Moving Average Crossover Strategy: Does It Still Work in Forex?

Short answer: Yes — but not as a stand-alone "set-and-forget" system. Moving Average (MA) crossovers still form the backbone of many trend-following methods, but in 2025 they must be combined with filters, risk controls, and sensible execution to remain profitable.

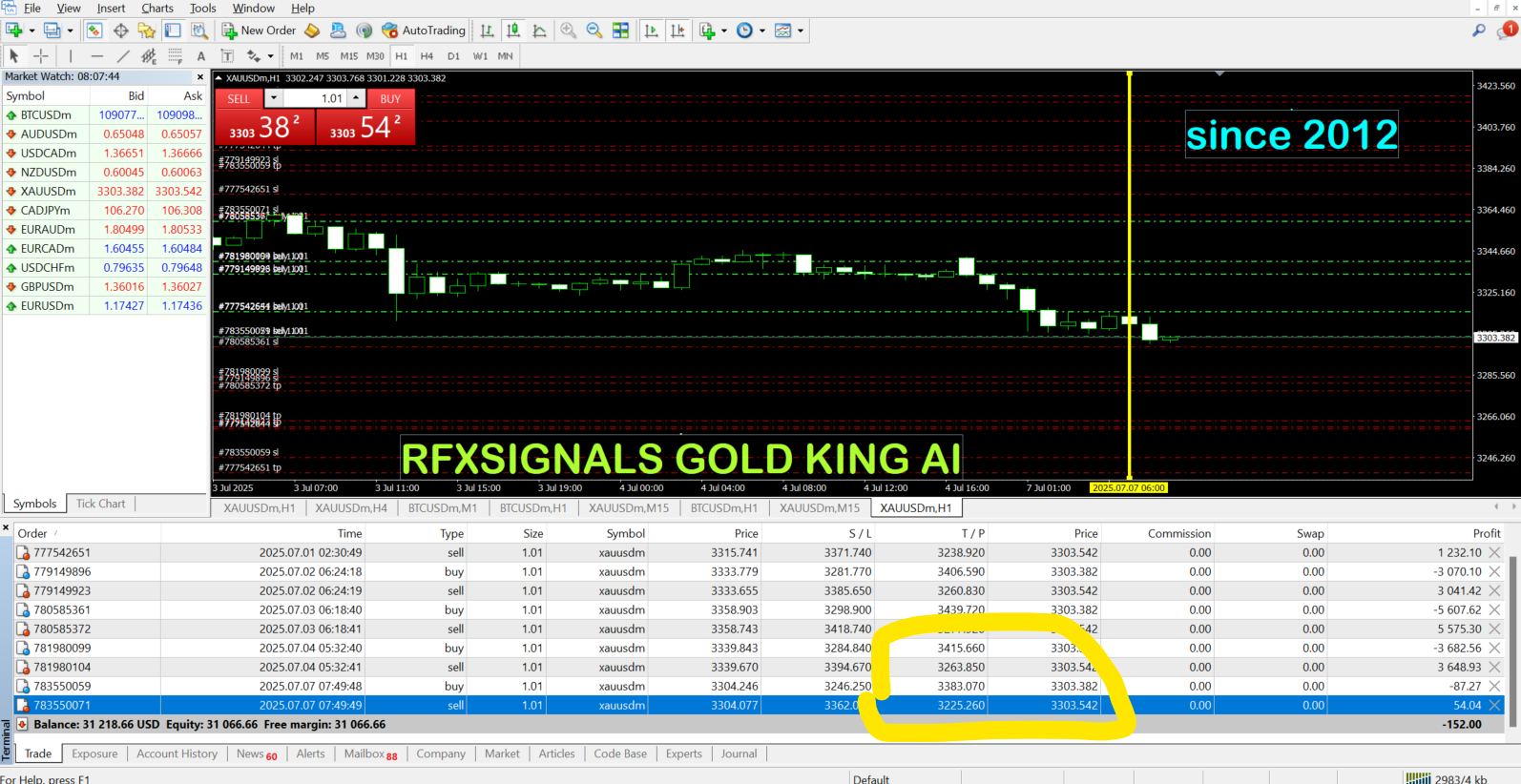

Join RFXSignals channels for real-time signals, MA-based setups, and trade management tips — perfect for traders who want practical implementation help.

What is an MA Crossover Strategy?

At its core, an MA crossover uses two (or more) moving averages of price — typically one “fast” (short period) and one “slow” (long period). A buy signal occurs when the fast MA crosses above the slow MA; a sell signal occurs when it crosses below. Common pairs include EMA(9)/EMA(21), SMA(50)/SMA(200) and EMA(20)/EMA(50).

Why MA Crossovers Worked Historically

MA crossovers are simple trend-following triggers. They worked because markets exhibit persistent trends and moving averages smooth price noise, allowing traders to ride directional moves while staying out of sideways markets. Simplicity also meant easy backtesting and clear rules for entries and exits.

Why a Raw MA Crossover Often Fails Today

- Whipsaw in ranging markets: frequent false signals when price oscillates between support and resistance.

- Delay: MAs are lagging indicators — entries often occur after a large part of the move.

- Execution & costs: spreads, slippage and commissions can eat small MA profits, especially for shorter timeframes.

- Market microstructure: algorithmic liquidity-taking and news-driven volatility produce spikes that trigger and then reverse crossover signals.

How to Make MA Crossovers Work in 2025 — Practical Upgrades

Don’t discard MA crossovers — upgrade them. Below are modern, practical enhancements that keep the simplicity but reduce the weaknesses.

1. Use Multi-Timeframe Confirmation

Require the MA crossover on a lower timeframe (e.g., H1) to agree with the trend on a higher timeframe (e.g., H4 or Daily). This reduces whipsaw and aligns entries with stronger trends.

2. Add a Trend Filter

Combine a long-term trend filter such as SMA(200) or the ADX. Example rule: only take long crossovers when price is above SMA(200) and ADX > 20. Filters block low-probability trades in choppy markets.

3. Use Price Structure & Support/Resistance

Prefer crossovers that occur near structure — pullbacks to trend support or resistance zones. A crossover that happens in the middle of a range is less reliable than one near confluence.

4. Improve Entries with Confirmation

Instead of market entering immediately on crossover, wait for a price candle close beyond the crossover or a micro pullback (retest) to improve risk-to-reward. Use lower timeframe rejection candles to fine-tune entry.

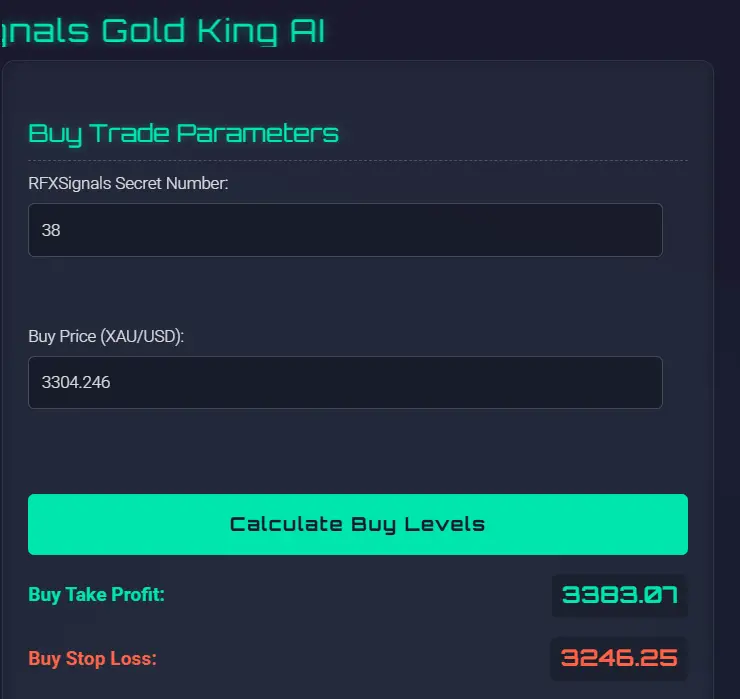

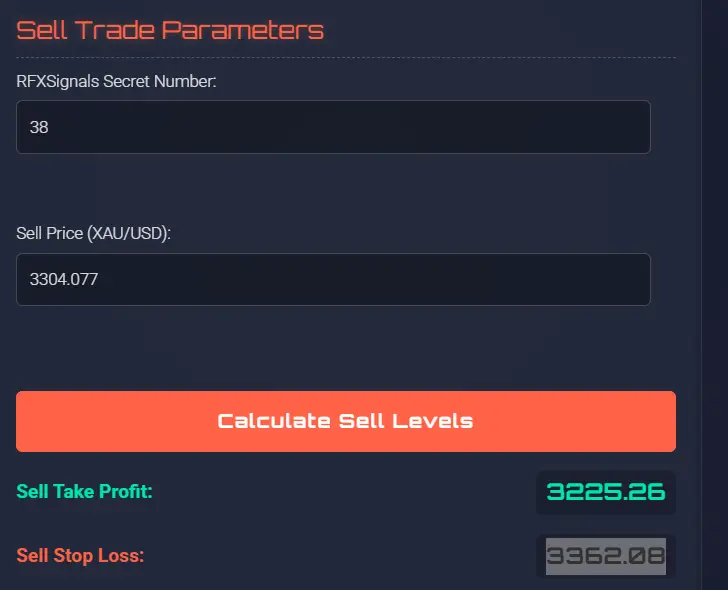

5. Smarter Stop and Target Placement

Use ATR(14) for dynamic stops or place stops beyond recent swing lows/highs. Avoid fixed pip stops that don't account for pair volatility. Targets can be fixed multiples (2–3R) or use trailing stops to capture extended trends.

Example Robust MA Crossover System (H1/H4)

- Trend filter: Daily SMA(200) — only trade in direction of Daily trend.

- Signal: EMA(20) crosses EMA(50) on H1.

- Confirmation: H4 EMA(20) > EMA(50) for longs (or vice versa for shorts).

- Entry: Wait for H1 candle close above crossover and a retest to EMA(20) or minor support.

- Stop: 1.5 × ATR(14) below entry or below last swing low.

- Take profit: initial target 1.5× risk, trail stop to capture larger move or scale out 40%/60% at partial targets.

Position Sizing & Risk Management

Good risk management turns an edge into a long-term profit stream. Use these rules:

- Risk no more than 0.5%–1% of account per trade (lower for frequent strategies).

- Cap aggregate portfolio risk: don’t allow more than 3–5% at risk across open positions.

- Avoid running uncompensated high leverage; use leverage as a tool, not as a crutch.

- Keep a trading journal tagging each trade as “MA crossover” with filter details — helps refine the setup over time.

Performance Expectations & Metrics

MA crossover systems are trend-followers — expect:

- Low win rate but positive expectancy if winners are allowed to run.

- Long periods of small losing trades interrupted by infrequent large winners (fat tails).

- Key metrics to track: expectancy, profit factor, max drawdown, average trade length and percent of equity at risk.

Common Pitfalls and How to Avoid Them

- Chasing late entries: don’t enter impulsively after a big crossover candle — use a small retest or confirmation candle.

- Ignoring spread & slippage: ensure expected reward covers transaction costs, especially for shorter-term MAs.

- No rules for news: MA systems can be broken by high-impact data; apply news filters or reduce position size around scheduled events.

- Over-optimization: avoid curve-fitting MA periods to historical data; prefer robust parameter ranges and walk-forward testing.

How to Combine MA Crossovers With Other Techniques

MA crossovers are a great timing tool — combine with:

- SMC / Market Structure: use crossovers for entries when structure flips or OBs are retested.

- Volume/Order Flow: confirm that crossovers align with increased participation.

- Momentum Oscillators: confirm direction with RSI or Stochastic to filter low momentum crossovers.

Link Building & Funneling Traders to RFXSignals

Internal links: Throughout your content link to practical pages like Daily Forex Market Analysis, multi-strategy guides, and service pages that describe signal delivery.

Community CTAs: Use the CTAs above to funnel readers to your Telegram & WhatsApp groups: Telegram: @rfxtrading and WhatsApp Group. Add UTM parameters to links to track conversions from specific articles.

Off-page: Syndicate short “how-to” snippets to Forex blogs and include a canonical backlink to this cornerstone MA article. Offer guest posts that show a live trade log (screenshots + results) and link back to your channel for trade evidence.

Quick Implementation Checklist

- Choose MA pair (e.g., EMA(20)/EMA(50) on H1 + SMA(200) Daily filter).

- Backtest at least 2–5 years with commission & spread simulated.

- Forward-test on demo for 6–8 weeks, logging each trade.

- Define stops, targets, and portfolio risk caps.

- Publish results to your community and iterate based on data.

We share MA-based setups, chart annotations and trade management tips inside our channels. Join to see live examples and downloadable spreadsheets that show entry/exit logic.

Conclusion & Disclaimer

Moving Average crossover strategies remain a valid foundation for trend-following forex systems in 2025 — but only when upgraded with filters, multi-timeframe confirmation, robust risk management, and modern execution practices. Treat MA crossovers as a decision-making component, not an all-in-one system. Backtest, forward-test, and keep a disciplined journal to refine your edge.

Disclosure: This article is educational and not financial advice. Forex trading involves significant risk. Test systems on demo accounts and trade only with capital you can afford to lose.