🔍 Top 3 Forex Indicators Every Beginner Should Master

As a new forex trader, the number of available tools and indicators can feel overwhelming. But not all indicators are made equal. In this article, we’ll walk you through the top 3 indicators that offer clarity, precision, and actionable insights—perfect for traders just starting out.

1. 📈 Relative Strength Index (RSI)

What it does: RSI measures the speed and change of price movements, indicating if a currency pair is overbought or oversold.

RSI > 70 = Overbought → Potential sell zone

RSI < 30 = Oversold → Potential buy zone

Why it matters: It helps you avoid entering trades at the top or bottom of a trend.

2. 🔁 Moving Averages (MA)

Types:

SMA (Simple Moving Average) – Smoother, slower

EMA (Exponential Moving Average) – Faster, more reactive

Use cases:

Identify trend direction

Entry/exit confirmation

Crossover strategies (e.g., 50 EMA crossing 200 EMA)

Best for: Trend-following strategies and confirmations.

3. 📊 MACD (Moving Average Convergence Divergence)

What it shows: Trend strength and momentum by comparing short- and long-term moving averages.

Key components:

MACD Line

Signal Line

Histogram

Signals:

MACD crosses above Signal Line → Buy

MACD crosses below Signal Line → Sell

Best for: Spotting momentum shifts before price reversals.

🛠️ How to Combine These Indicators

Using all three together enhances confirmation and accuracy:

RSI confirms if the asset is overbought/oversold.

MACD shows momentum and signal changes.

MA confirms the broader trend.

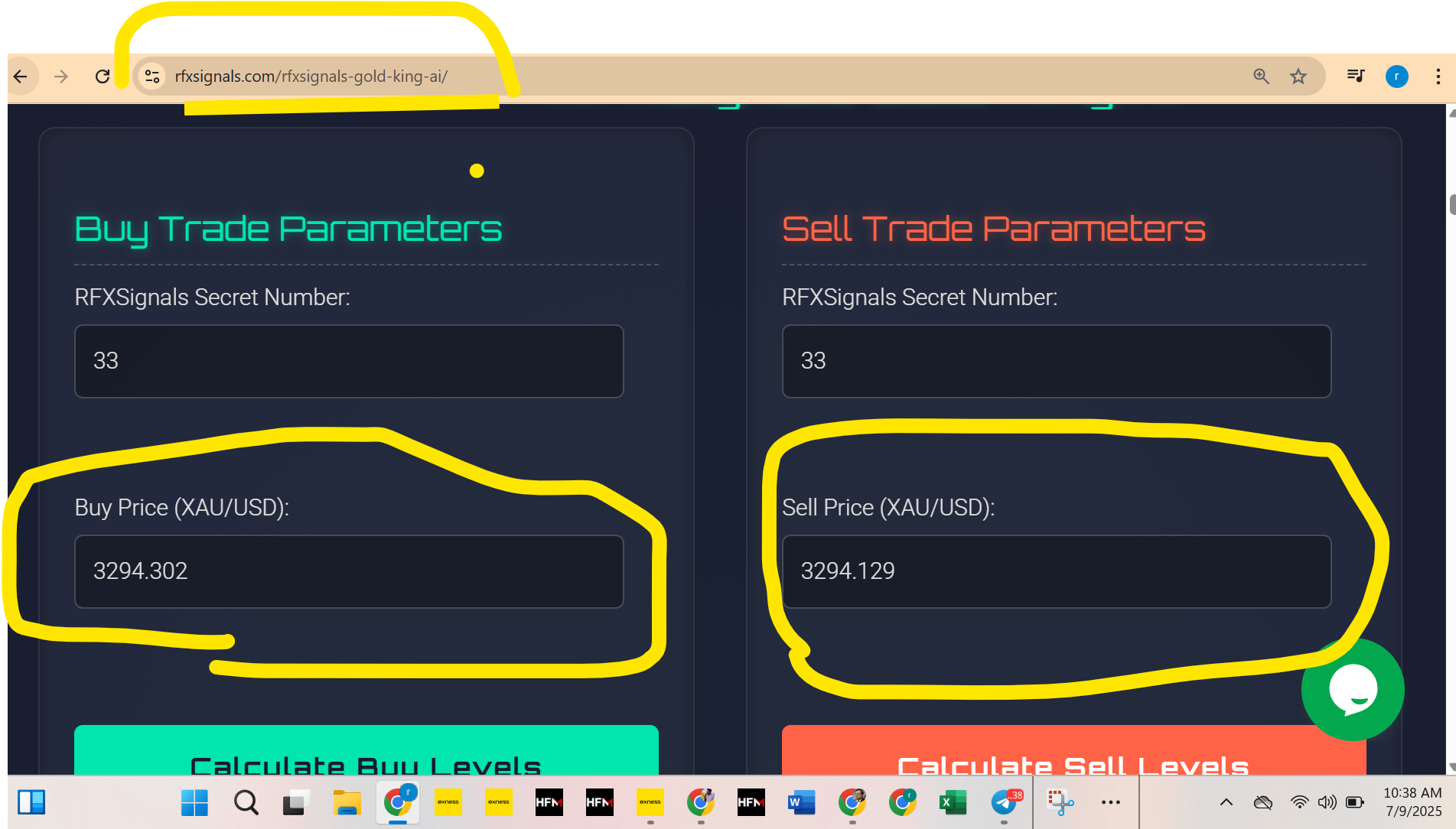

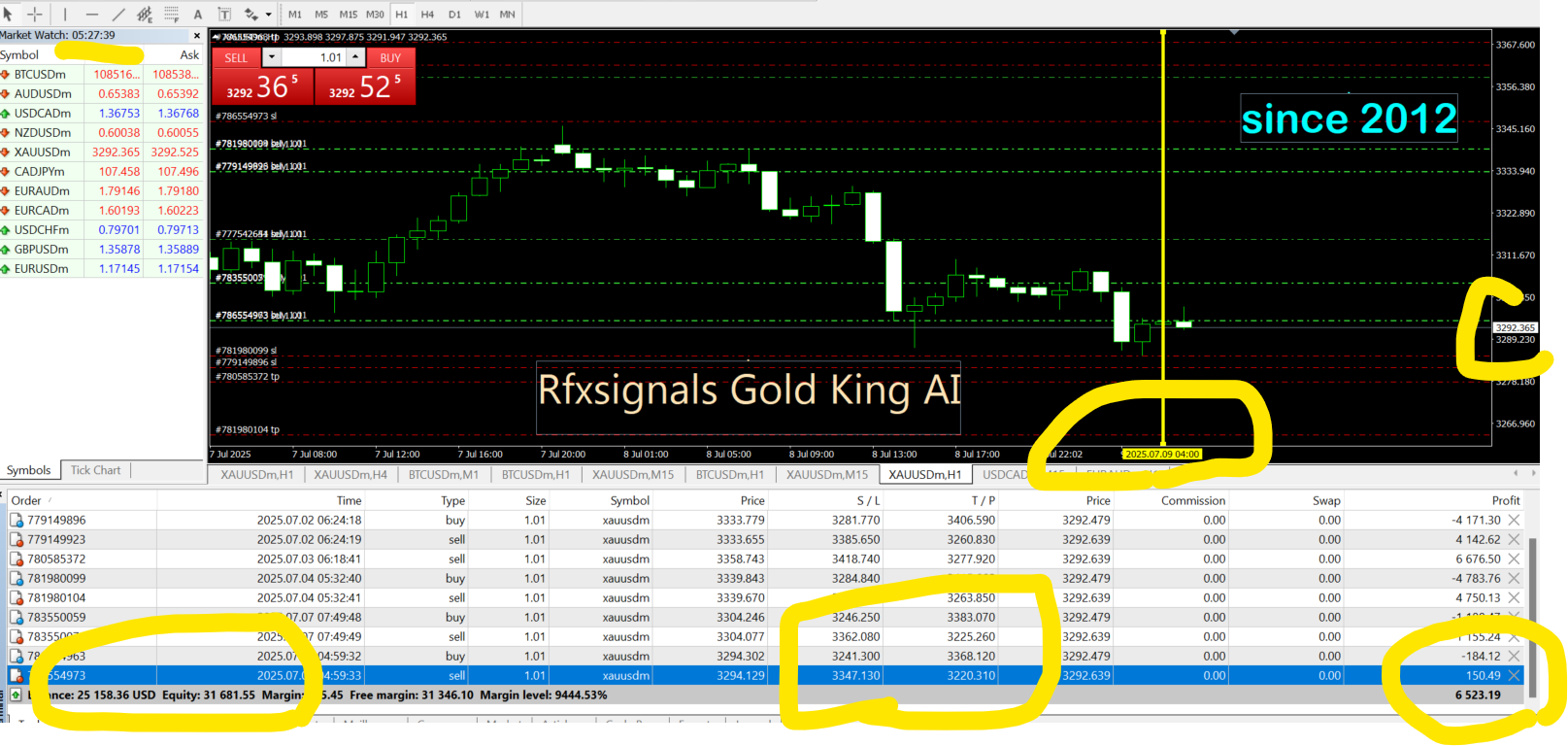

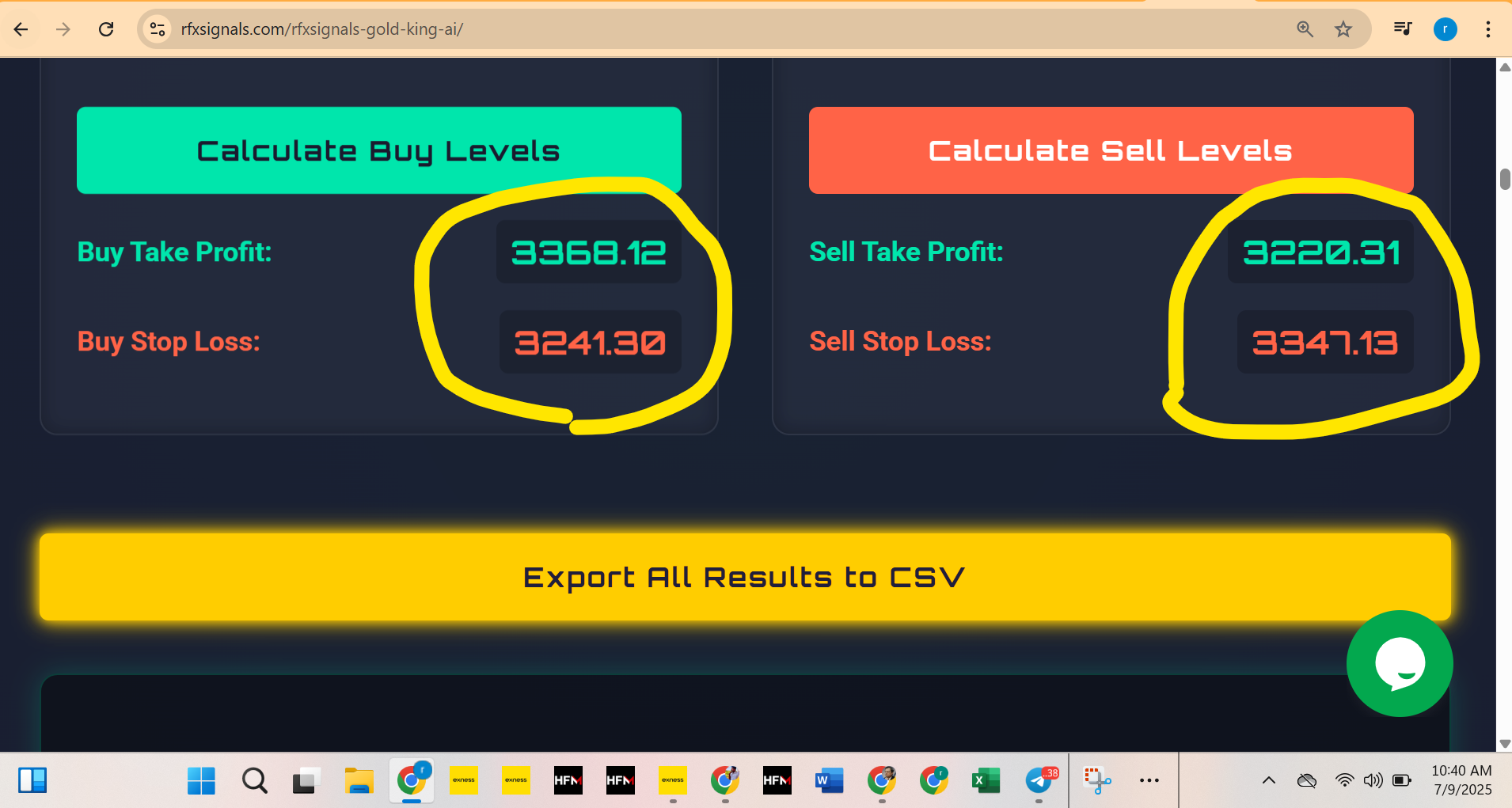

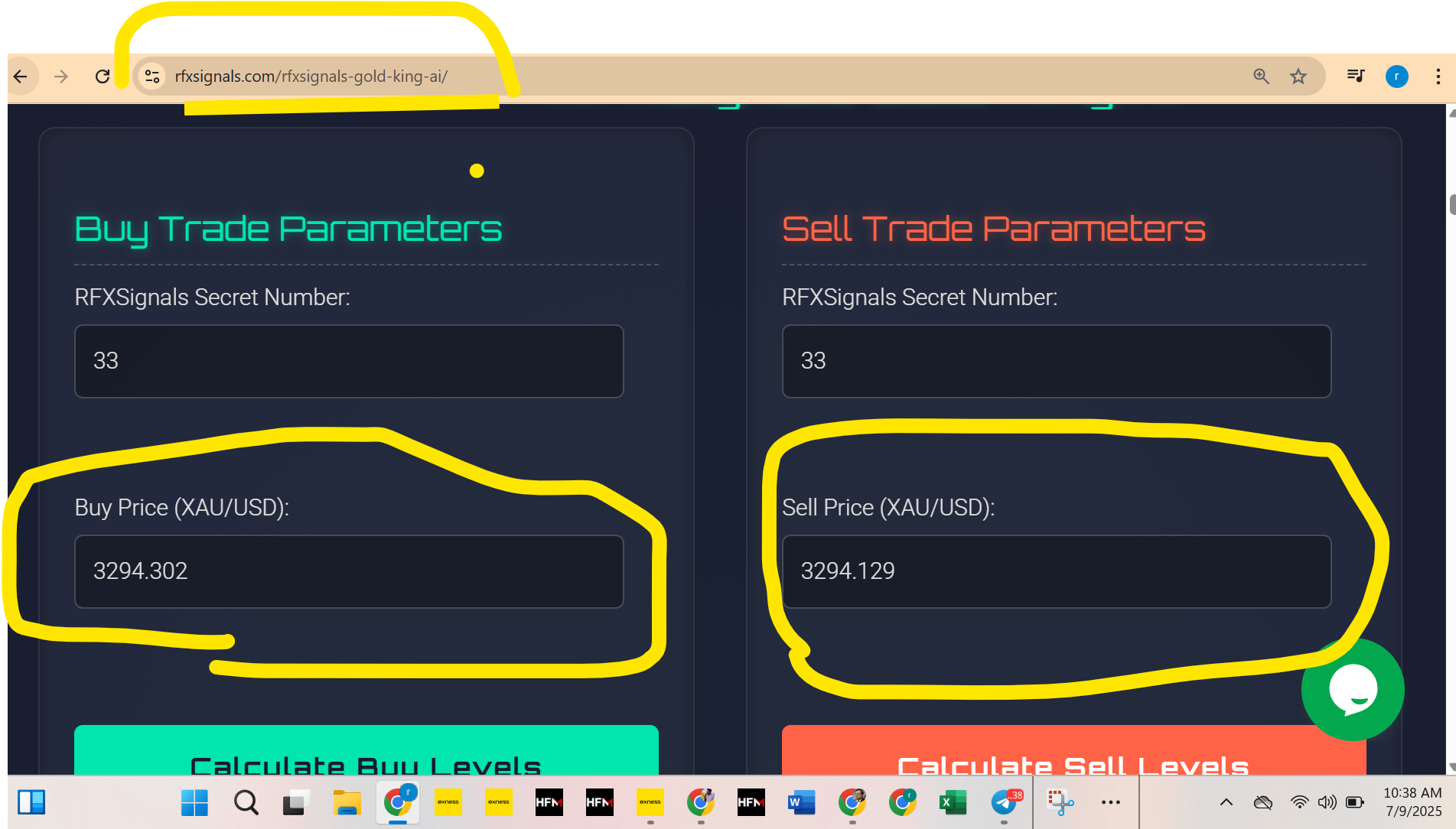

🚀 Learn Forex the Smart Way with RFXSignals

Stay updated with expert tips, live market analysis, and premium signals. Join our Telegram group today and start trading smarter.

🔔 Join Our Telegram Channel