05.09.2019

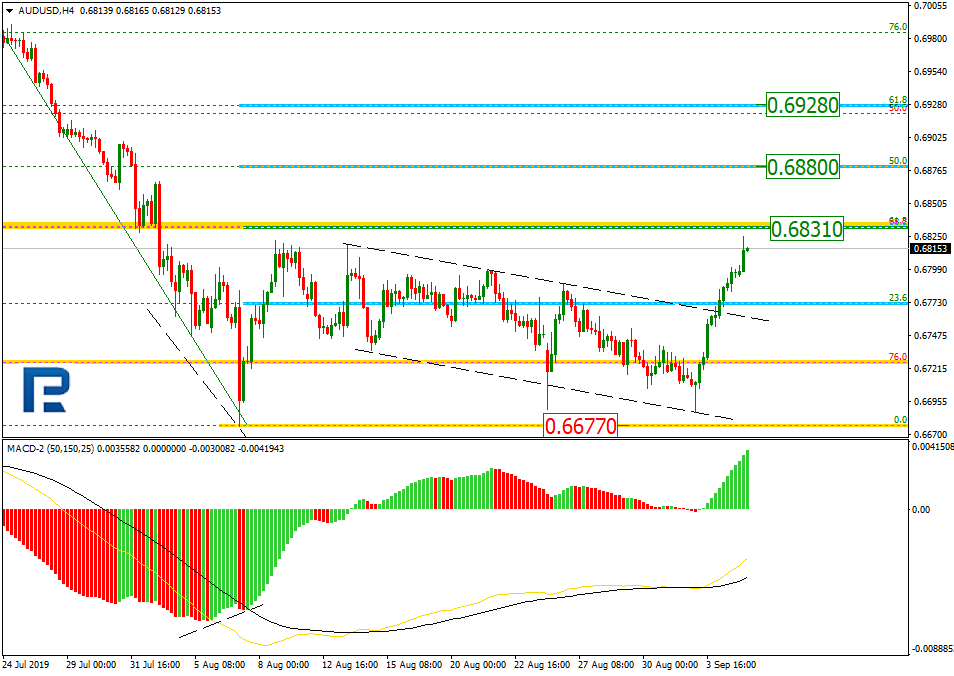

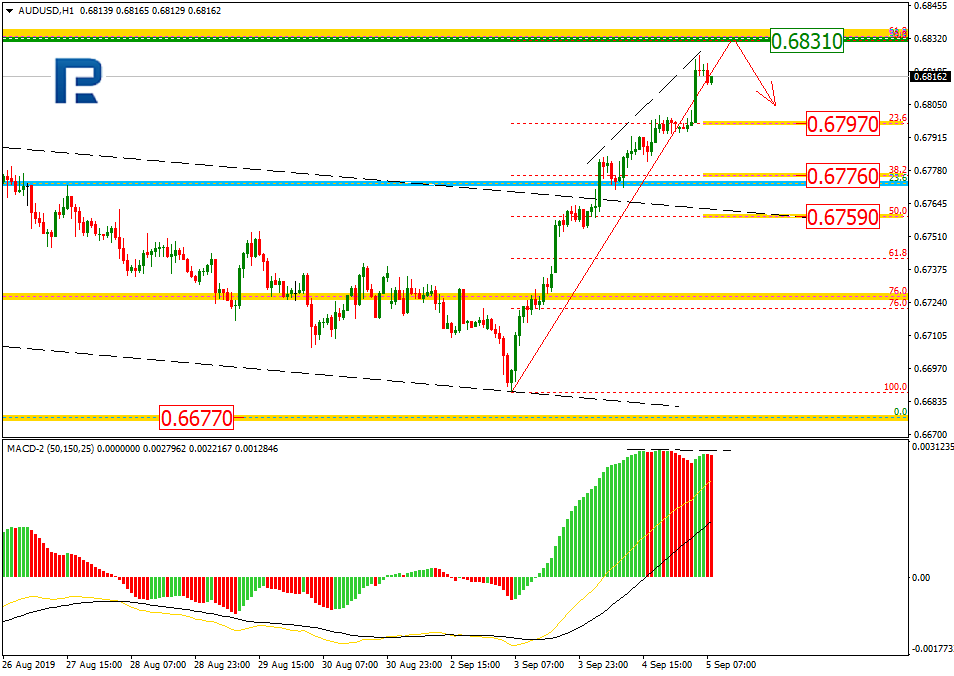

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, AUDUSD is moving upwards, but the mid-term correction continues. The pair is heading towards 38.2% fibo at 0.6831 and may later reach 50.0% and 61.8% fibo at 0.6880 and 0.6928 respectively. After breaking the local support at 0.6677, the instrument may continue falling to reach the long-term low at 0.6547.

In the H1 chart, AUDUSD is steadily trading upwards, but there is a divergence on MACD, which may indicate a new pullback after the price reaches 38.2% at 0.6831. The targets of this pullback may be 23.6%, 38.2%, and 50.0% fibo at 0.6797, 0.6776, and 0.6759 respectively.

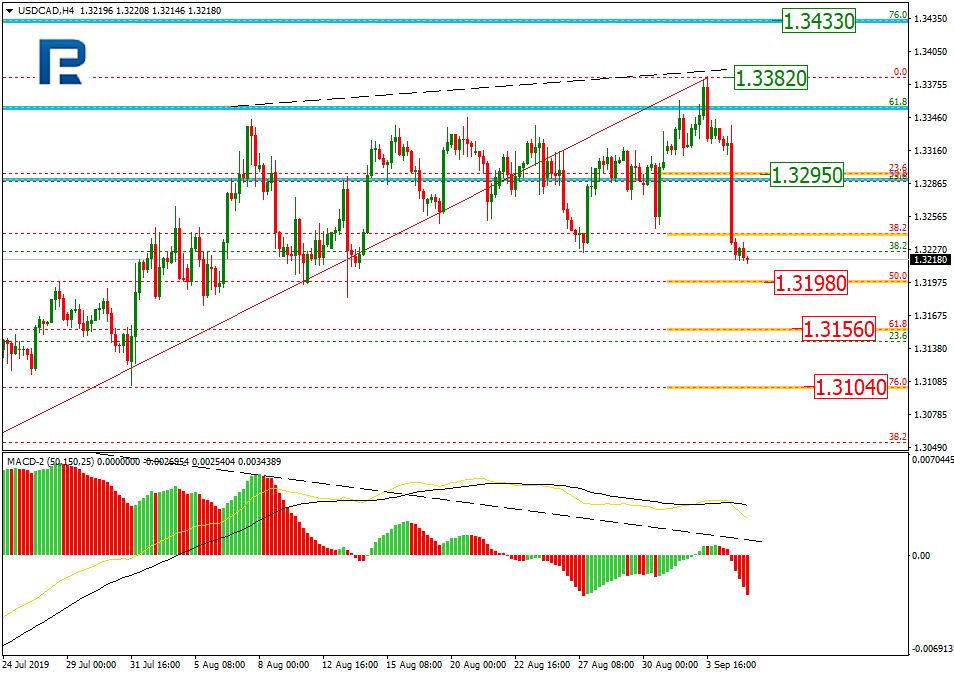

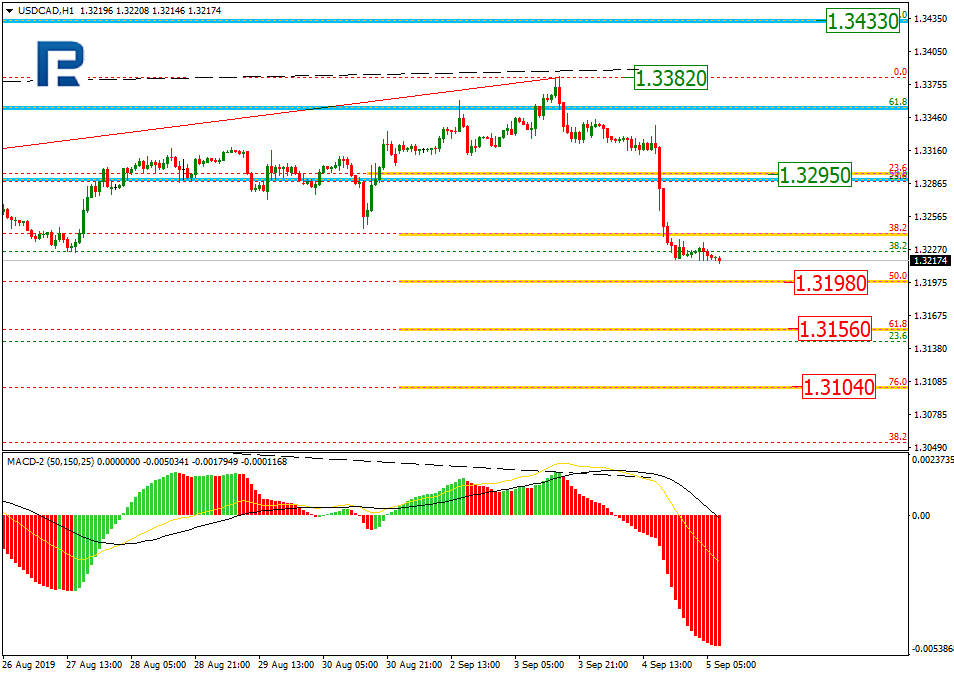

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, after breaking the previous high and testing 61.8% fibo, USDCAD couldn’t reach 76.0% fibo at 1.3433. There was a divergence on MACD, which made the pair start a new decline. By now, this decline has already reached 38.2% fibo and may yet continue towards 50.0%, 61.8%, and 76.0% fibo at 1.3198, 1.3156, and 1.3104 respectively. The local resistance is at 1.3295.

The H1 chart shows more detailed structure of the current decline. USDCAD is getting closer to 50.0% fibo at 1.3198.

Back to listAttention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.