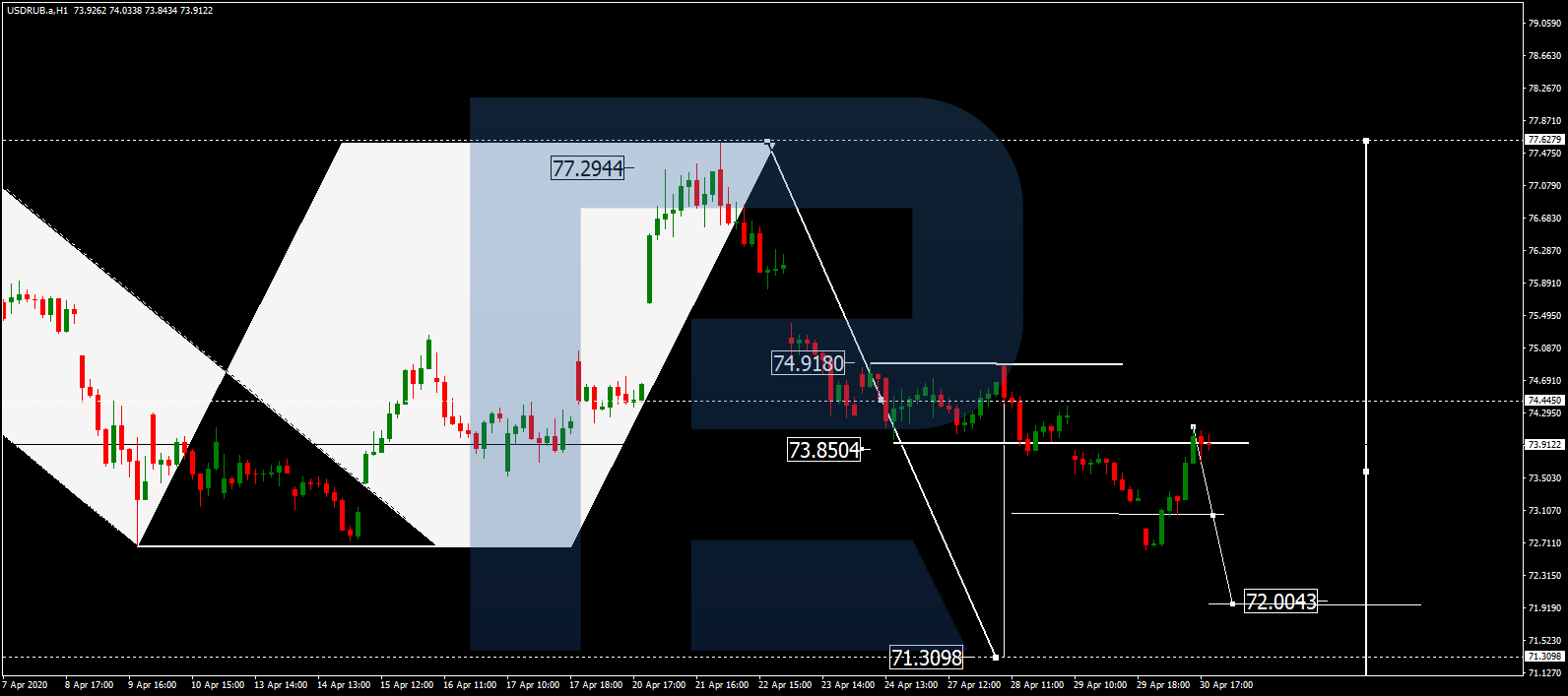

Daily Free Forex Signals For 04/05/2020

Here your going to see Daily Free Forex Signals For 04/05/2020 to free forex signal alert from our kitkat trading system and other trading logic’s .we provide like this free forex signals from 2012 on wards with more than 50,000 traders around the world .The free forex signals have 70 to 85% quality always .we give for you a note as maximum focus take profit 1 as your target and must use stop loss values .if you have any other query’s please visit our live chat or email option

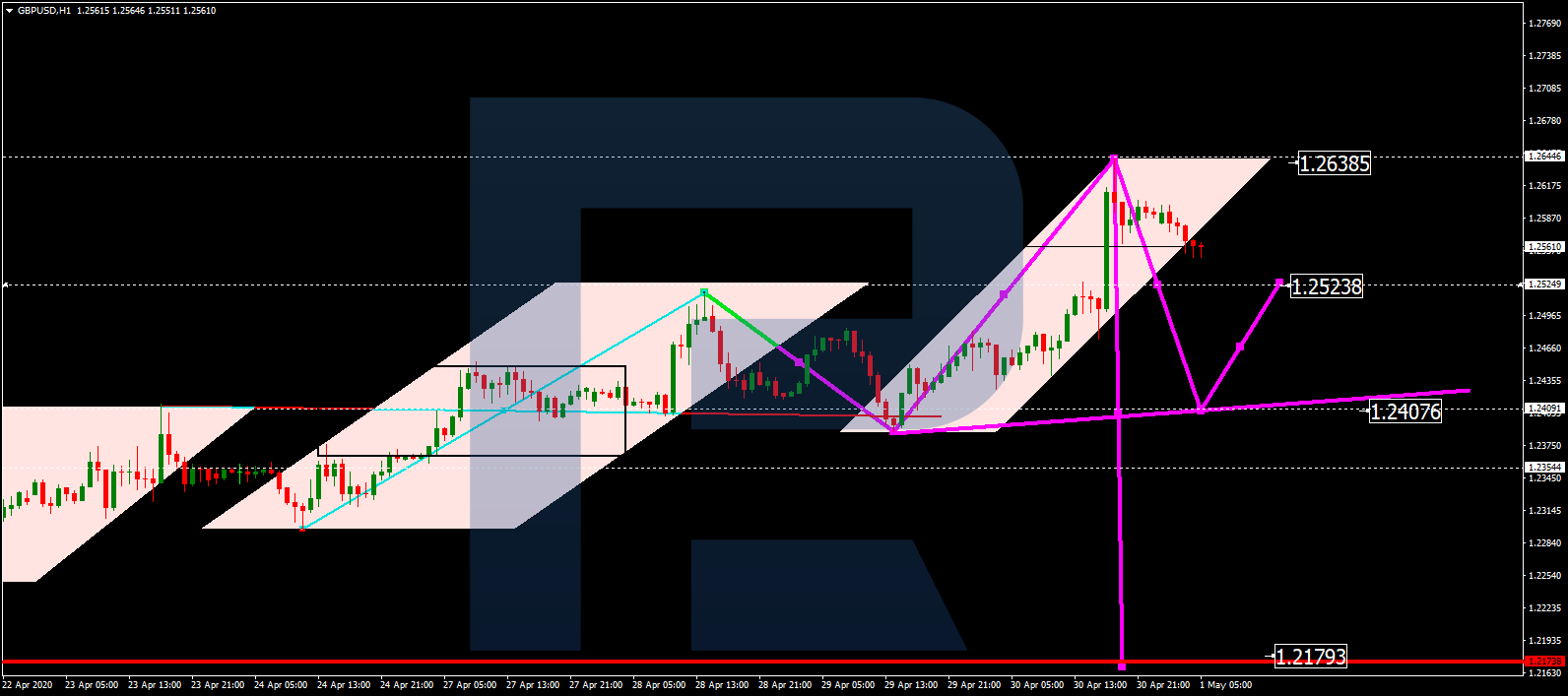

GBPCAD SELL-1.75630

SL-1.76161

TP1-1.75434

TP2-1.75193

GBPNZD SELL-2.06288

SL-2.06672

TP1-2.06069

TP2-2.05856

EURNZD SELL-1.81267

SL-1.81704

TP1-1.81050

TP2-1.80873

EURAUD SELL-1.71012

SL-1.71515

TP1-1.70827

TP2-1.70638

EURGBP SELL-0.87706

SL-0.88074

TP1-0.87495

TP2-0.87295

EURCHF SELL-1.05373

SL-1.05820

TP1-1.05161

TP2-1.04919

EURCAD SELL-1.54331

SL-1.54849

TP1-1.54075

TP2-1.53841

NZDCAD BUY -0.85325

SL-0.84782

TP1-0.85571

TP2-0.87555

GBPAUD SELL-1.94663

SL-1.95078

TP1-1.94460

TP2-1.94238

GBPCHF SELL-1.19728

SL-1.21100

TP1-1.19291

TP2-1.18823

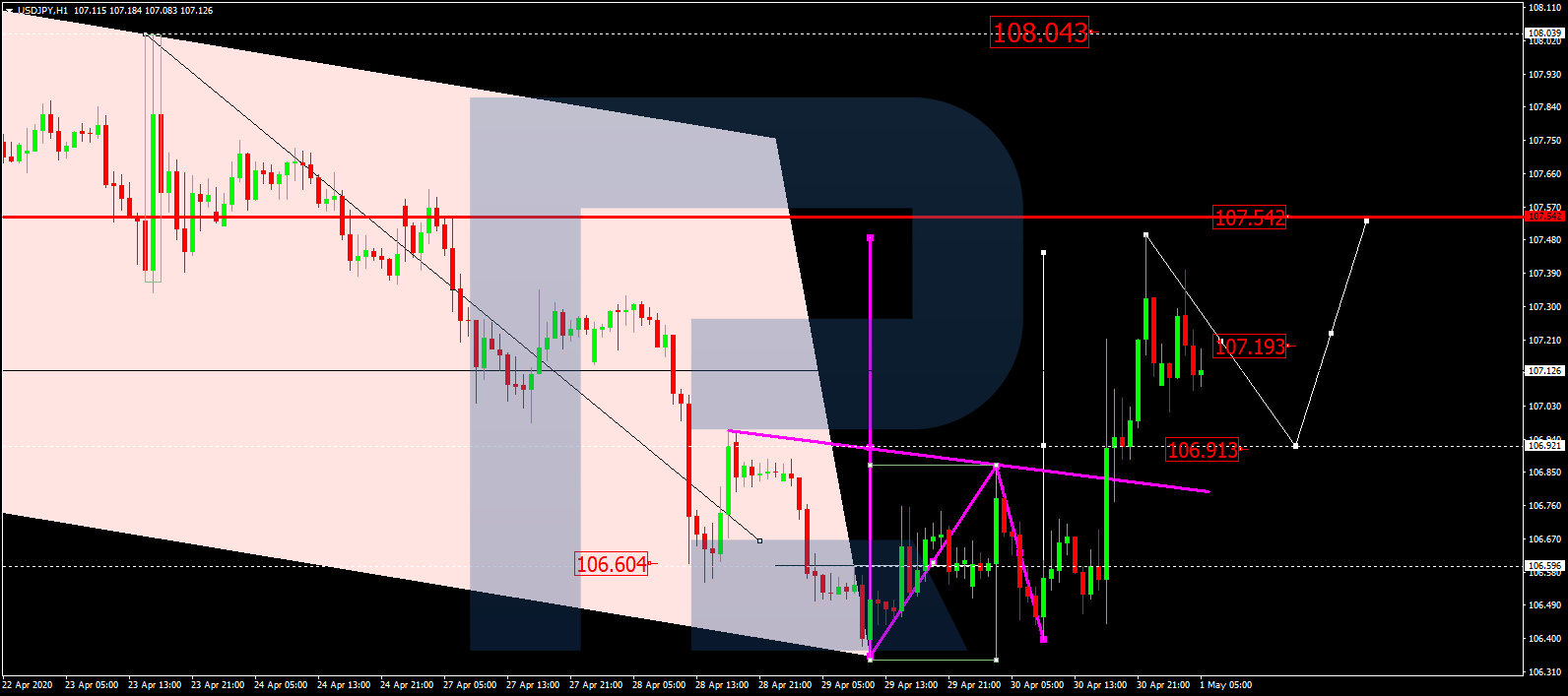

GBPJPY SELL-132.711

SL-133.446

TP1-132.380

TP2-132.063

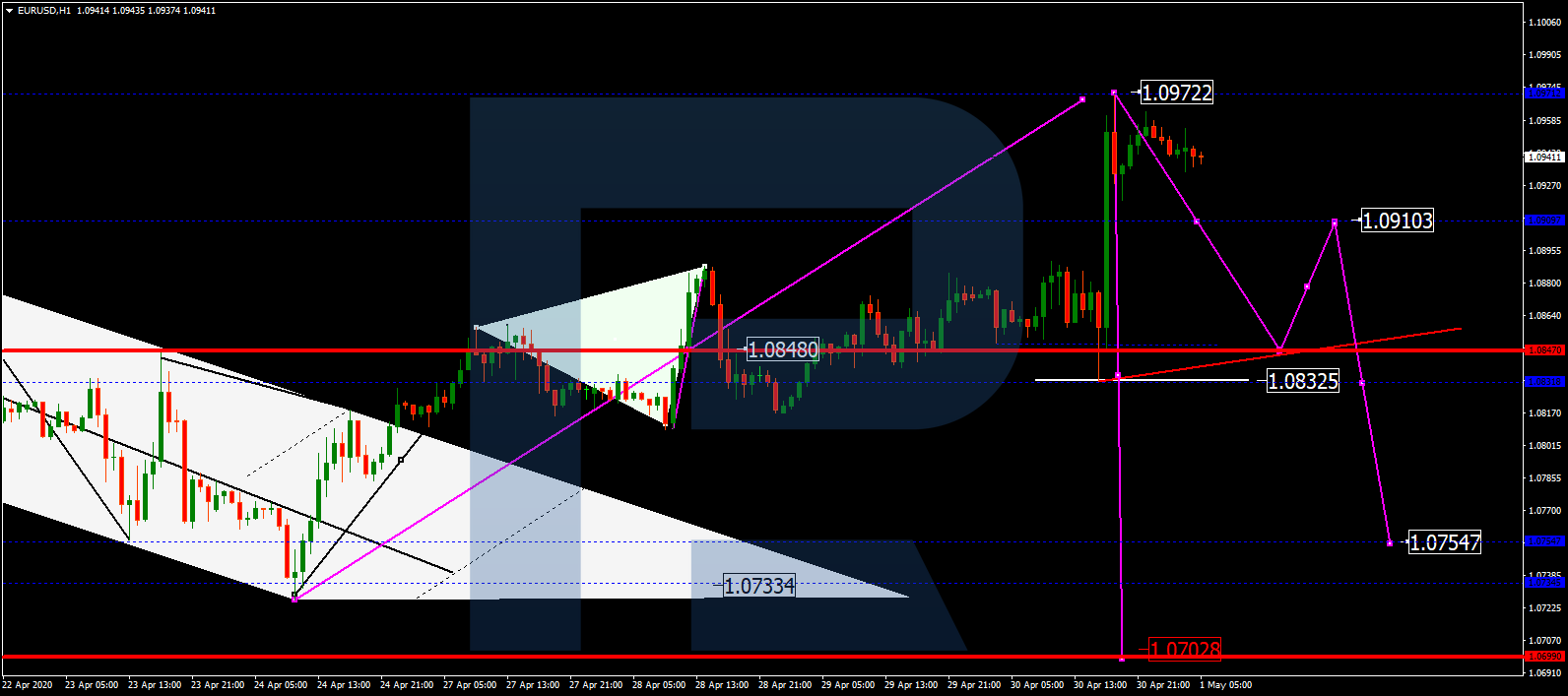

EURUSD SELL-1.09300

SL-1.09795

TP1-1.09100

TP2-1.08889

RESULT

Yesterday GBPCAD SELL SIGNAL reaches target 2 and we got 38 pips profit now 🙂

Yesterday GBPNZD SELL SIGNAL reaches target 2 and we got 40 pips profit now 🙂

Yesterday EURNZD SELL SIGNAL reaches target 2 and we got 37 pips profit now 🙂

Yesterday EURAUD SELL SIGNAL reaches target 2 and we got 40 pips profit now 🙂

Yesterday EURGBP SELL SIGNAL reaches target 1 and we got 20 pips profit now 🙂

Yesterday GBPAUD SELL SIGNAL reaches target 2 and we got 38 pips profit now 🙂

Yesterday EURUSD SELL SIGNAL reaches target 1 and we got 20 pips profit now 🙂