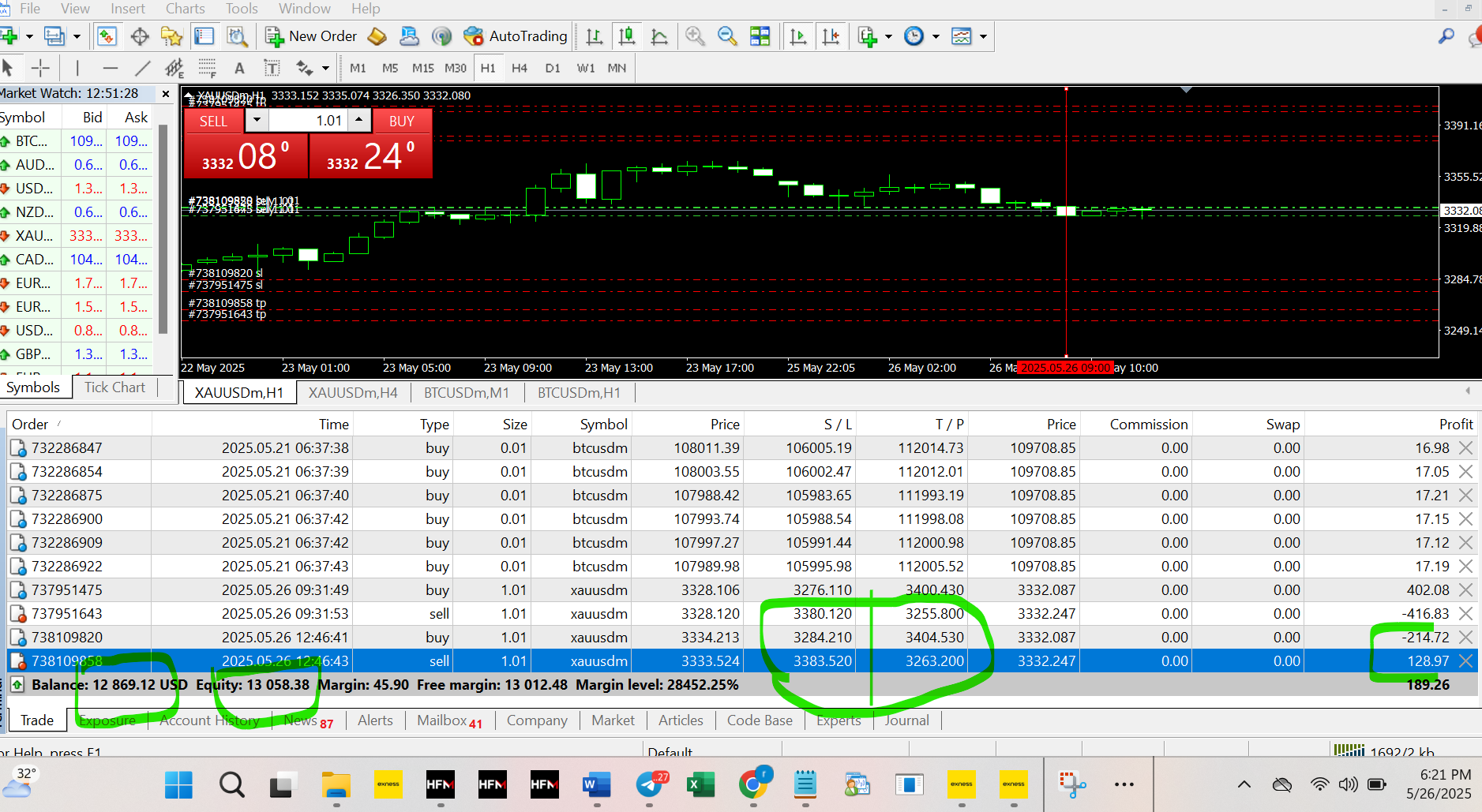

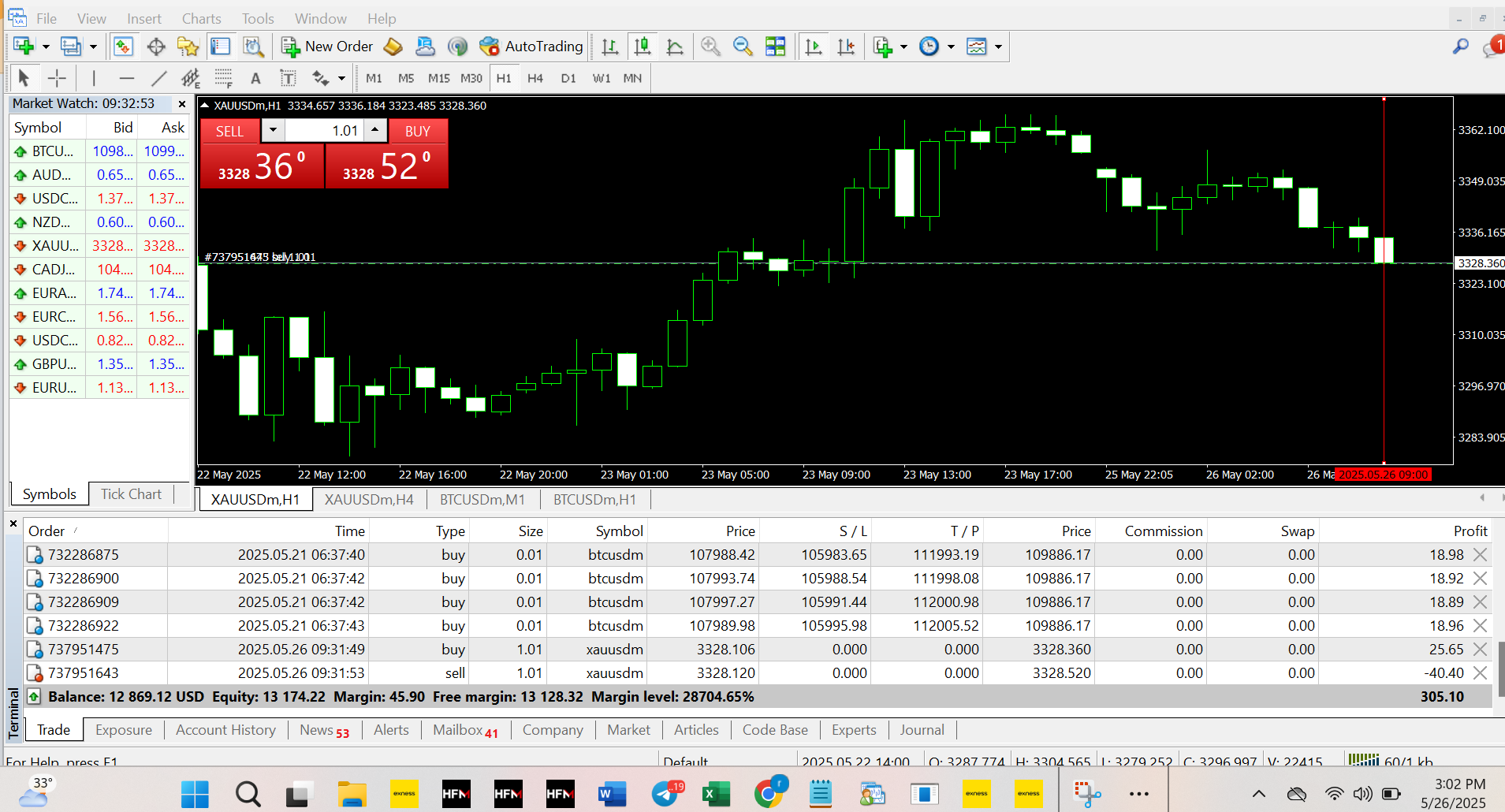

FXSignals Gold King AI: Outsmarting the Market with AI Precision – Trade 7 Analysis

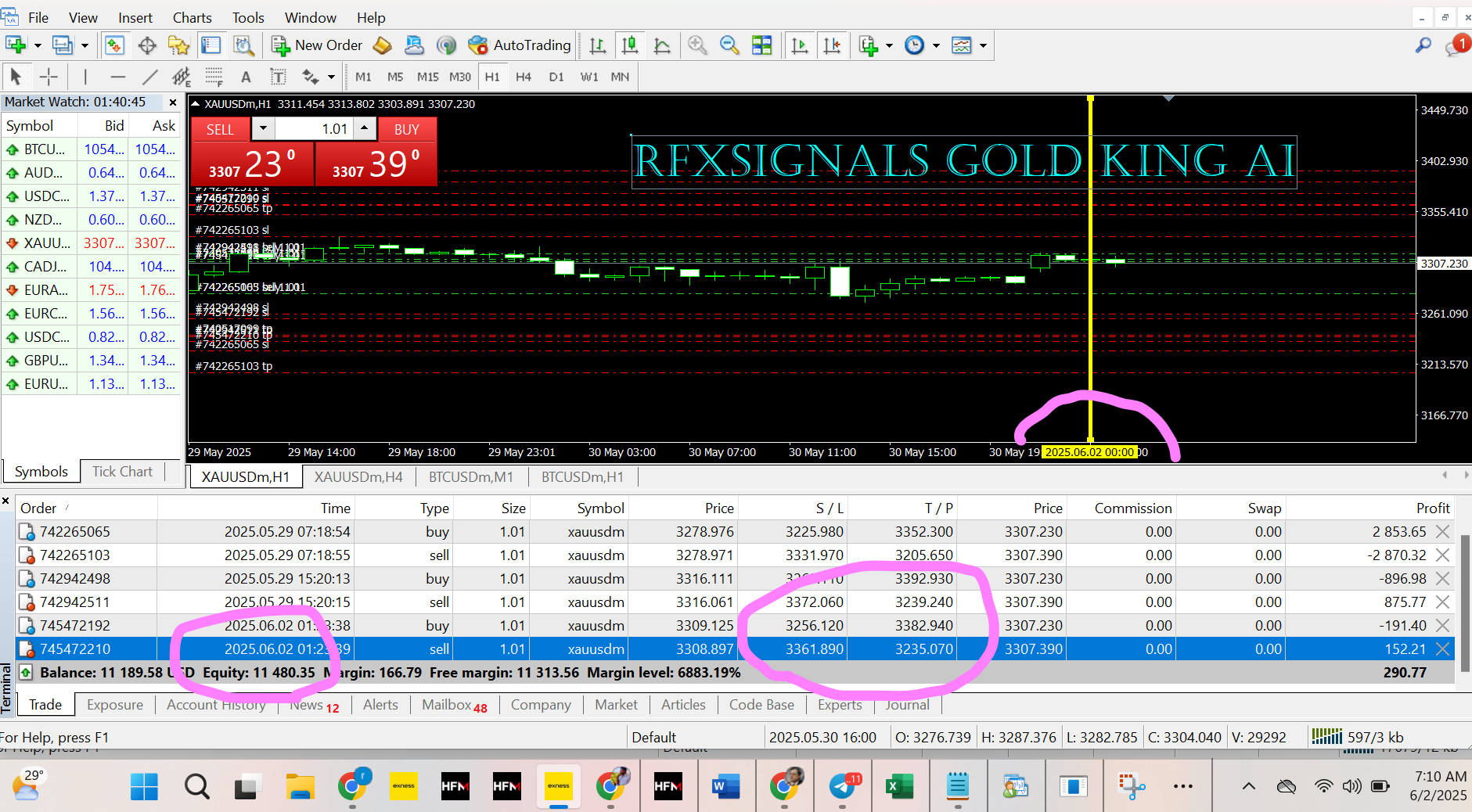

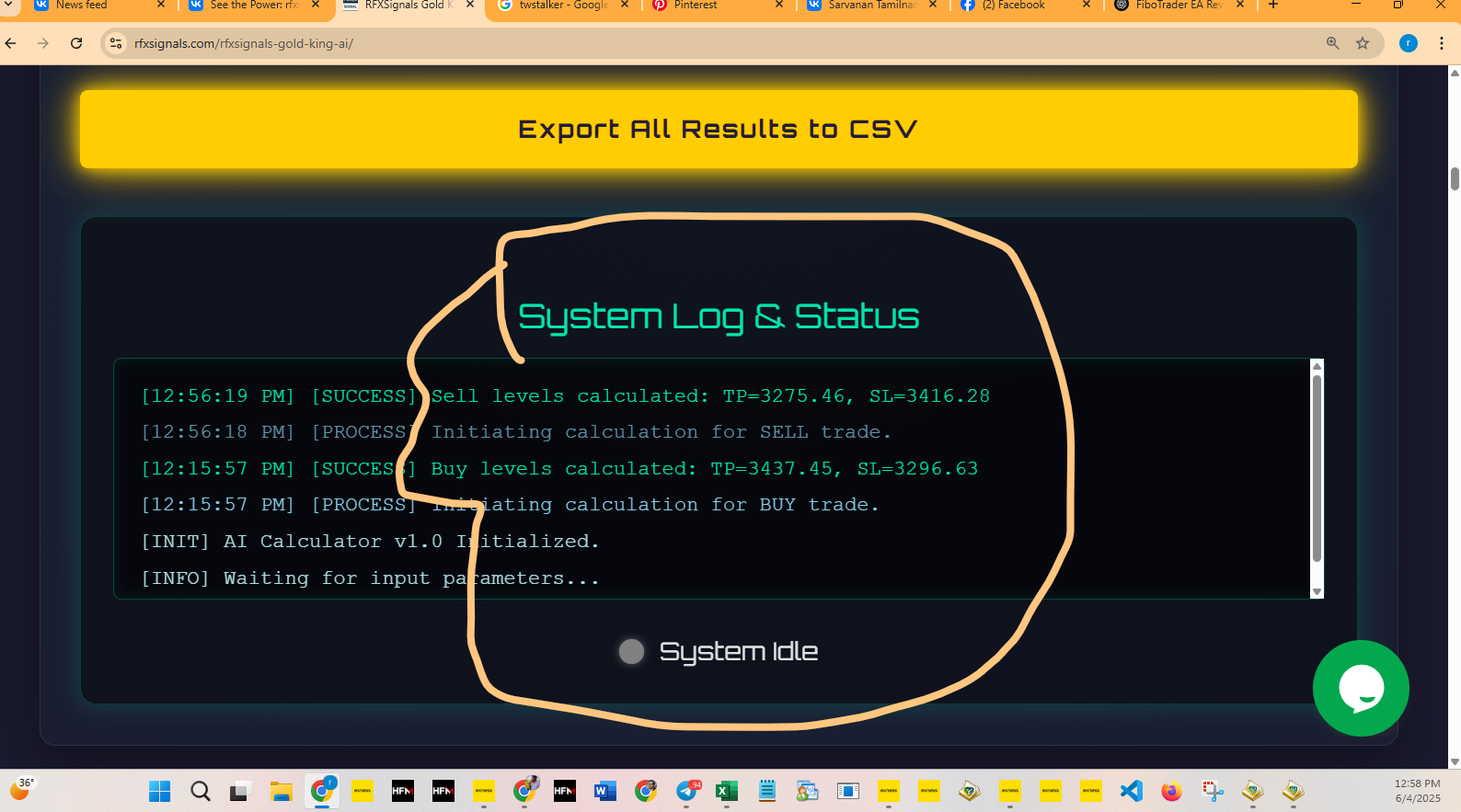

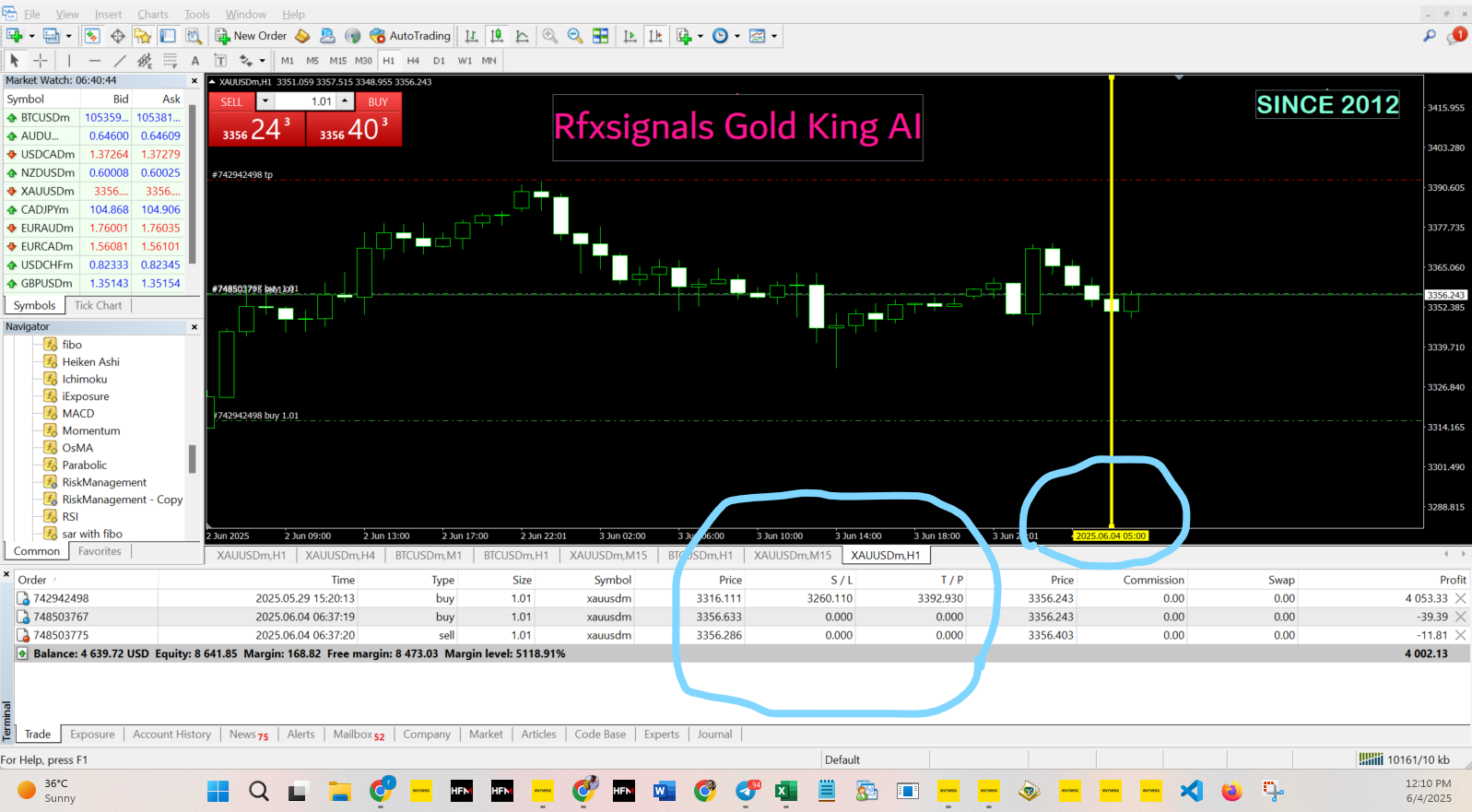

In today’s dynamic Forex market, traders are constantly seeking an edge. The RFXSignals Gold King AI is emerging as a powerful ally, demonstrating how AI-powered trading systems can revolutionize your approach to Gold (XAU/USD) trading. A recent trade on June 4, 2025 (Trade 7), perfectly illustrates the system’s capability to harness mathematical precision and automated intelligence for effortless profit generation.

Dissecting Success: The Trade 7 Execution Details

Let’s break down how RFXSignals Gold King AI navigated the market in this exemplary trade:

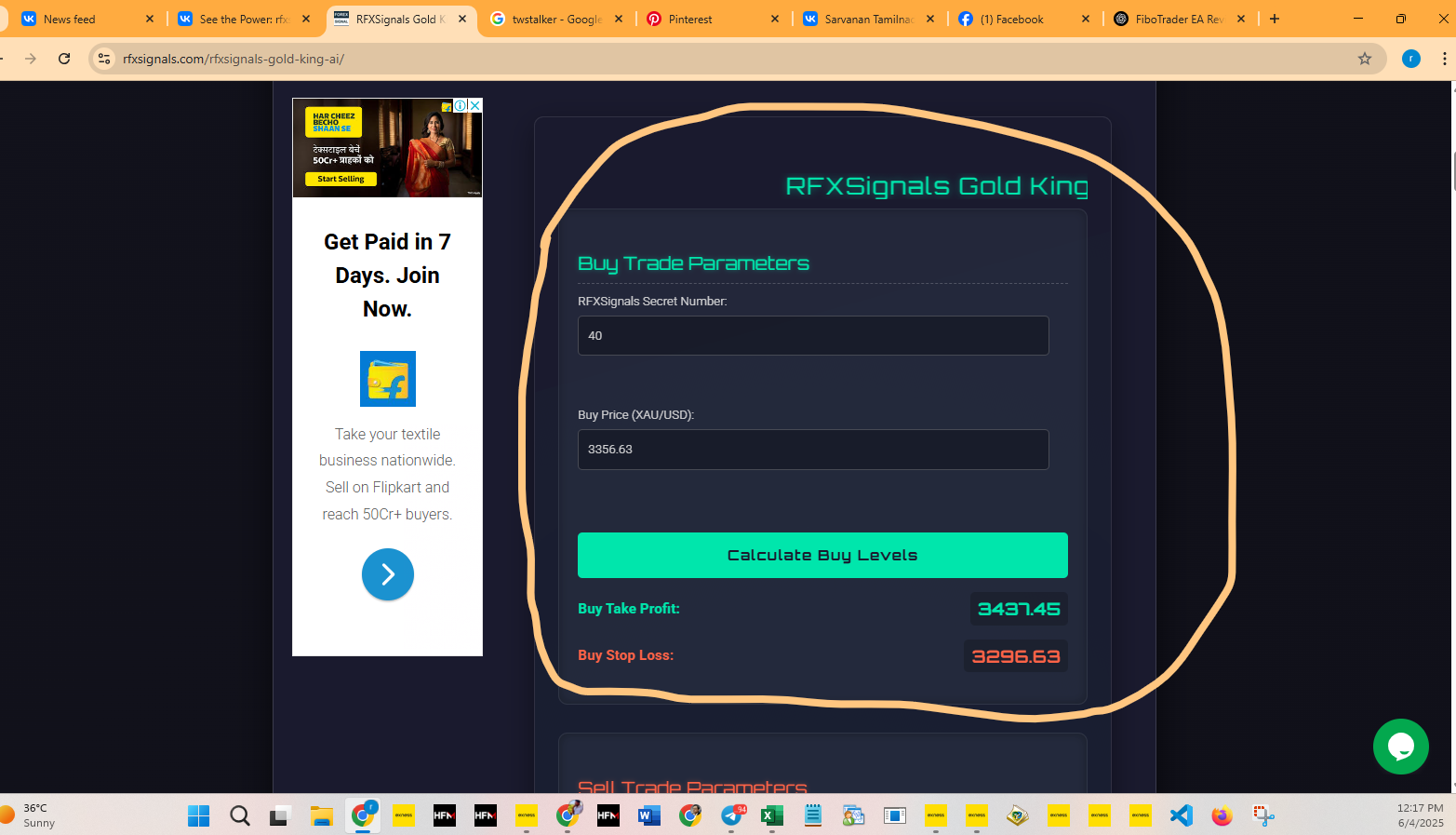

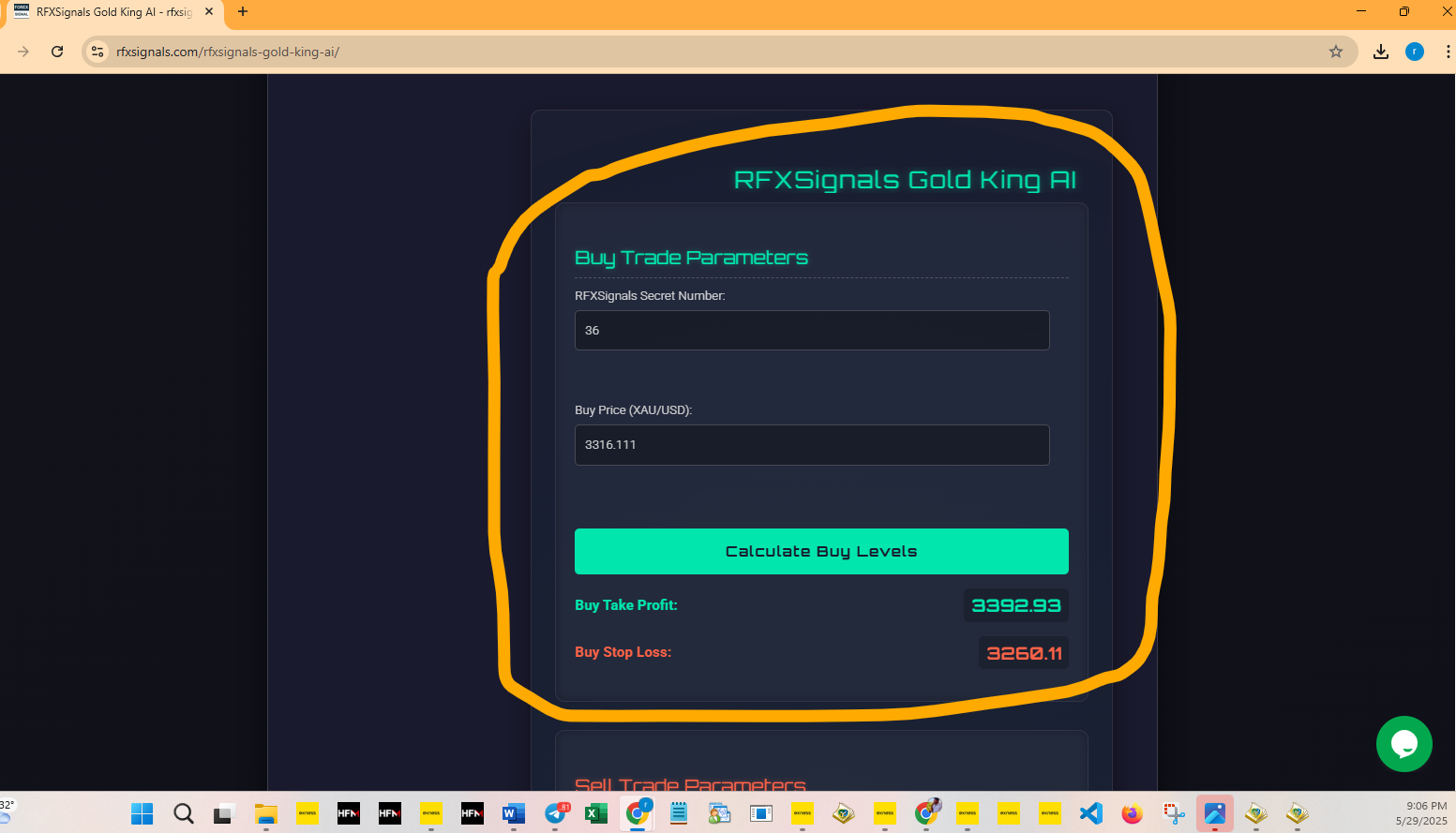

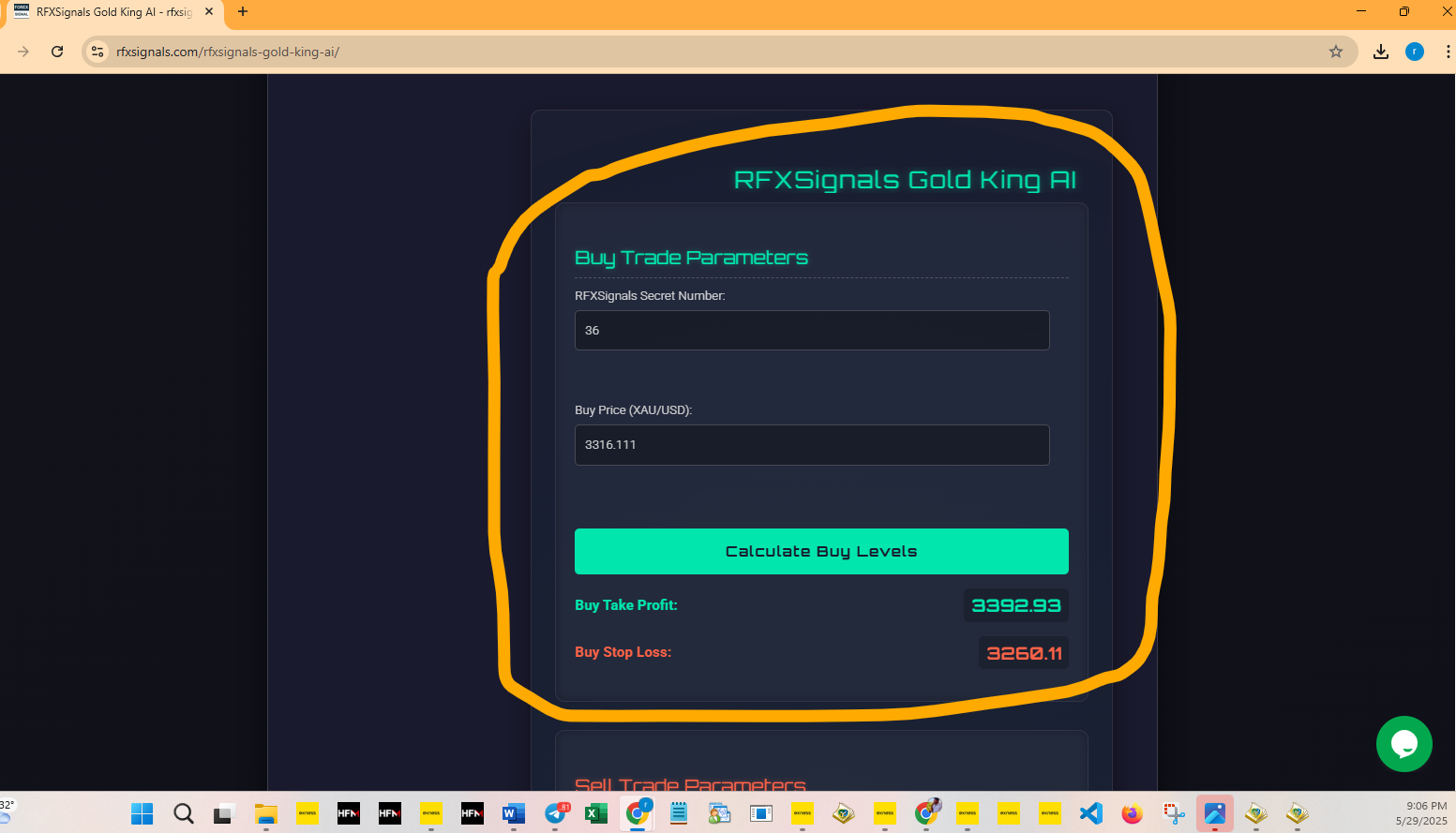

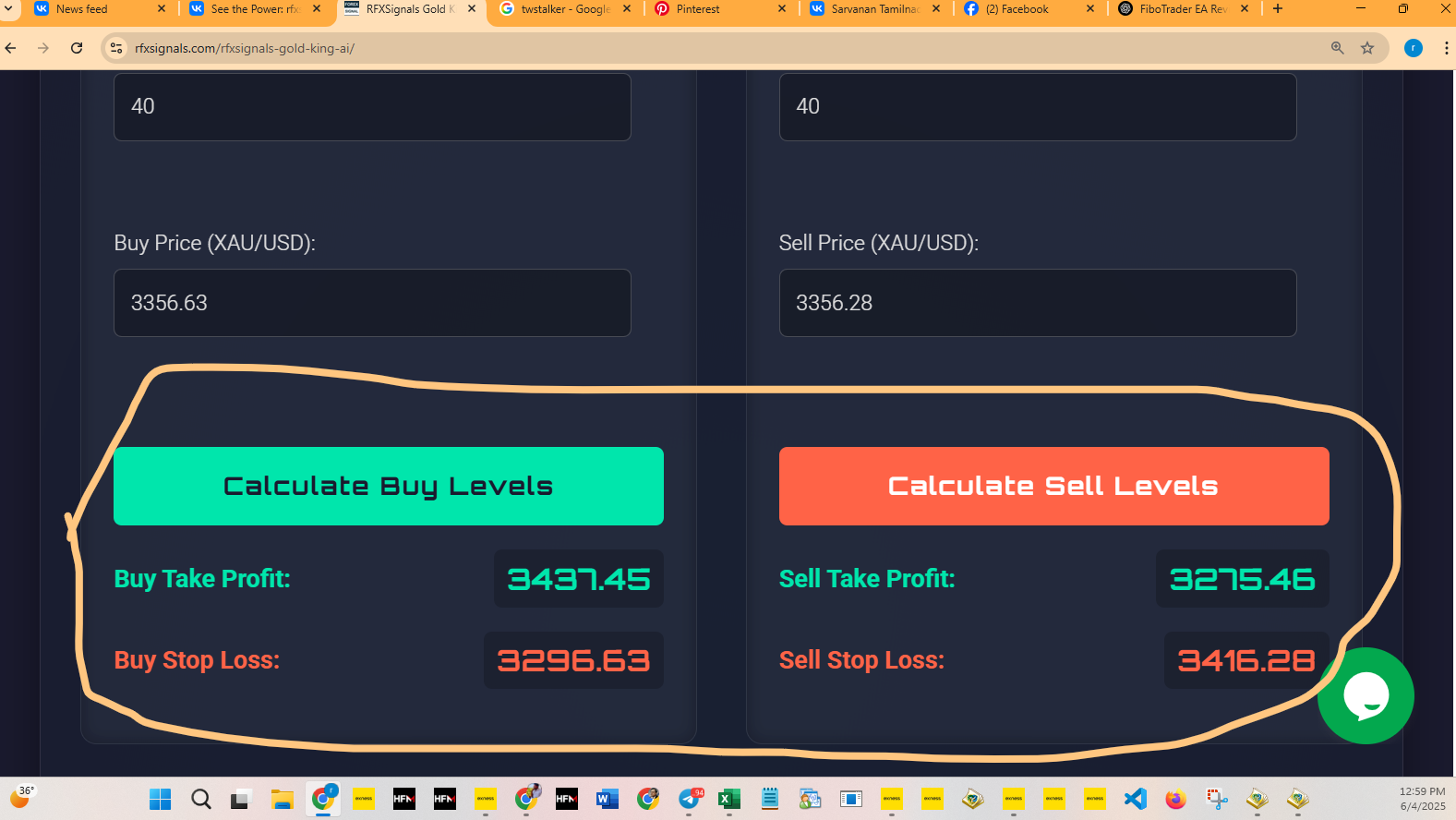

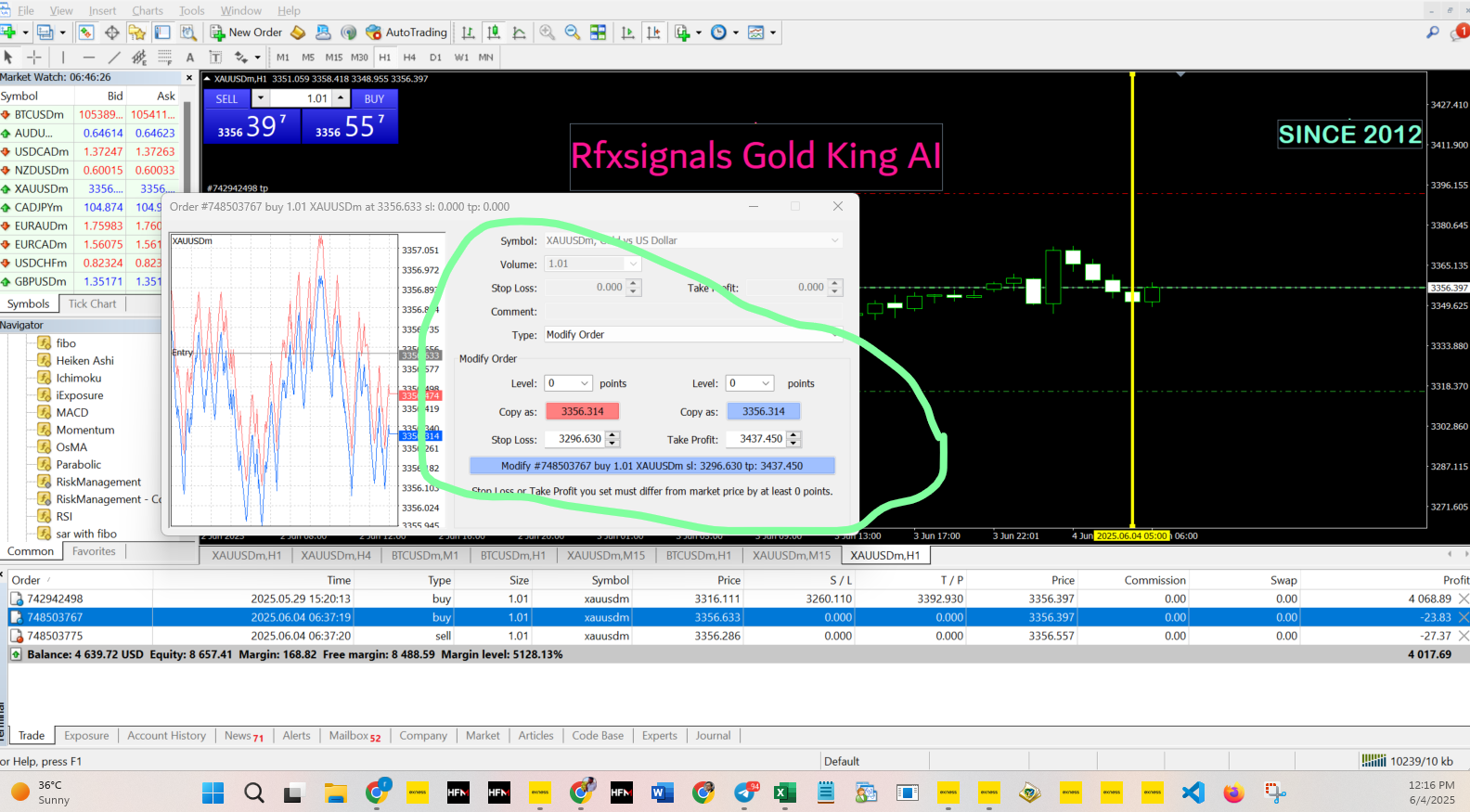

Buy Entry Setup:

- Entry Price: 3356.63

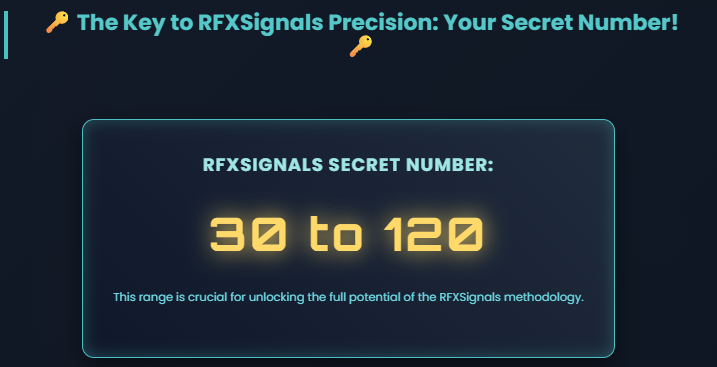

- RFXSignals Secret Number: 40

- Take Profit (TP): 3437.45

- Stop Loss (SL): 3296.63

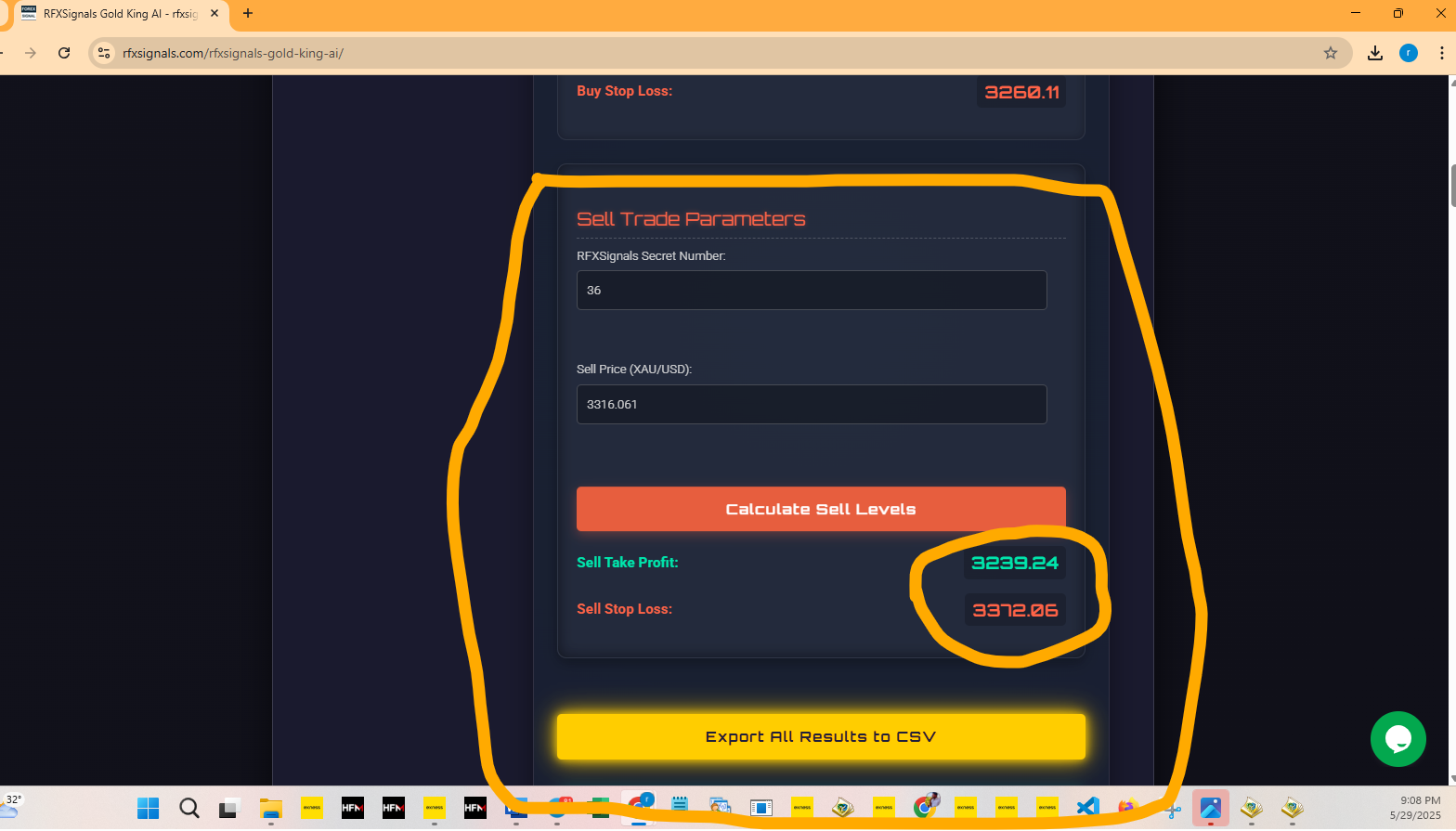

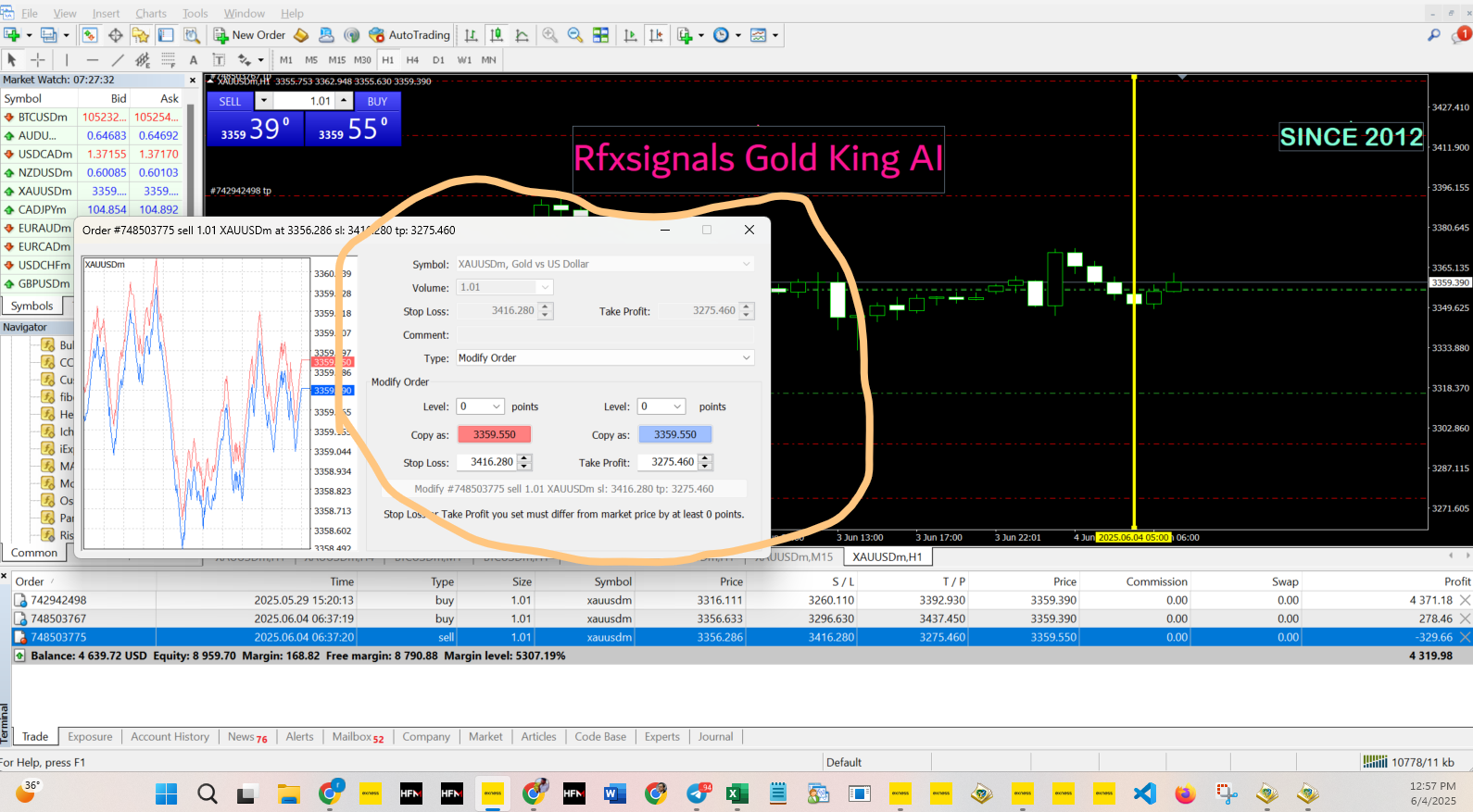

Sell Entry Setup:

- Entry Price: 3356.28

- RFXSignals Secret Number: 40

- Take Profit (TP): 3275.46

- Stop Loss (SL): 3416.28

This meticulous setup is a hallmark of the RFXSignals Gold King AI, designed for optimal outcomes.

How RFXSignals Gold King AI Delivers Consistent Results

What’s the magic behind its effectiveness? It boils down to a sophisticated yet user-friendly approach:

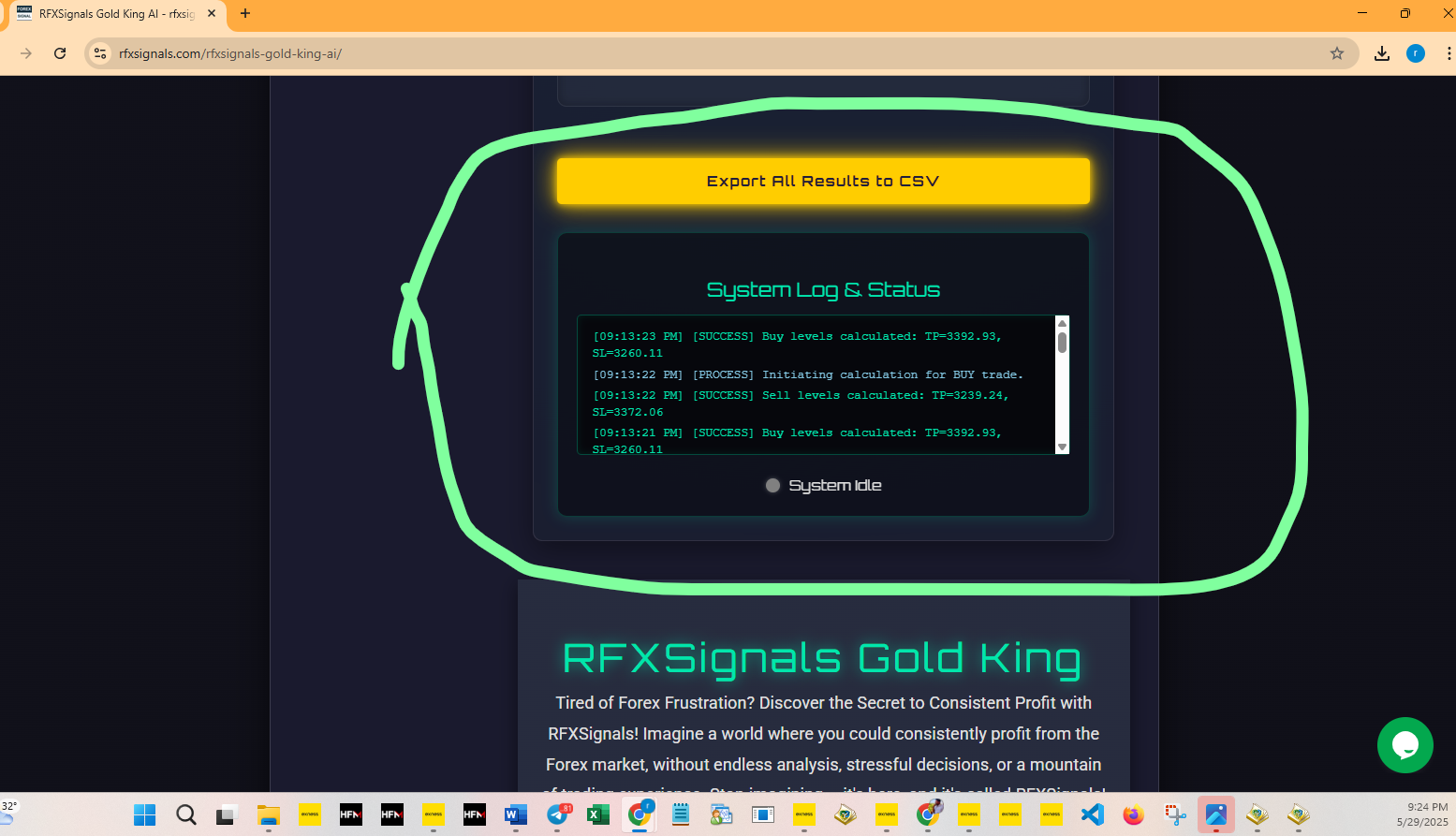

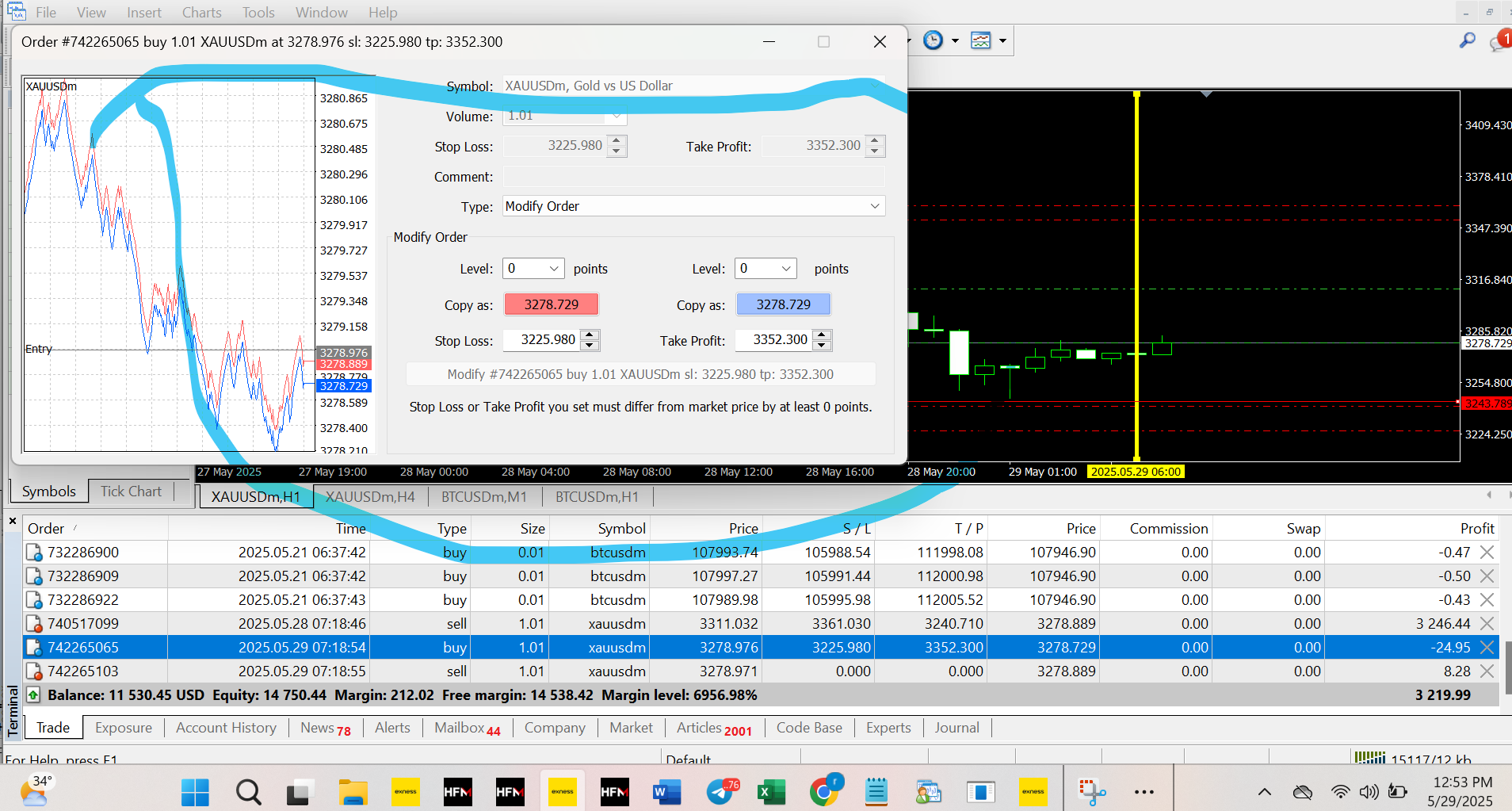

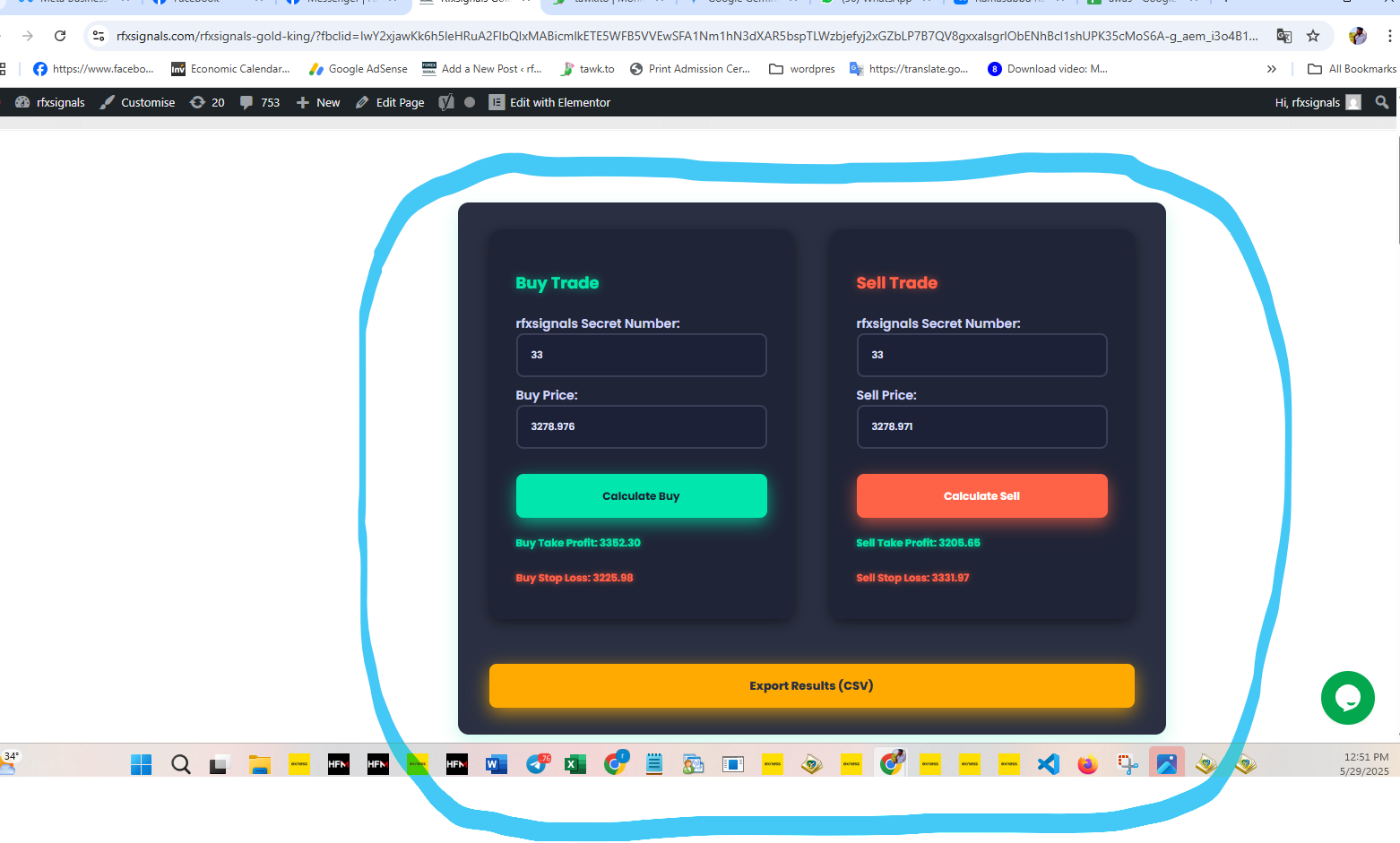

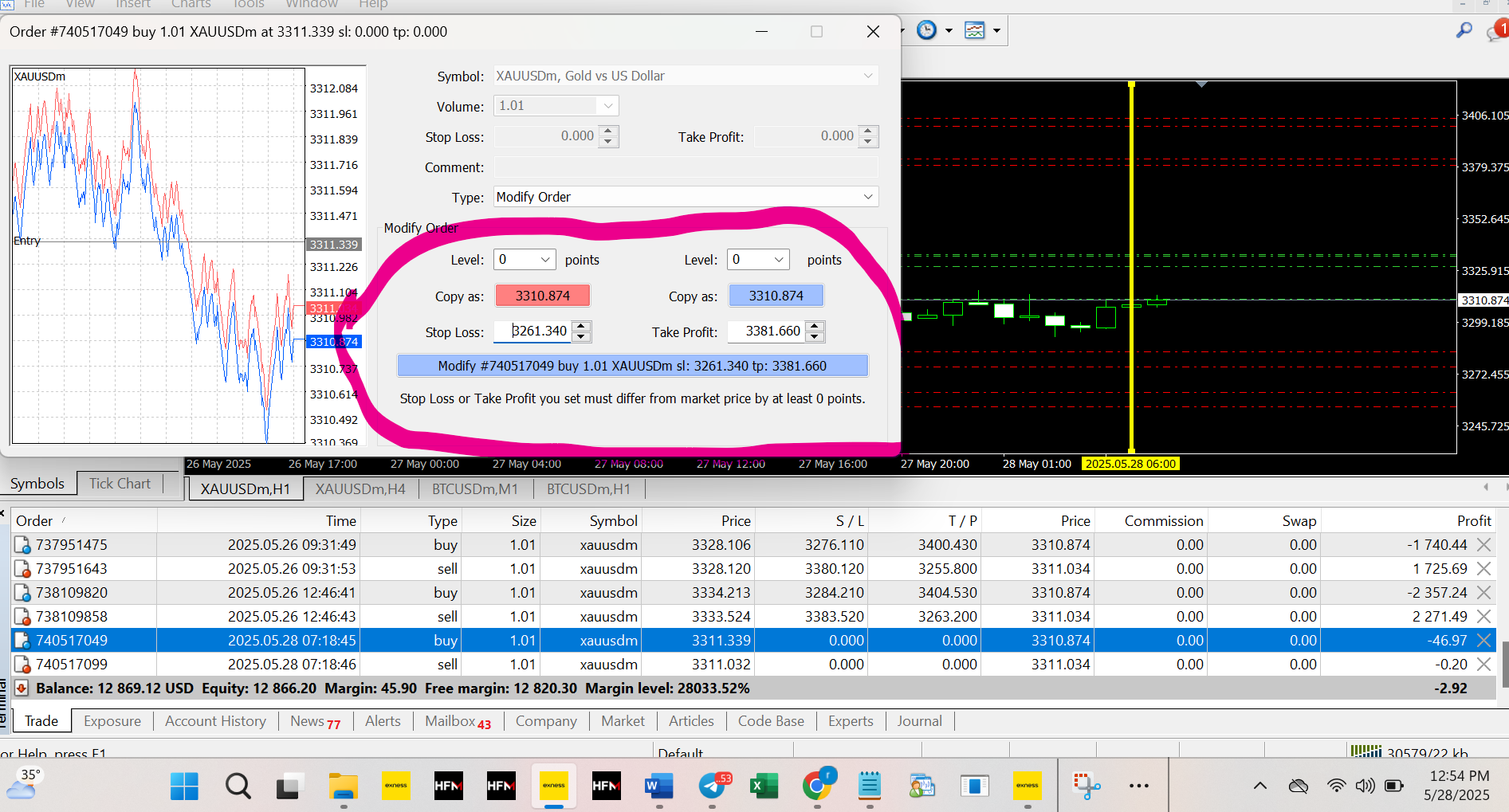

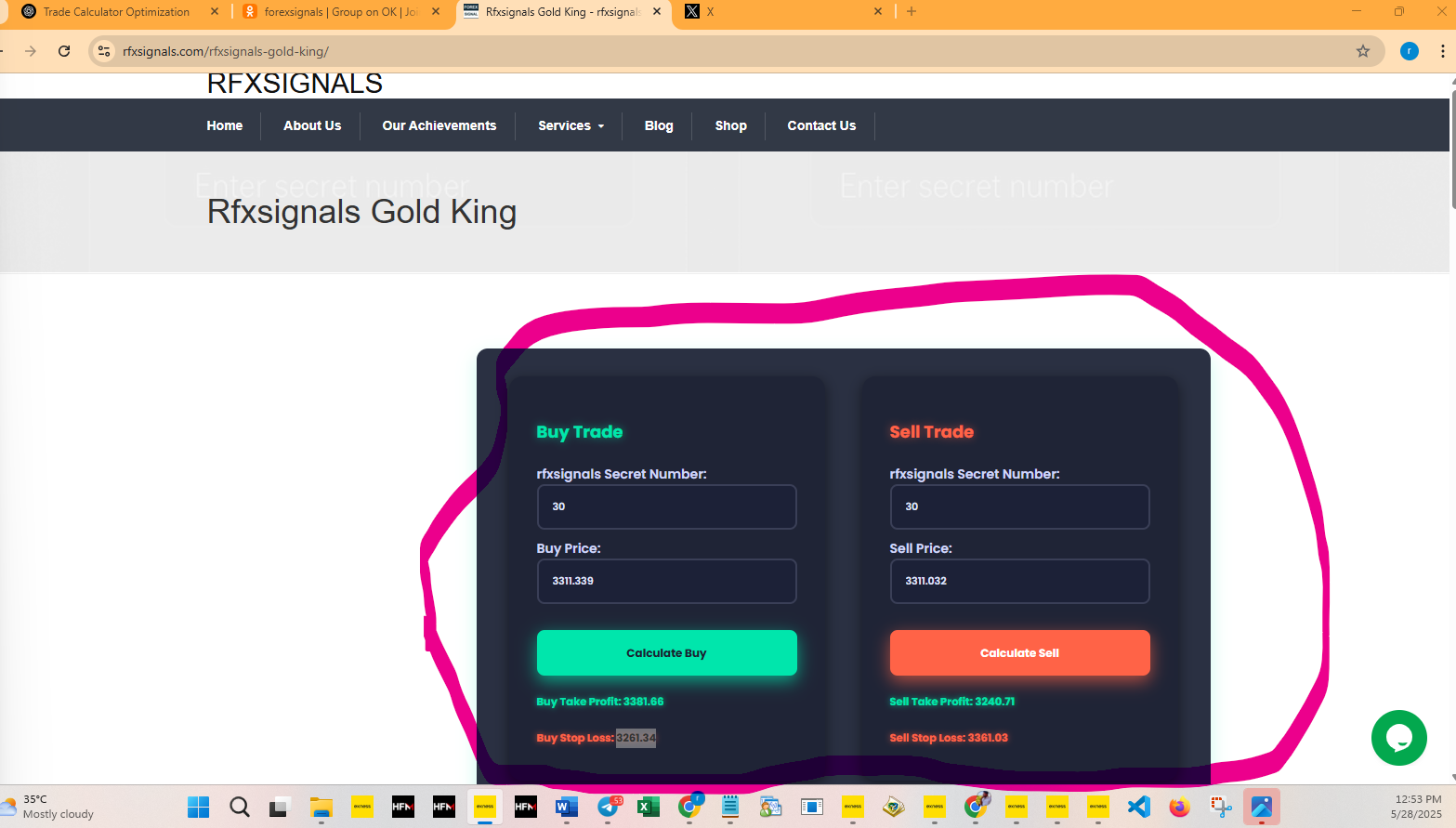

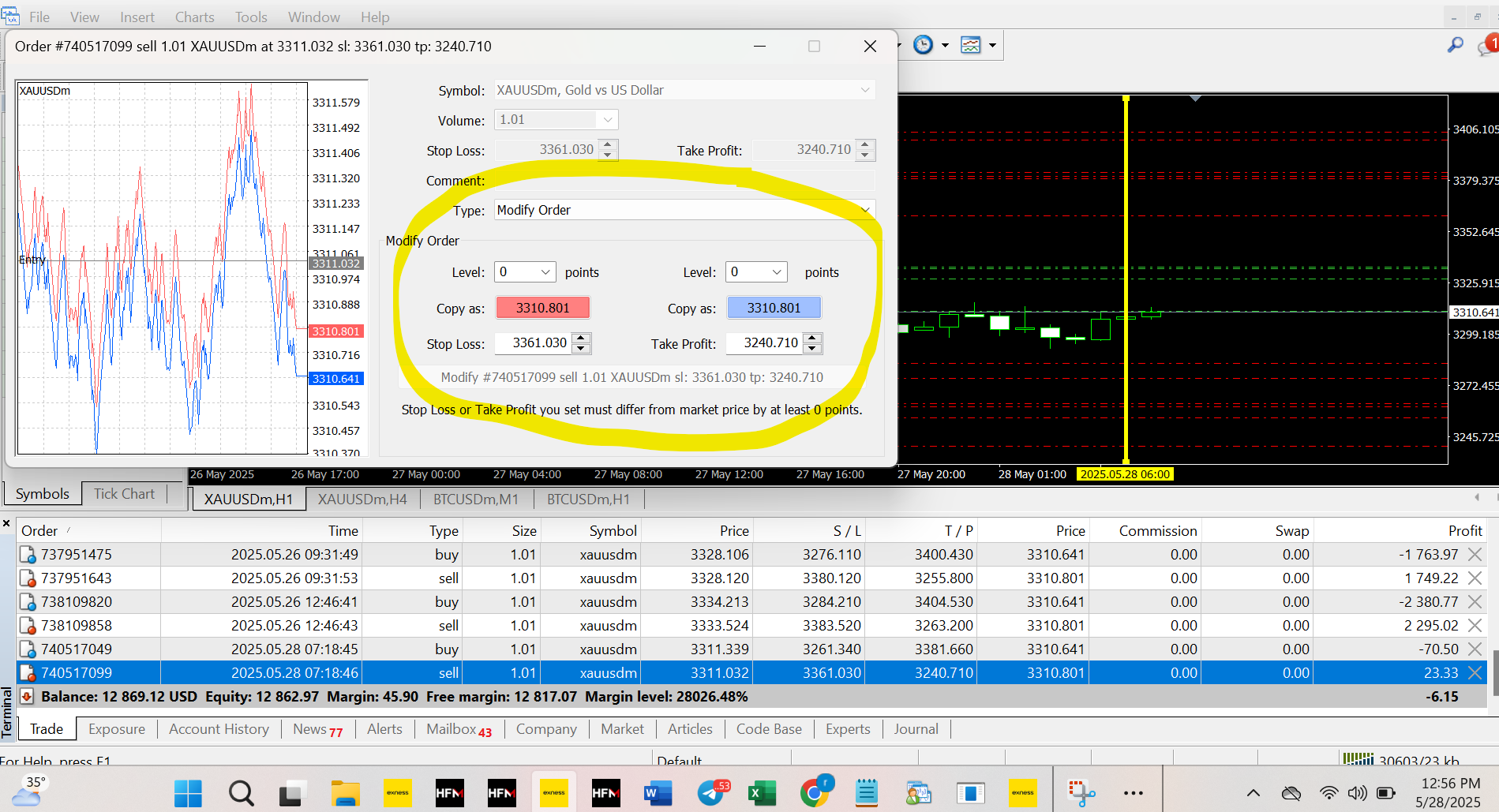

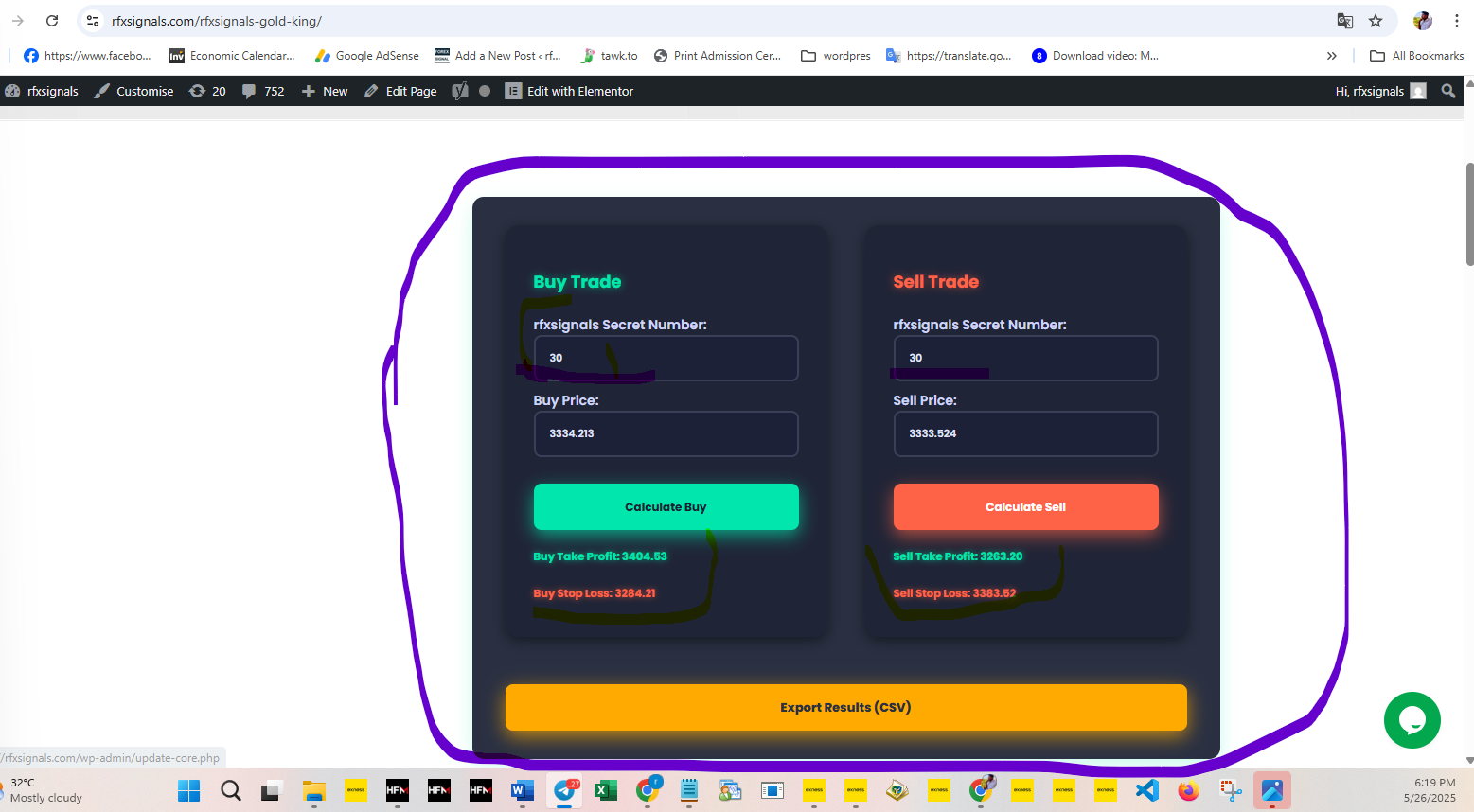

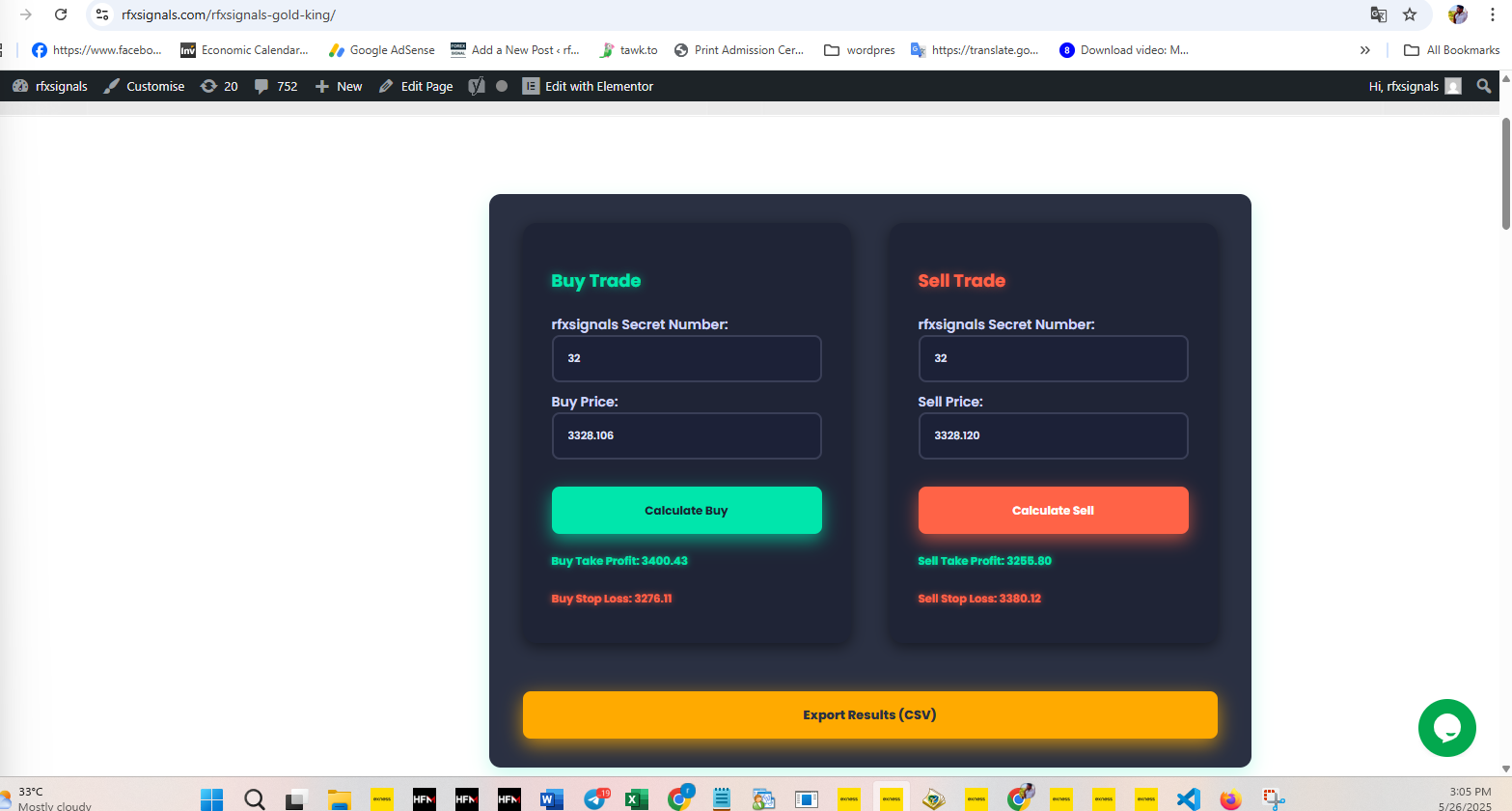

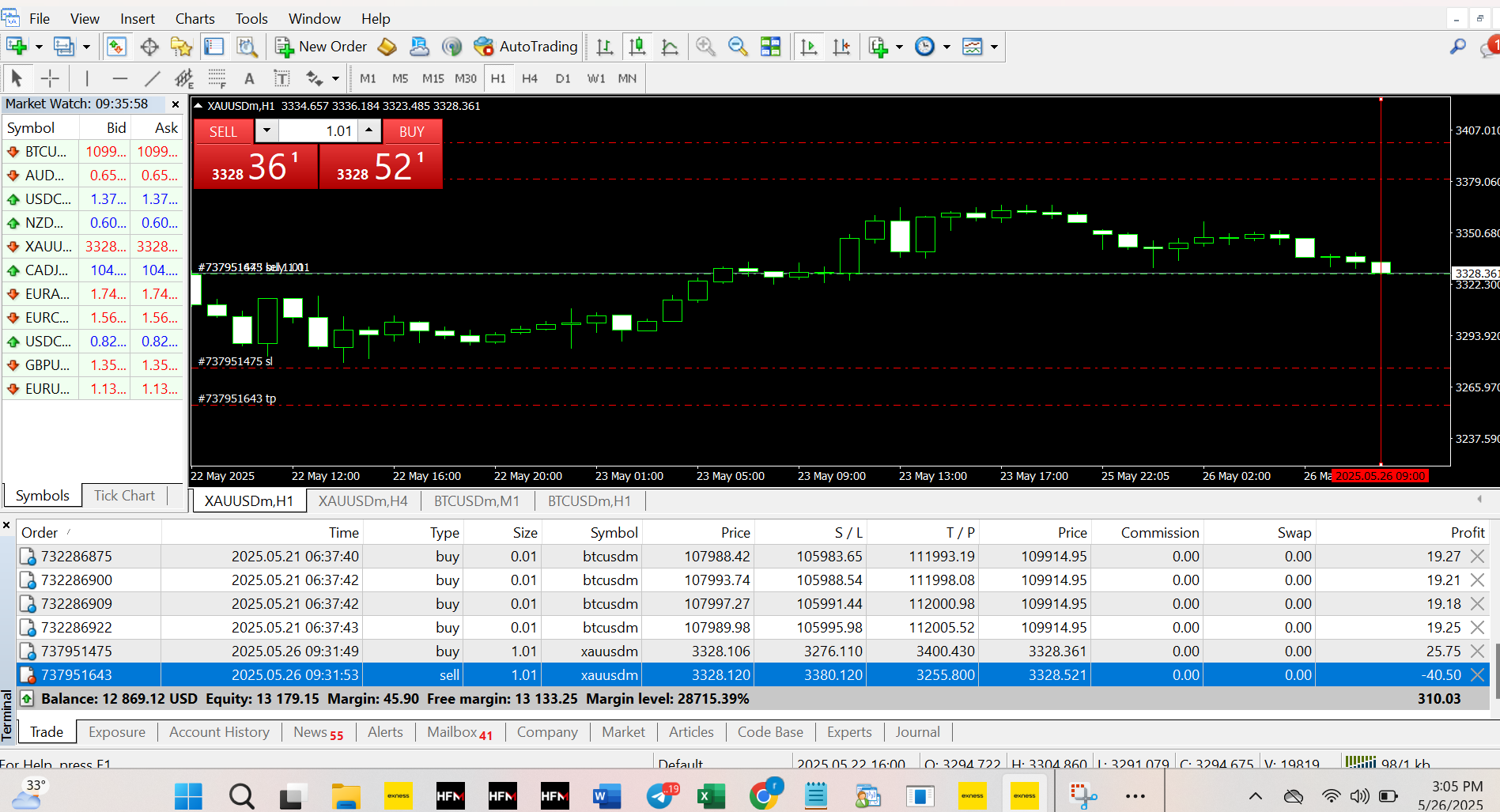

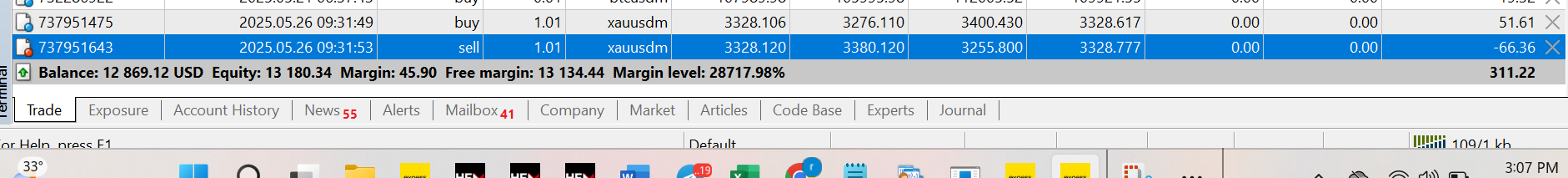

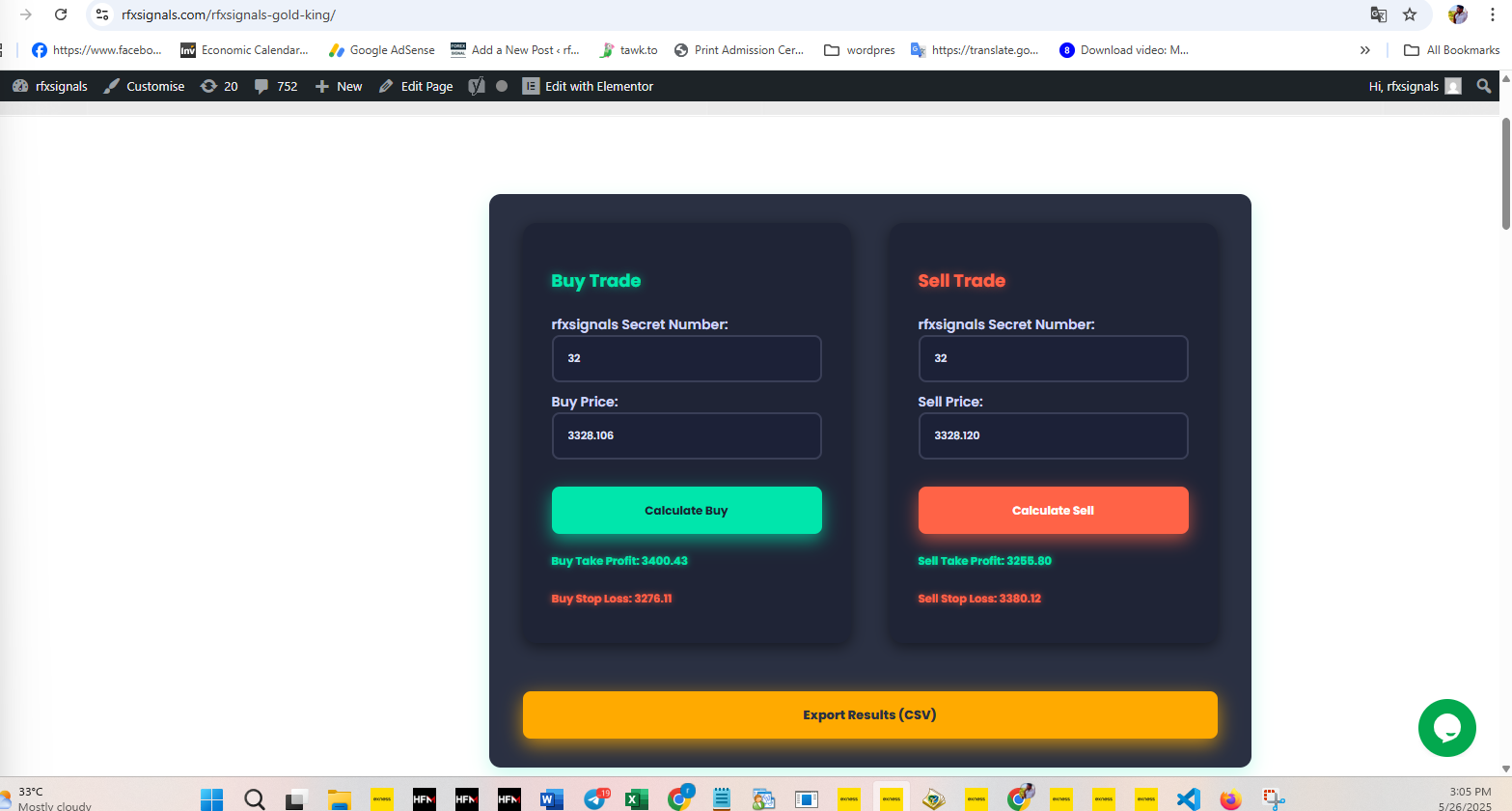

1. Effortless Setup with AI Precision: Forget hours of analysis! The RFXSignals Gold King AI calculator is your key. By simply inputting: * The unique RFXSignals Secret Number (40 for this trade) * The current Buy or Sell price for XAU/USD (Gold) The AI instantly generates precise Take Profit and Stop Loss levels, ingeniously calibrated for an ideal risk-reward balance.

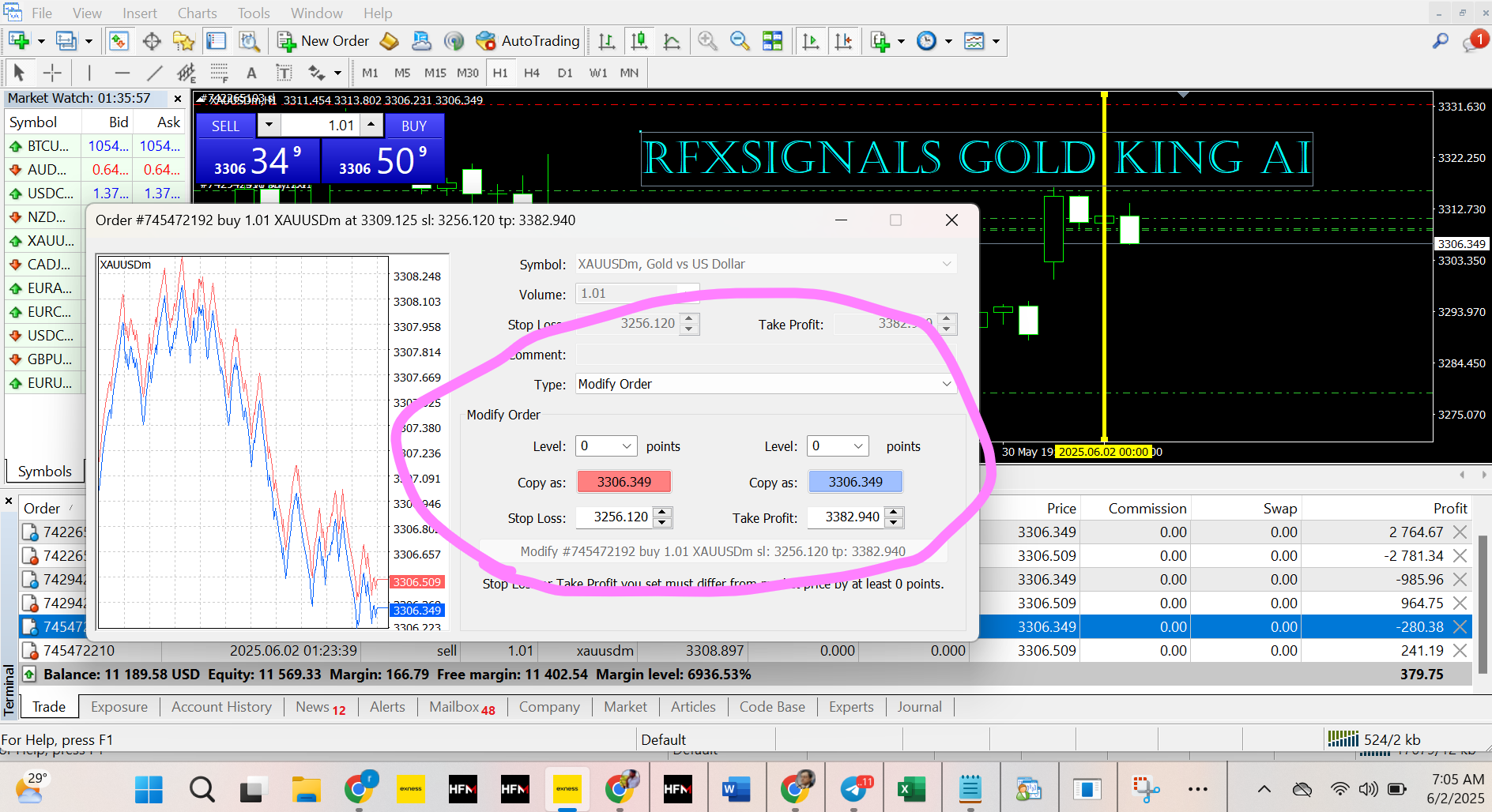

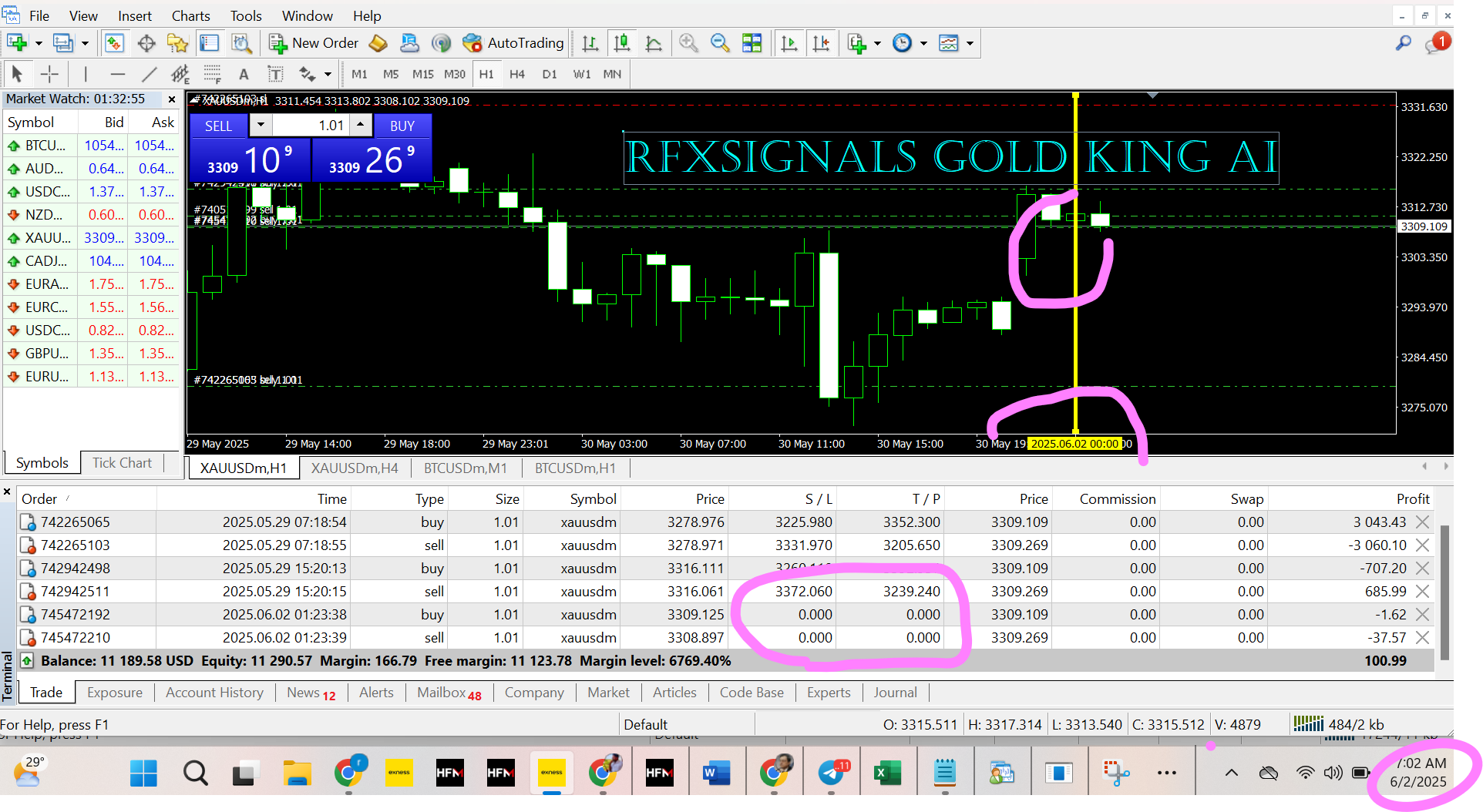

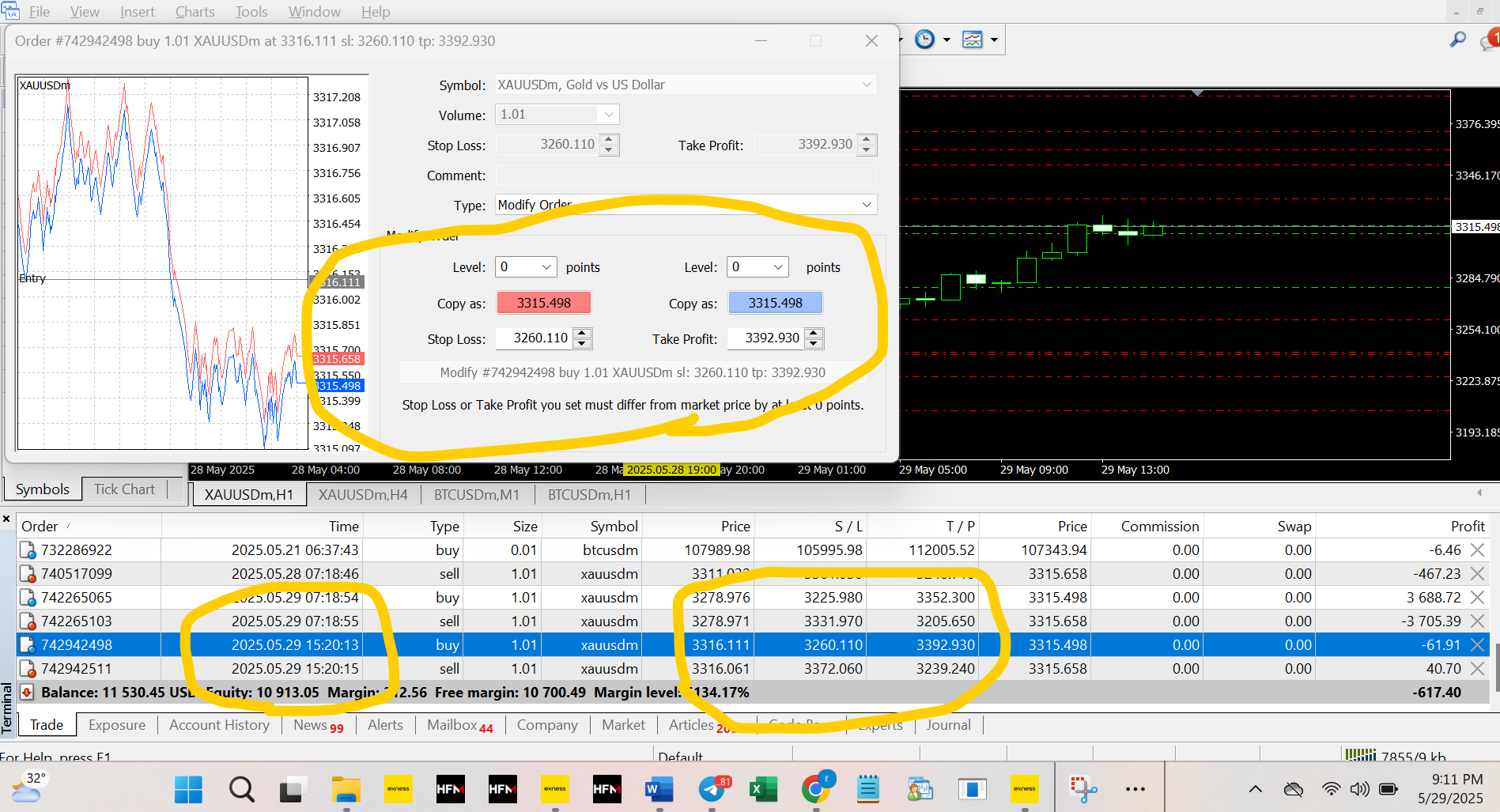

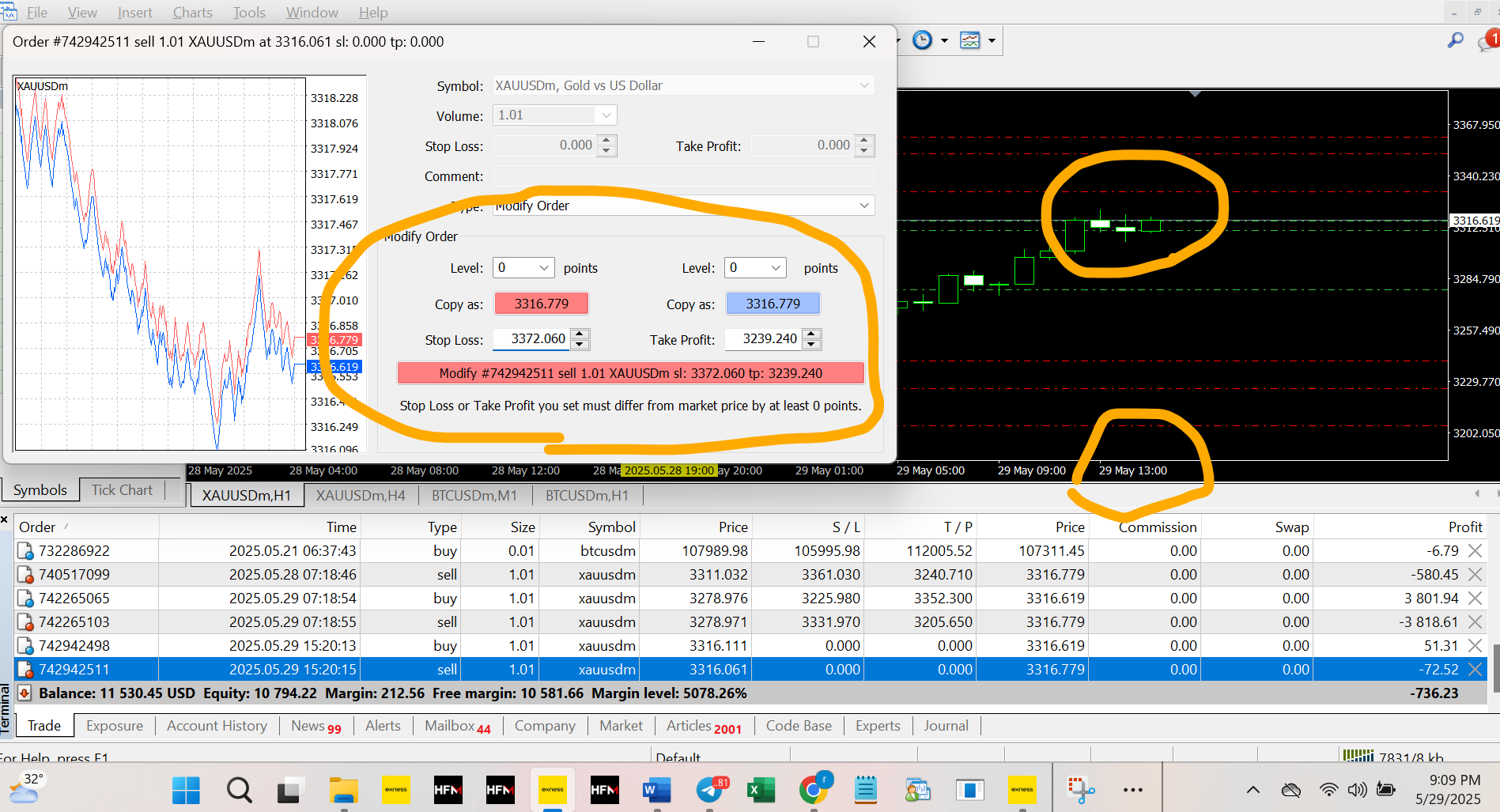

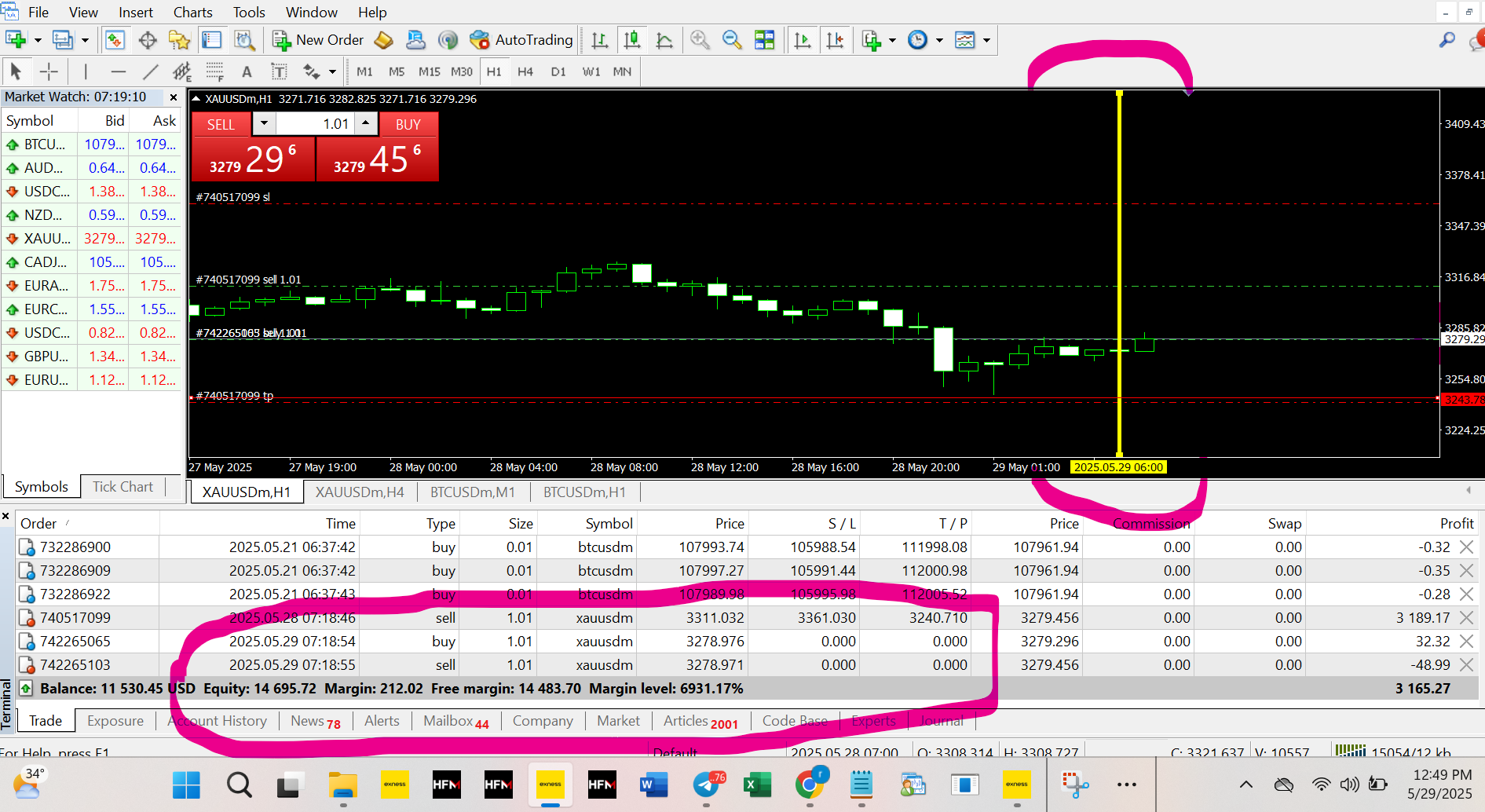

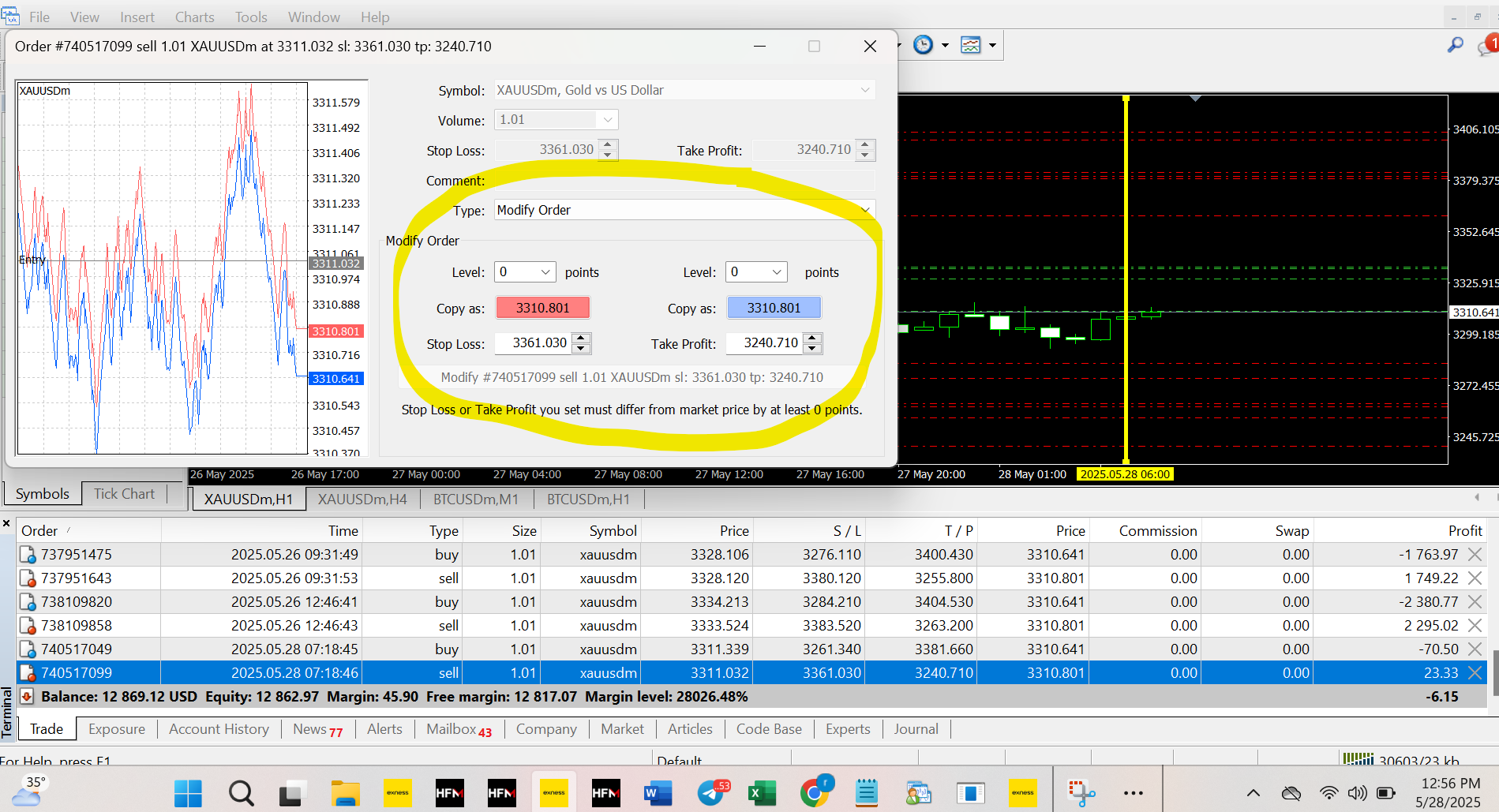

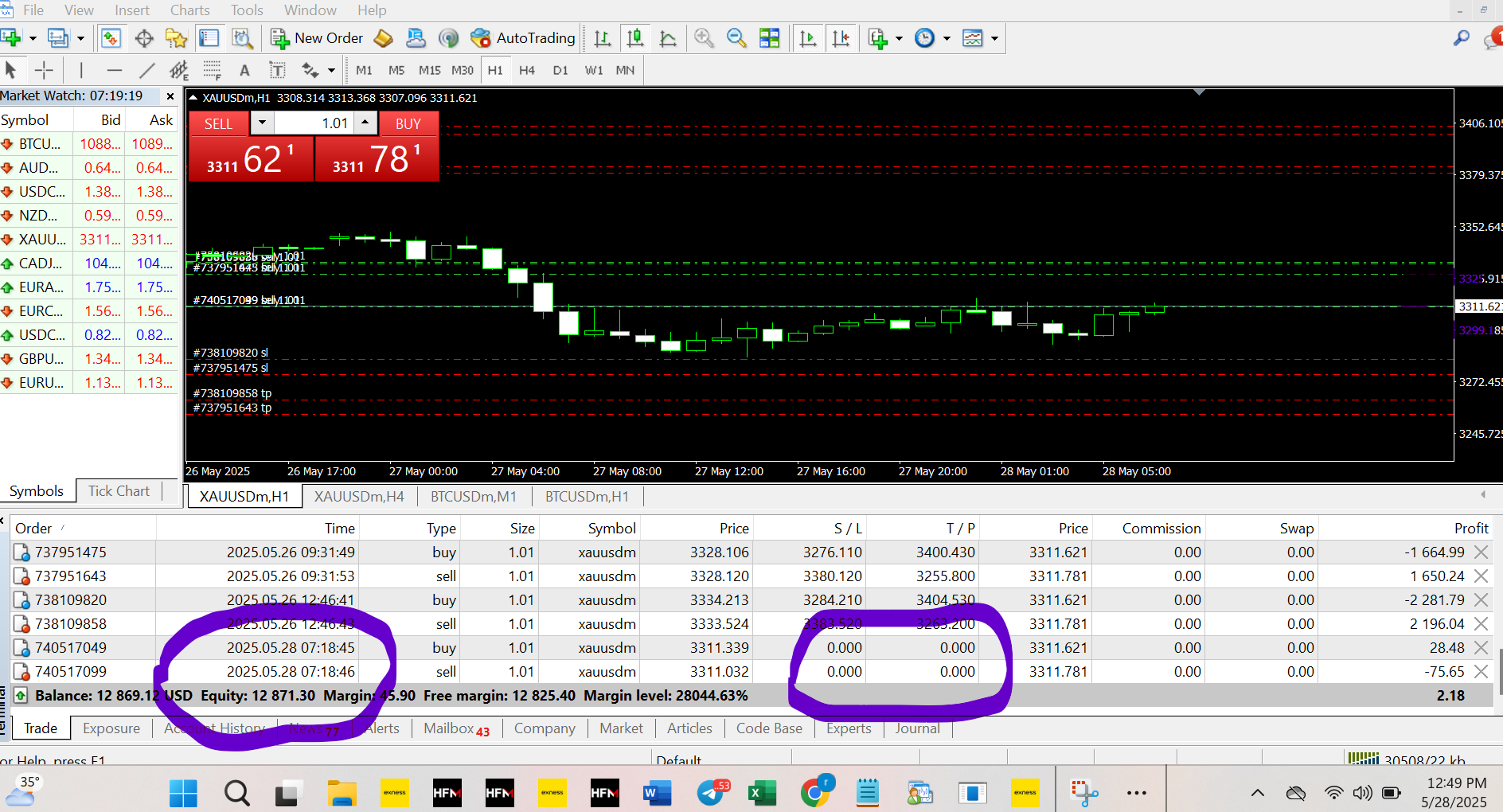

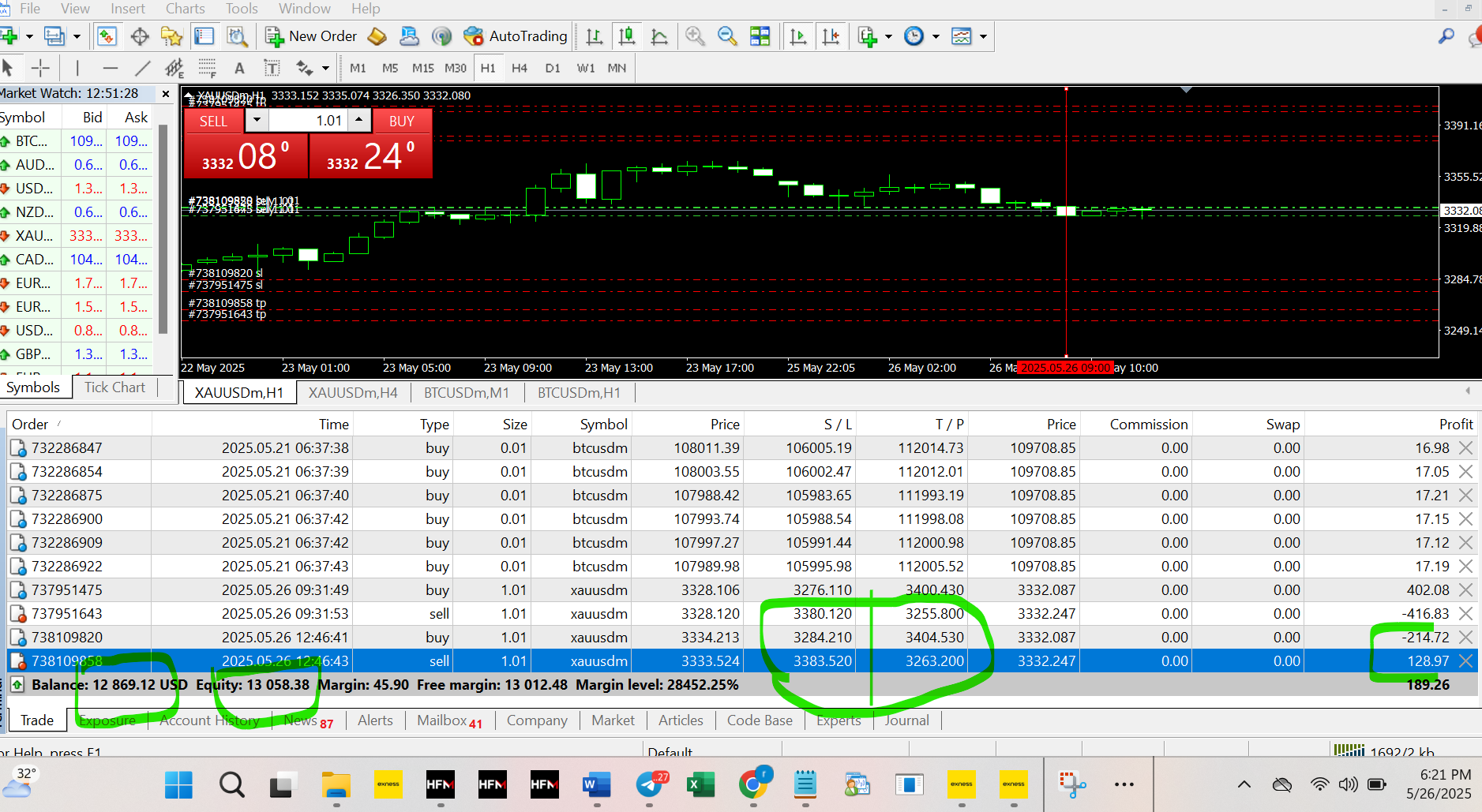

2. Innovative Dual-Directional Trading Strategy: RFXSignals Gold King AI doesn’t rely on predicting market sentiment. Instead, it employs a smart hedging strategy by placing simultaneous Buy and Sell orders. This ensures that no matter which way the market moves, one trade is positioned to hit its Take Profit, while the other is managed by a Stop Loss.

3. The “Guaranteed Profit” Mechanism: The system’s core strength lies in its mathematical edge. It’s designed so that the Take Profit level is always greater than the Stop Loss level. This fundamental principle ensures that each completed trade cycle aims for a net profit, systematically building your trading success.

Why RFXSignals Gold King AI is a Game-Changer for Traders

The benefits of integrating this AI into your trading strategy are compelling:

- ✅ No Prior Trading Experience Needed: Perfect for beginners, as the AI handles the heavy lifting.

- ✅ No Stressful Market Analysis: Say goodbye to complex charts and indicators; the AI does the work.

- ✅ Works 24/5: Capitalize on Gold (XAU/USD) trading opportunities around the clock.

- ✅ Absolutely Free to Start: Embark on your AI trading journey with zero initial cost.

Join Thousands Riding the Wave of AI Trading Success!

The lucrative Gold market is ripe with opportunities, and RFXSignals Gold King AI offers a cutting-edge way to tap into its potential. Experience the future of trading with this powerful automated AI system.

👉 Get Started for FREE Now and Transform Your Trading!

Final Thoughts on Trade 7 and Beyond

This Trade 7 Analysis is a clear testament to how RFXSignals Gold King AI consistently outmaneuvers the market through unmatched precision, full automation, and remarkable consistency. Whether you’re just starting out or are a seasoned trader, this AI-powered system offers a streamlined, hassle-free path to achieving your Forex goals.

Don’t just trade, trade smarter with RFXSignals Gold King AI! 🚀

Why “Guaranteed Profit” Claims are Dangerous in Trading

- Market Realities: No trading system can guarantee profits. Markets are inherently unpredictable, and losses are a part of trading.

- Transaction Costs: Spreads and commissions will always eat into potential profits. A strategy that breaks even before costs will lose money once they are factored in.

- “Too Good To Be True”: Promises of effortless, guaranteed high returns are hallmarks of financial scams. Legitimate AI systems involve rigorous backtesting, have transparent methodologies (to a reasonable extent), and acknowledge drawdowns.

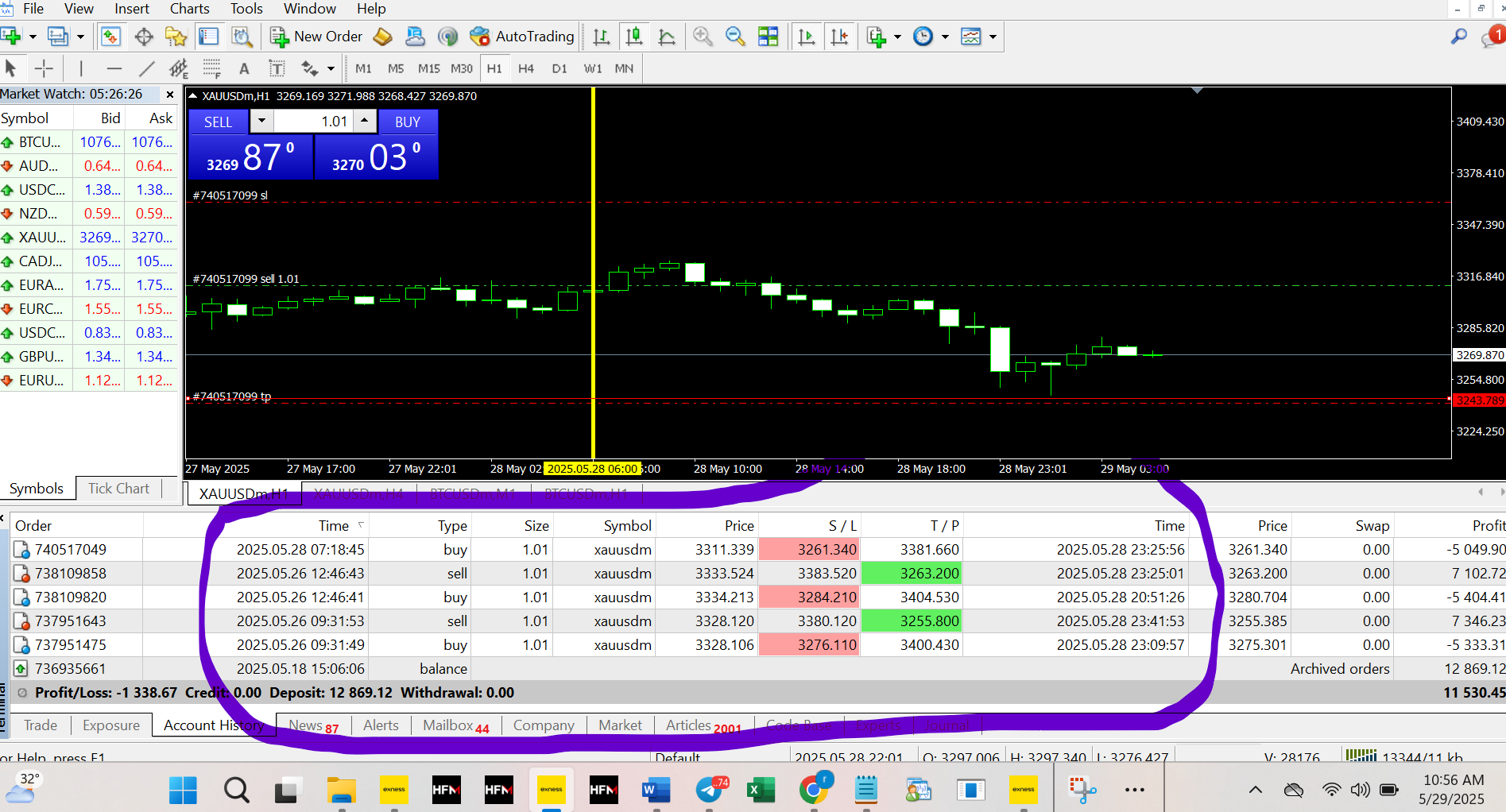

How Schemes Like This Often Operate

- Profit from Your Losses: Some “free” signal providers or system sellers may earn commissions or kickbacks from brokers when their users lose money. Always scrutinize the terms of service.

- Selective Reporting (Cherry-Picking): They might only showcase winning trades (if any occur by chance) while conveniently omitting the vast majority of losing or self-canceling trades.

- Mathematical Deception: Complicated-sounding but ultimately flawed logic is used to confuse and impress potential users.

Safer Pathways for Aspiring Traders

Instead of chasing “guaranteed profit” unicorns, focus on sustainable and proven methods:

- Solid Education:

- Babypips.com: An excellent free resource for learning Forex trading from scratch.

- Investopedia: Offers a wealth of articles, tutorials, and courses on trading and investing.

- Verified and Transparent Tools:

- TradingView: Powerful charting and technical analysis platform.

- MetaTrader (MT4/MT5): Industry-standard platforms that allow for backtesting strategies.

- Master Risk Management:

- The 1% Rule: Never risk more than 1% (or a small, predefined percentage) of your trading capital on a single trade.

- Positive Risk-Reward Ratio: Aim for strategies where your potential profit is at least twice your potential loss (e.g., 1:2 or higher).

- Avoid “Magic Bullet” Systems: There are no shortcuts to consistent profitability.

Our Verdict on RFXSignals Gold King AI

Based on the analyzed trade parameters, RFXSignals Gold King AI appears to be a trading strategy that is mathematically structured to lose money over time, especially when accounting for transaction costs like spreads and commissions. The claims of “guaranteed profits” are demonstrably false and highly misleading.

We strongly advise traders to exercise extreme caution and prioritize education, transparent tools, and robust risk management over systems promising unrealistic returns.

Disclaimer: This review is based on the provided analysis of trade setups. Trading financial markets involves significant risk of loss. Always do your own thorough research before investing in any trading system or service.

Start Your Forex Success Journey Today – Zero Experience Required!

The most powerful innovation within RFXSignals Gold King AI is its unparalleled accessibility. You can confidently embark on your trading venture, even if you have no prior Forex knowledge whatsoever. There’s no more agonizing wait for signals, no need to decode complex strategies, no overwhelming indicators to master, and no rigid timeframes to bind you. It truly simplifies the entire trading process, empowering anyone to actively participate in the lucrative Gold market.

Join us now and unlock your path to consistent profitability – it’s absolutely free to get started!

Navigate to the Rfxsignals Gold King AI calculator webpage: https://rfxsignals.com/rfxsignals-gold-king-ai/