❌ How to Avoid Common Forex Trading Mistakes

Every successful forex trader once made beginner mistakes—what sets them apart is how they learned from them. In this article, you’ll discover the most common pitfalls and how to sidestep them to improve your success rate.

1. 🚫 Trading Without a Plan

Problem: Many beginners dive in without a clear strategy.

Solution: Always trade with a written plan that includes entry/exit points, risk-reward ratios, and trade size.

📌 Tip: Stick to your plan no matter the emotion or market noise.

2. 🧨 Overleveraging

Problem: Using high leverage can amplify losses as fast as gains.

Solution: Keep leverage low and manage your lot size based on account equity.

✔️ Pro Rule: Risk only 1–2% of your capital per trade.

3. 🧠 Emotional Trading

Problem: Greed, fear, and revenge trading ruin many accounts.

Solution: Automate parts of your trading or take breaks when emotions run high.

🧘 Stay objective. Set alerts and walk away from the screen when needed.

4. 🔄 Ignoring Stop Losses

Problem: Not setting a stop loss is like driving without brakes.

Solution: Every trade should have a stop loss. Respect it.

🚨 Stop losses save capital. Protect it like your life depends on it.

5. 📊 Not Reviewing Trades

Problem: Without review, mistakes will repeat.

Solution: Maintain a trade journal. Analyze what worked and what didn’t.

✅ Summary Table

| Mistake | How to Fix It |

|---|---|

| No Trading Plan | Write and follow a strategy |

| Overleveraging | Use proper risk management |

| Emotional Trading | Automate and pause during stress |

| No Stop Loss | Set stop loss and stick to it |

| No Review or Learning | Keep a journal, study your performance |

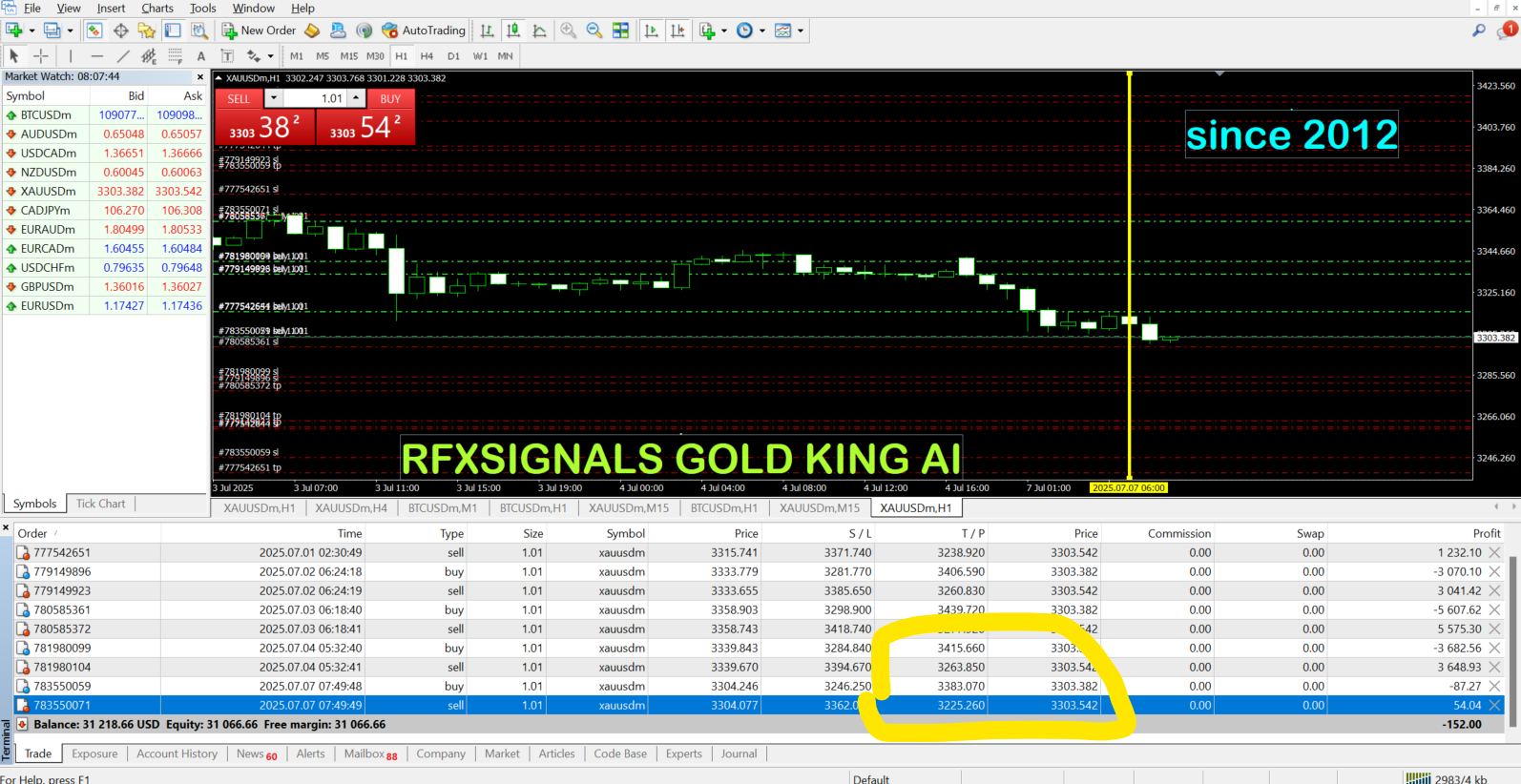

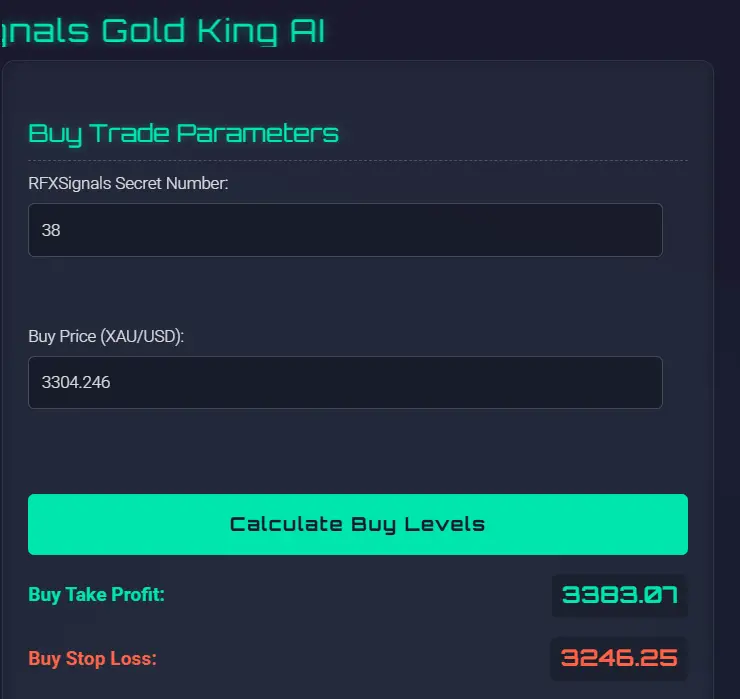

📈 Learn and Earn with RFXSignals

Avoid costly mistakes by following experts. Get daily Gold signals and market insights on Telegram.

🚀 Join Our Telegram Channel