What is Forex Trading? A Beginner’s Guide

Published by: RFXSignals

Forex trading, also known as foreign exchange trading, is the world’s largest financial market where global currencies are bought and sold. This beginner’s guide will walk you through the basics of forex trading, why it matters, how to get started, and how RFXSignals can help you with accurate forex signals.

🔹 What is Forex Trading?

Forex (foreign exchange) trading is the process of exchanging one currency for another in the hopes of making a profit. For example, when you exchange USD for EUR, you are engaging in a forex transaction. Unlike stock markets, forex operates 24 hours a day, 5 days a week, making it highly flexible and accessible.

🔹 Why Do People Trade Forex?

- Liquidity: Trade anytime with minimal restrictions.

- Leverage: Brokers allow traders to control large positions with small capital.

- Diversification: Traders can speculate on currency strength, hedge risks, or complement other investments.

- Opportunities: Both rising and falling markets can be profitable.

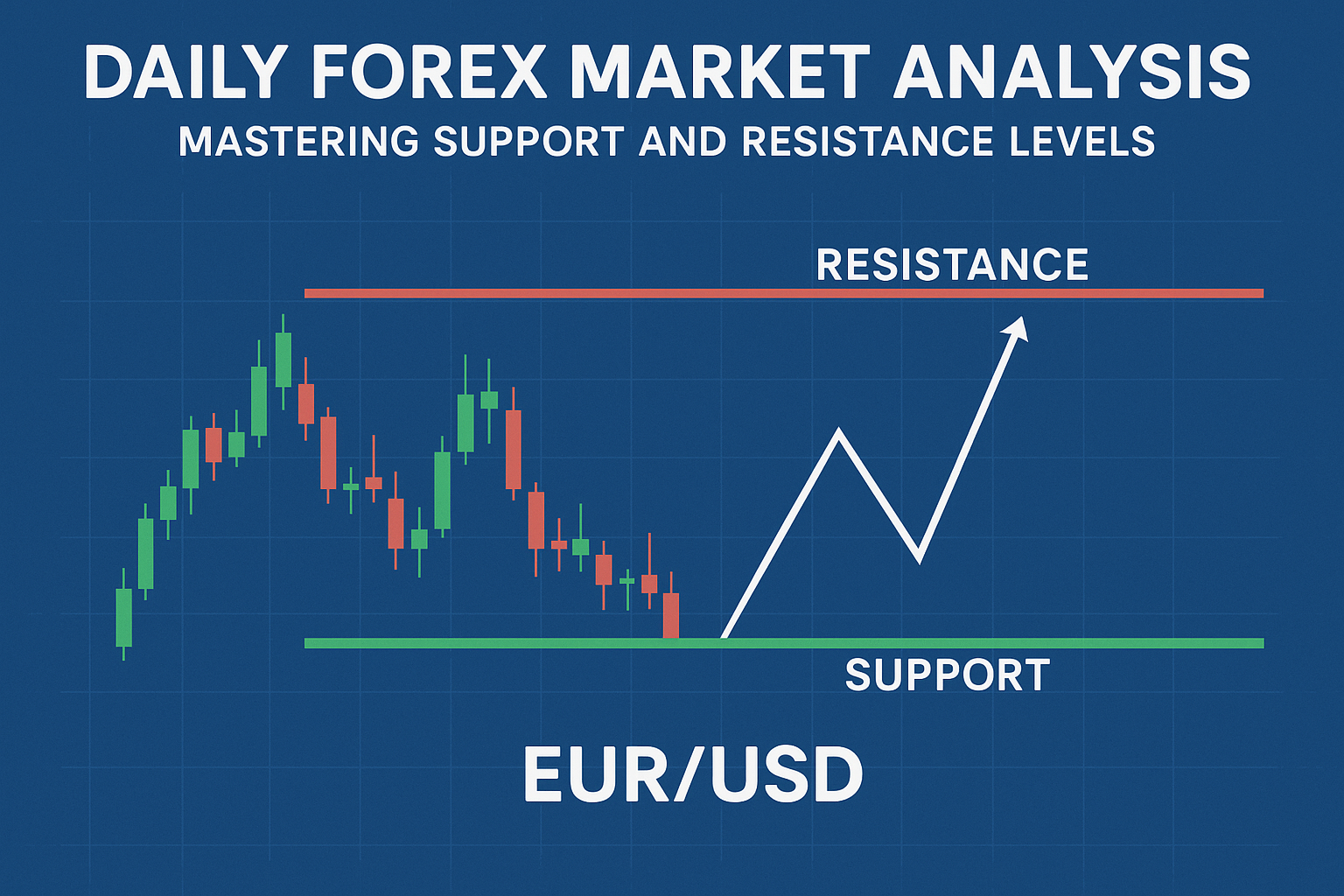

🔹 How Does Forex Trading Work?

Forex trading always happens in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency. When you trade forex, you’re betting on whether the base currency will rise or fall against the quote currency.

Example Trade:

If EUR/USD = 1.1000 and you believe the Euro will rise against the USD, you buy EUR/USD. If the rate climbs to 1.1200, you profit from the difference.

🔹 Key Terms Every Beginner Should Know

- Pips: Smallest price movement in forex.

- Lots: Standard trade sizes (micro, mini, standard).

- Leverage: Borrowing capital to increase trade exposure.

- Margin: The collateral required to open a leveraged trade.

- Spread: Difference between bid (buy) and ask (sell) price.

🔹 Popular Forex Trading Strategies

Successful traders often rely on proven strategies. Here are a few beginner-friendly ones:

- Scalping: Making multiple quick trades for small profits.

- Day Trading: Opening and closing trades within the same day.

- Swing Trading: Holding trades for several days to catch trends.

- Position Trading: Long-term trades lasting weeks or months.

🔹 Risks of Forex Trading

Like all financial markets, forex trading involves risks:

- High leverage can magnify both profits and losses.

- Emotional trading often leads to mistakes.

- Market volatility can cause unexpected price movements.

To manage risk, use stop-loss orders, trade small positions, and never invest more than you can afford to lose.

🔹 Getting Started with Forex Trading

- Choose a reliable broker: Look for regulation, tight spreads, and fast execution. (Read broker guide)

- Open a demo account: Practice trading with virtual money.

- Learn analysis: Master technical and fundamental analysis.

- Start small: Trade with a low-risk strategy and small lot sizes.

- Use forex signals: Services like RFXSignals Forex Signals provide accurate trade alerts to help beginners.

🔹 The Role of Forex Signals

Forex signals are trade recommendations sent to traders in real-time. At RFXSignals, we provide accurate signals based on expert analysis, helping beginners make profitable decisions without years of market experience.

🔹 Frequently Asked Questions (FAQ)

1. Is forex trading profitable?

Yes, but only if you manage risk properly. Many beginners lose money due to lack of discipline.

2. How much money do I need to start forex trading?

You can start with as little as $100, but $500–$1000 is recommended for flexibility.

3. Is forex trading safe?

Forex trading is safe if you use regulated brokers and practice strong risk management.

🔹 Conclusion

Forex trading is one of the most exciting ways to participate in global finance. With proper education, strategies, and the right tools like RFXSignals premium signals, beginners can accelerate their trading journey while reducing risks.

📈 Join RFXSignals & Improve Your Forex Trading