Fibonacci Retracements Analysis 20.12.2019 (BITCOIN, ETHEREUM)

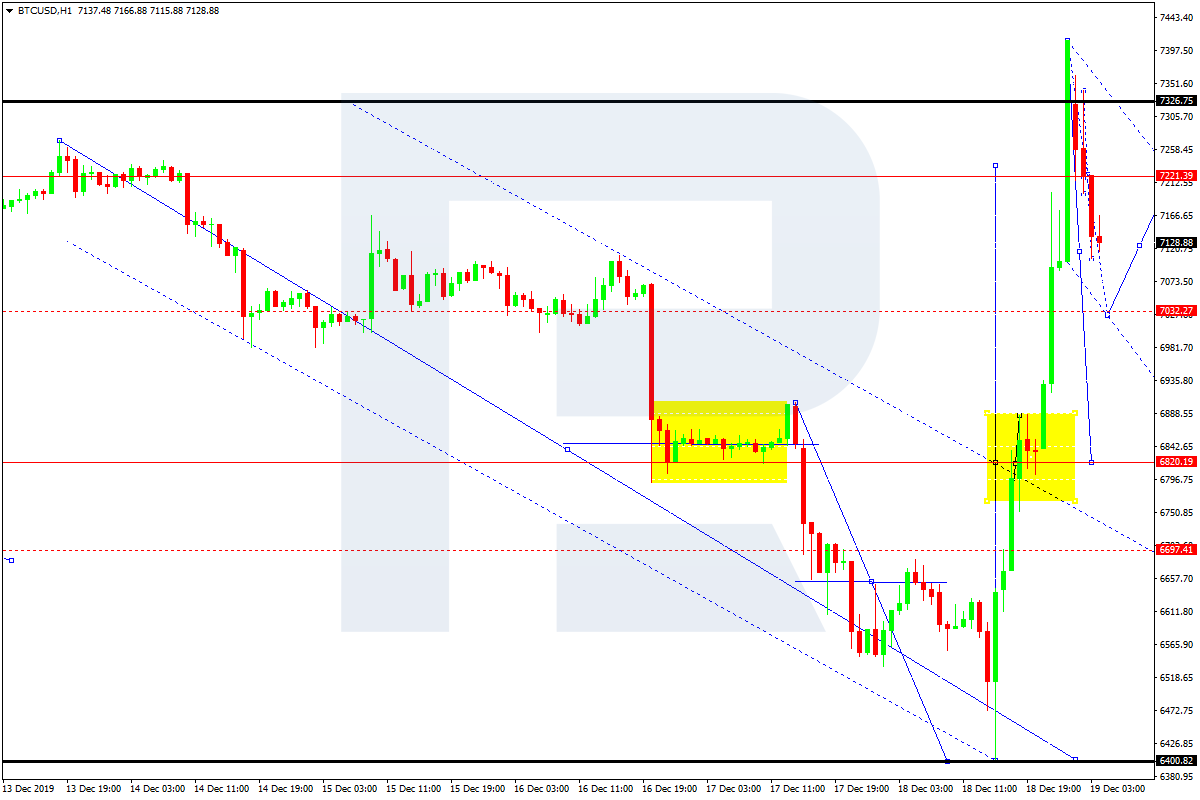

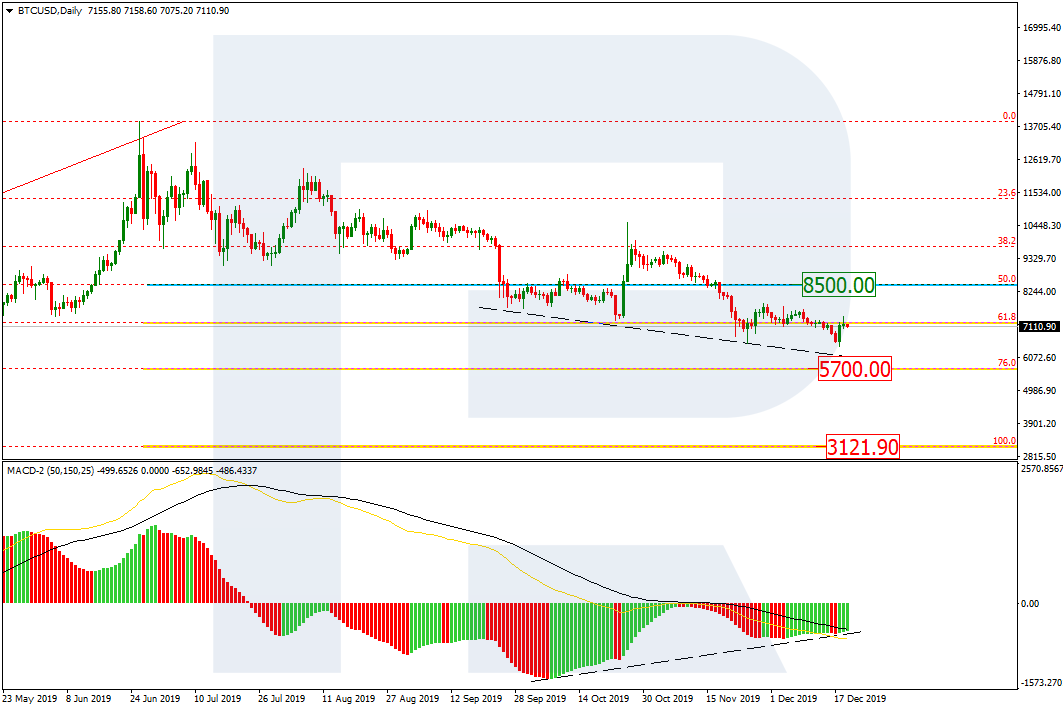

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the daily chart, the descending tendency continues. After updating the local low, BTCUSD has returned to 61.8% fibo. Considering the convergence on MACD, this movement may be described as a short-term correction. The resistance is 50.0% fibo at 8490.00. After completing the correction, the pair may resume falling towards the target at 76.0% (5700.00). The key mid-term downside target is the low at 3121.90.

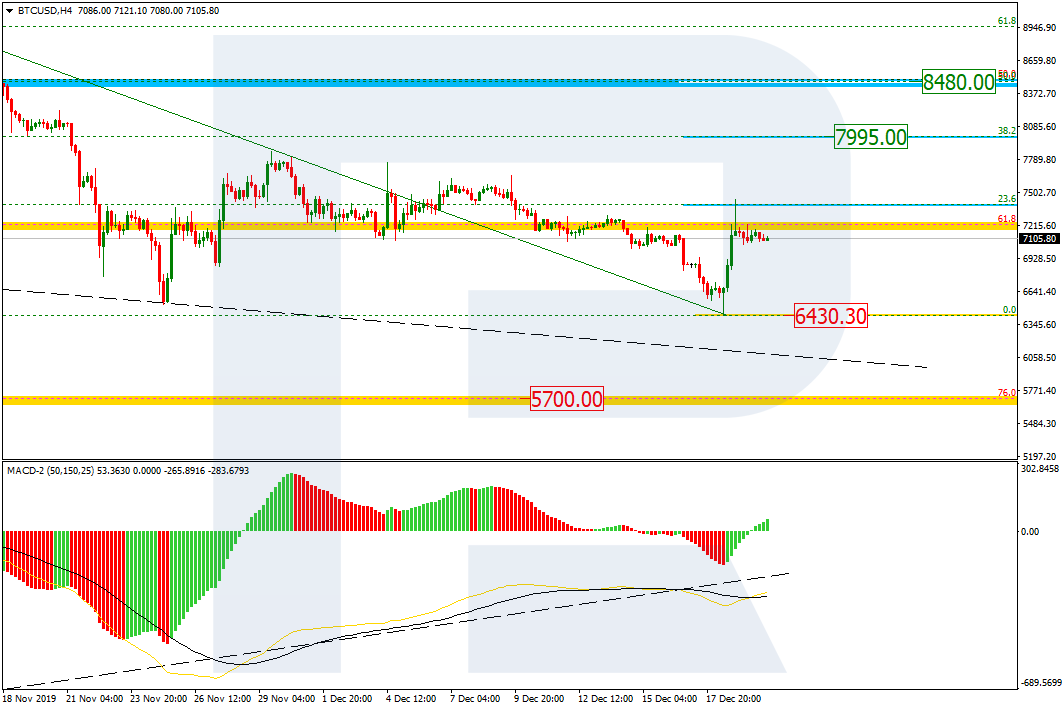

The H4 chart shows more detailed structure of the current local correction. By now, the pair has managed to reach 23.6% fibo; at the moment, the price is trading close to this level. The next rising impulse may later continue towards 38.2% and 50.0% fibo at 7995.00 and 8480.00 respectively. If the price breaks the local support at 6430.30, the correction will be over.

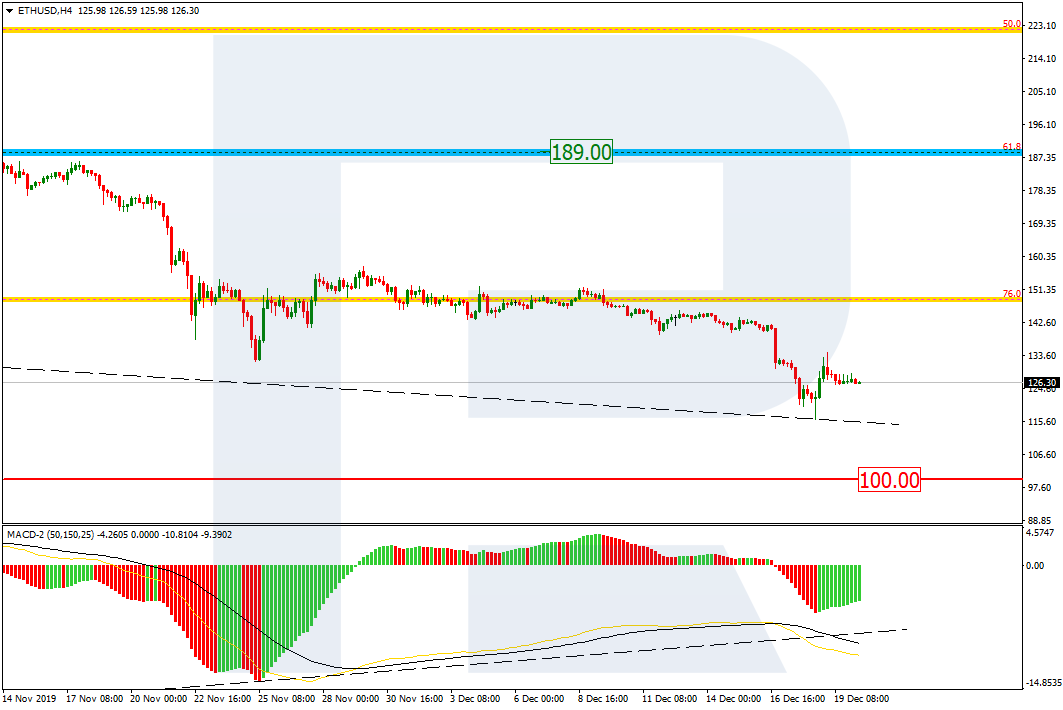

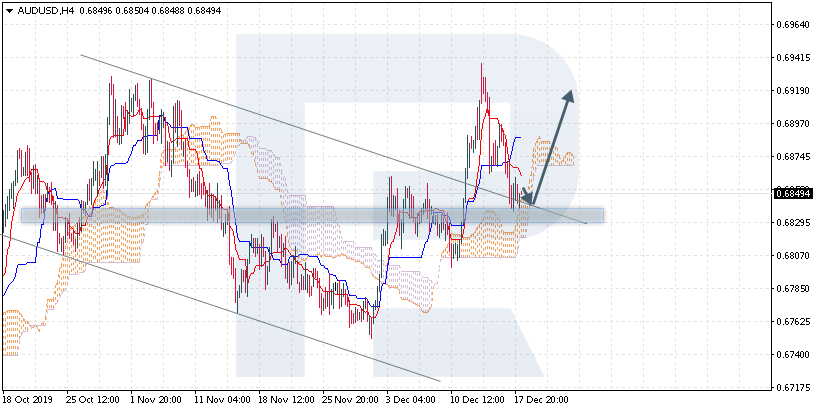

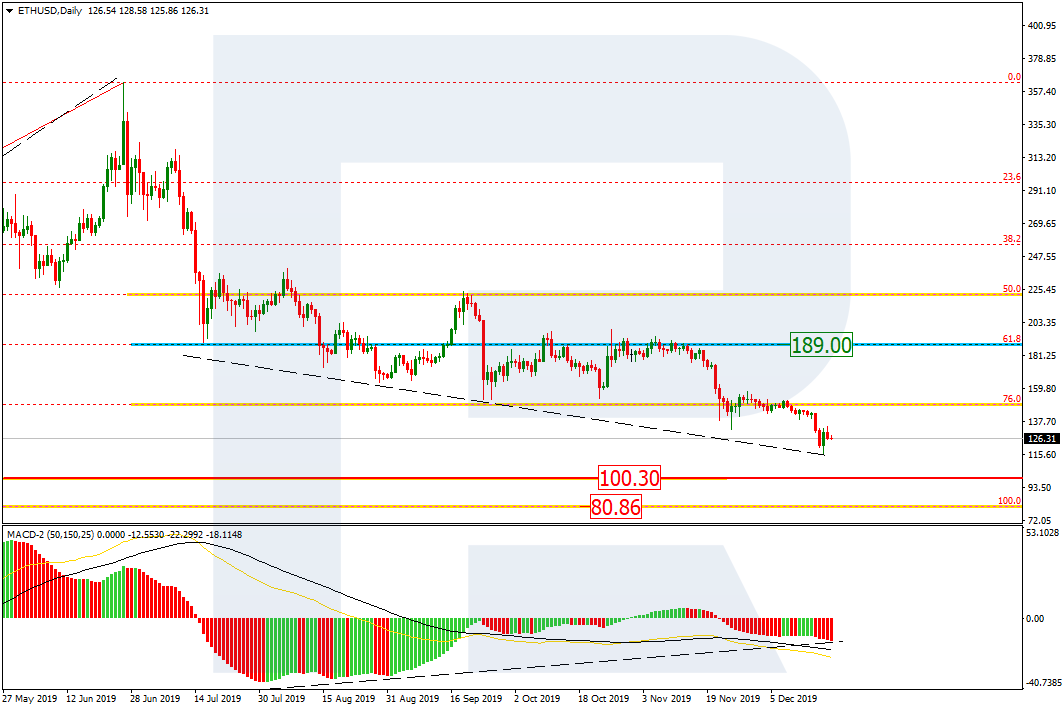

ETHUSD, “Ethereum vs. US Dollar”

As we can see in the daily chart, the downtrend has broken 76.0% fibo; right now, ETHUSD is heading towards this year’s low at 80.86 and must break a psychologically-crucial of 100.00 on its way. The resistance is 61.8% fibo at 189.00.

The H4 chart shows more detailed structure of the current correction, which is getting close to 100.00. At the same time, there is a convergence on MACD, which may indicate a new pullback soon.