Ichimoku Cloud Analysis 24.12.2019 (AUDUSD, NZDUSD, USDCAD)

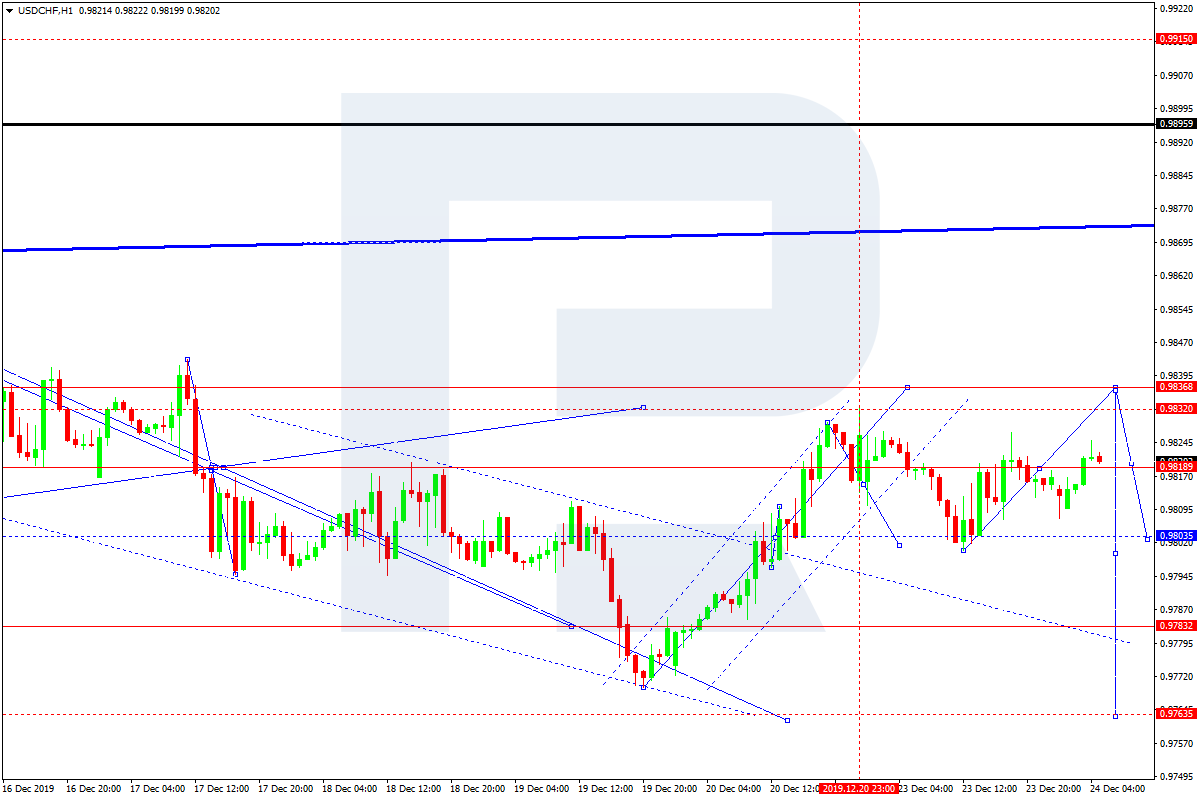

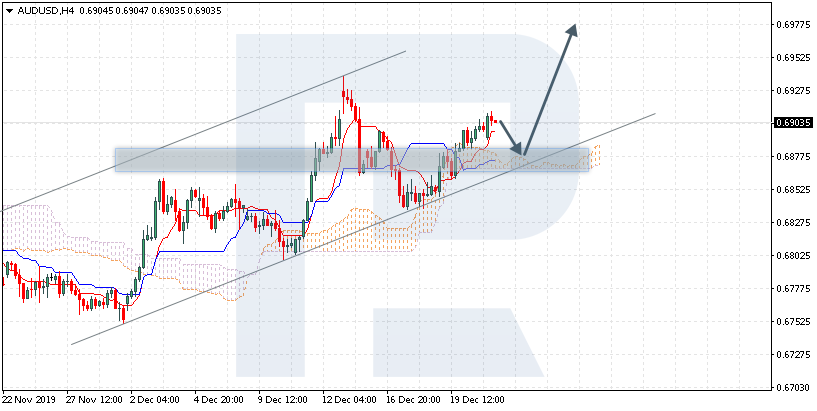

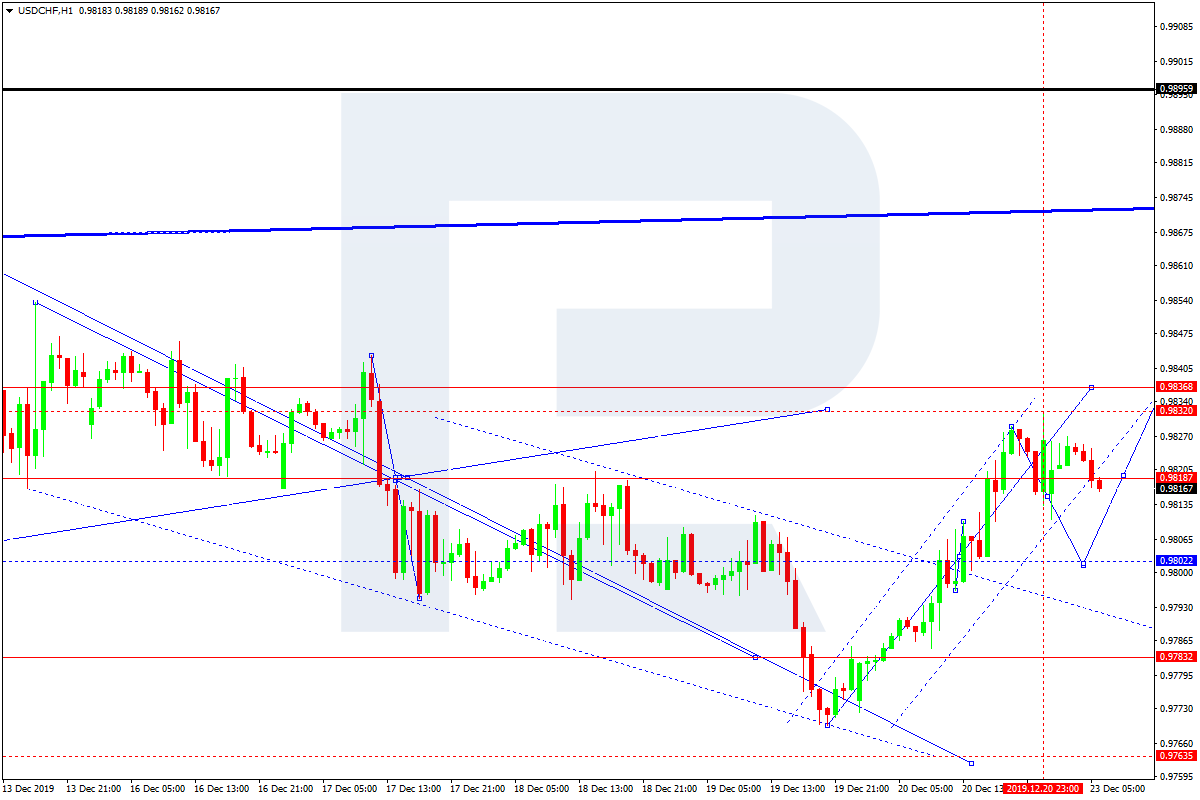

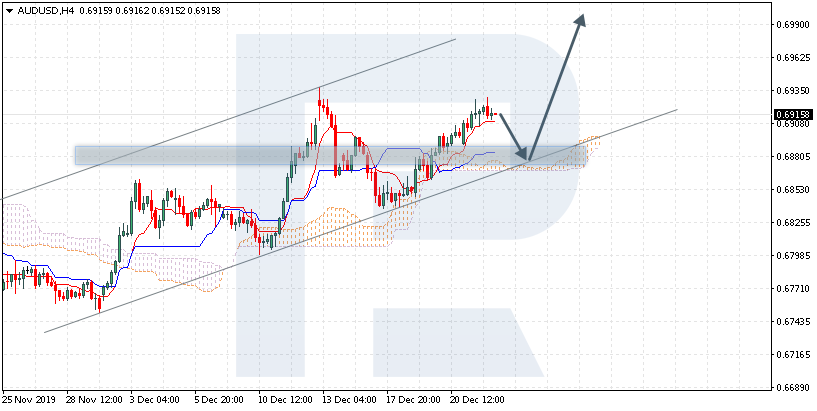

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is trading at 0.6915; the instrument is moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test the cloud’s upside border at 0.6885 and then resume moving upwards to reach 0.6995. Another signal to confirm further ascending movement is the price’s rebounding from the support level. However, the scenario that implies further growth may be canceled if the price breaks the cloud’s downside border and fixes below 0.6845. In this case, the pair may continue falling towards 0.6755.

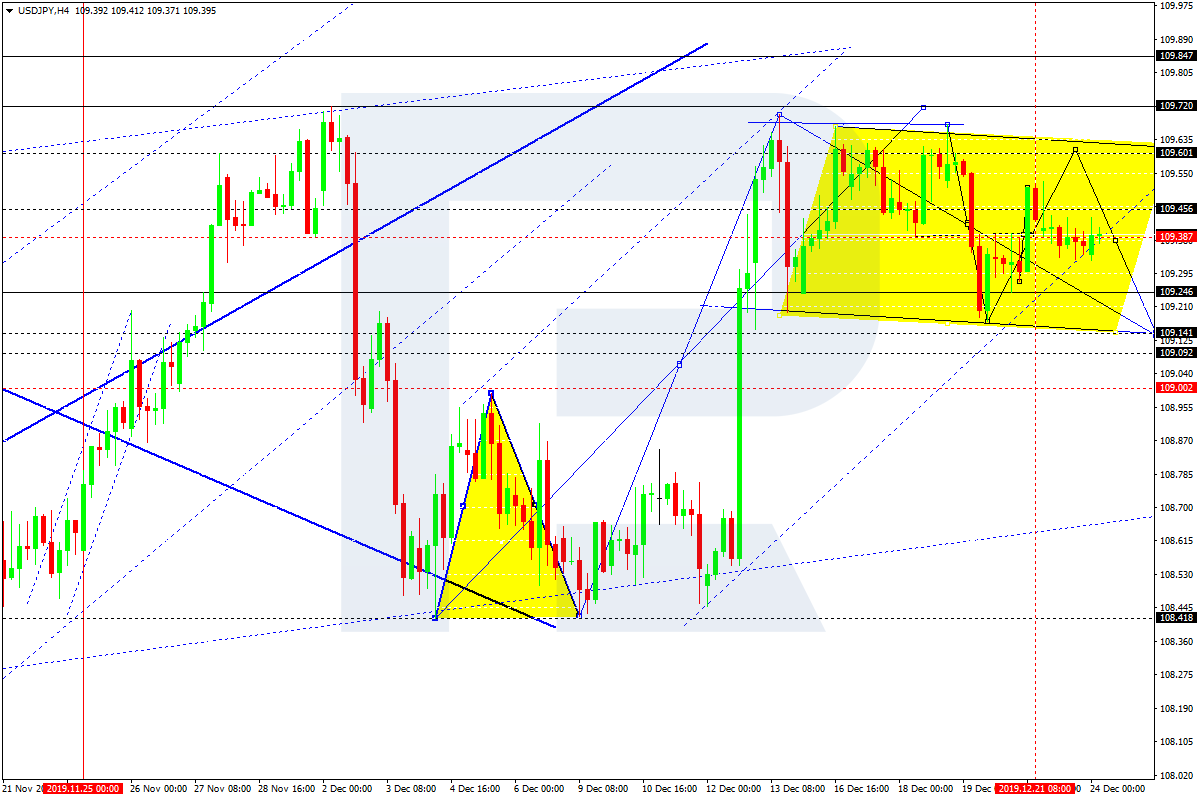

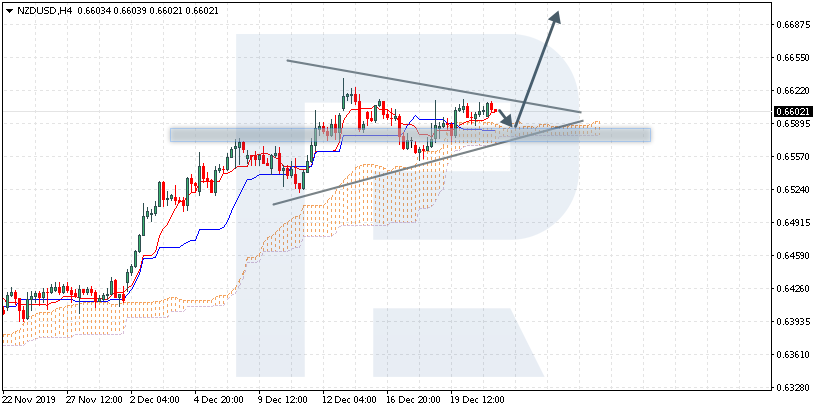

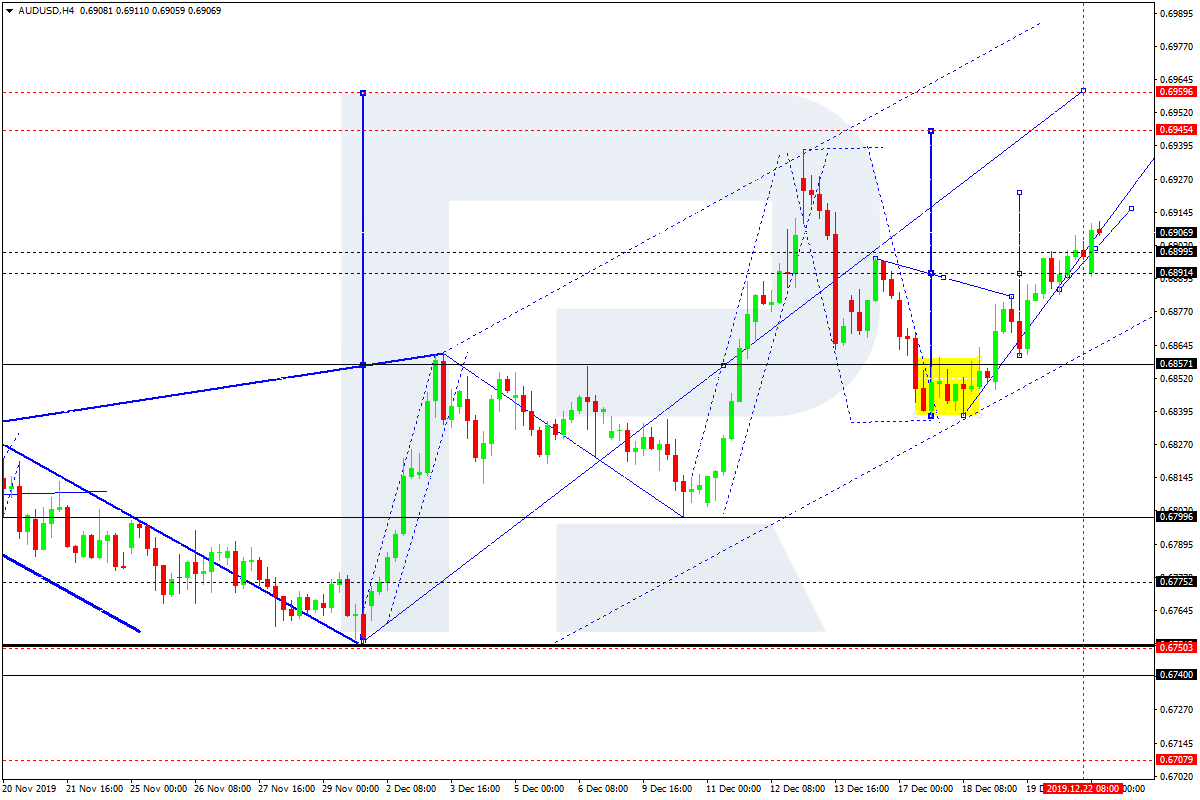

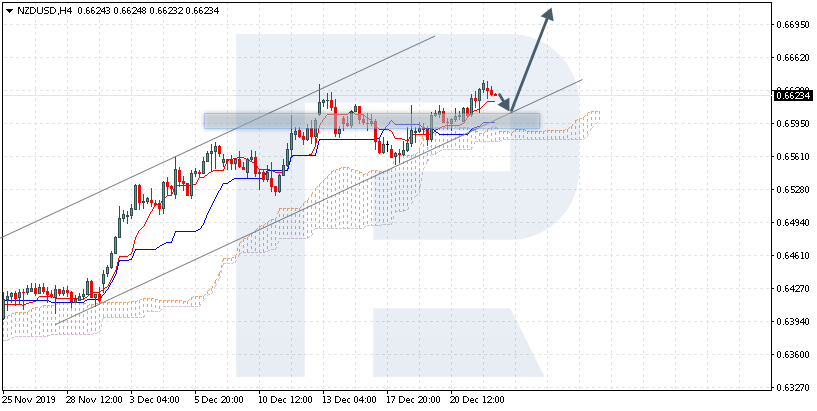

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is trading at 0.6623; the instrument is moving above Ichimoku Cloud, thus indicating an ascending tendency. The markets could indicate that the price may test Tenkan-Sen and Kijun-Sen at 0.6600 and then resume moving upwards to reach 0.6710. Another signal to confirm further ascending movement is the price’s rebounding from the rising channel’s downside border. However, the scenario that implies further growth may be canceled if the price breaks the cloud’s downside border and fixes below 0.6550. In this case, the pair may continue falling towards 0.6465.

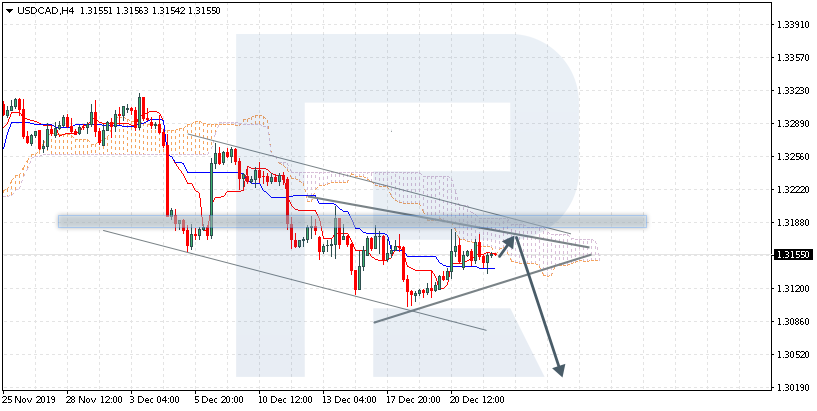

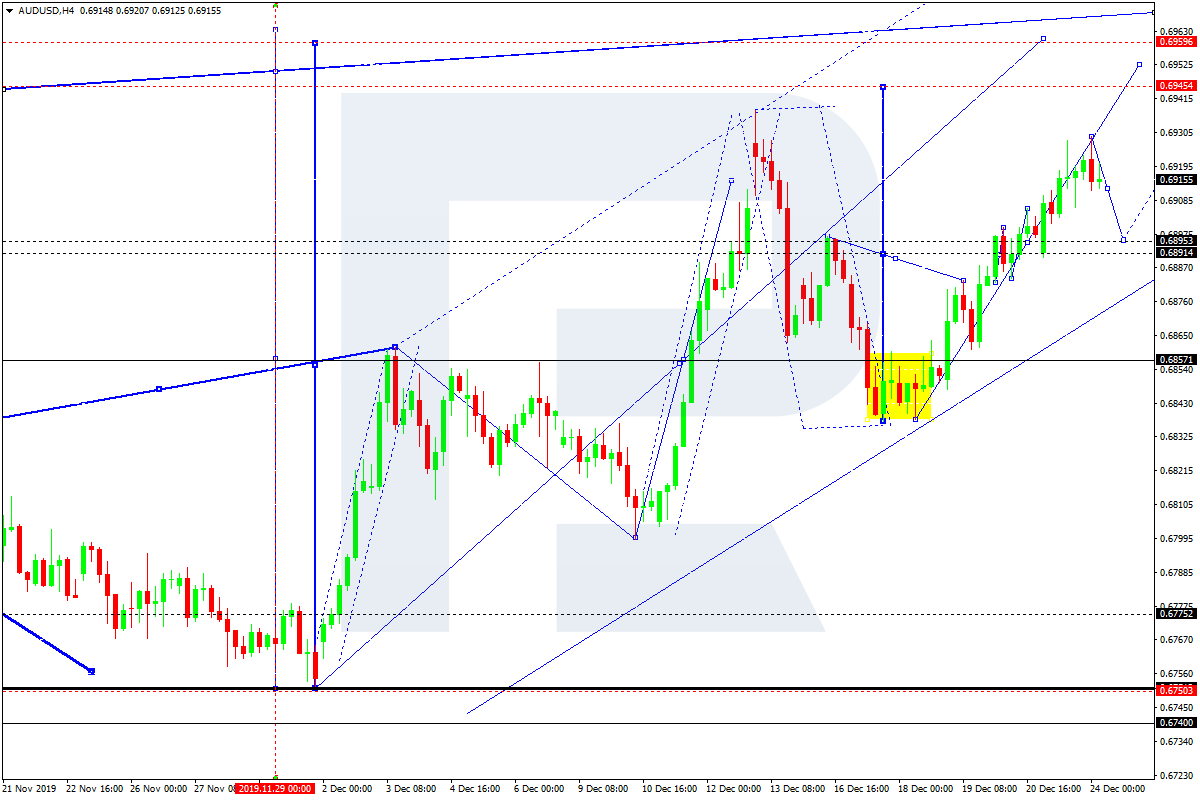

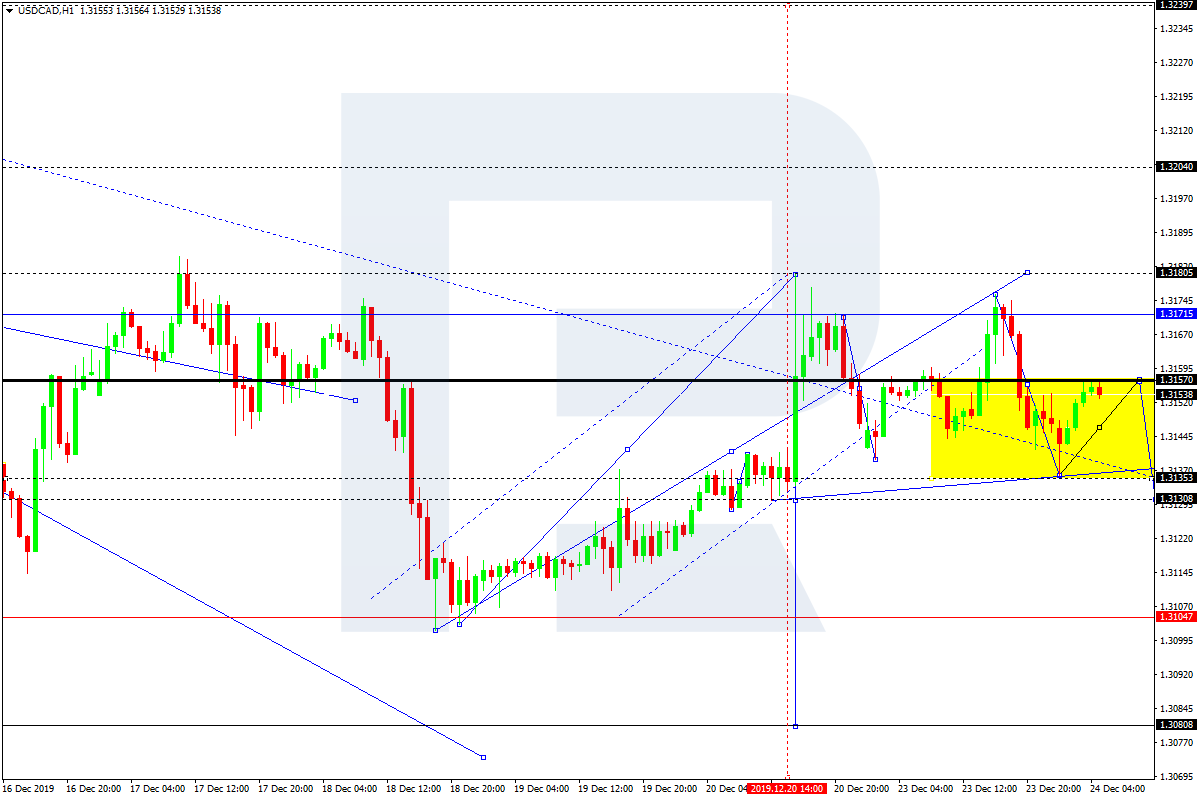

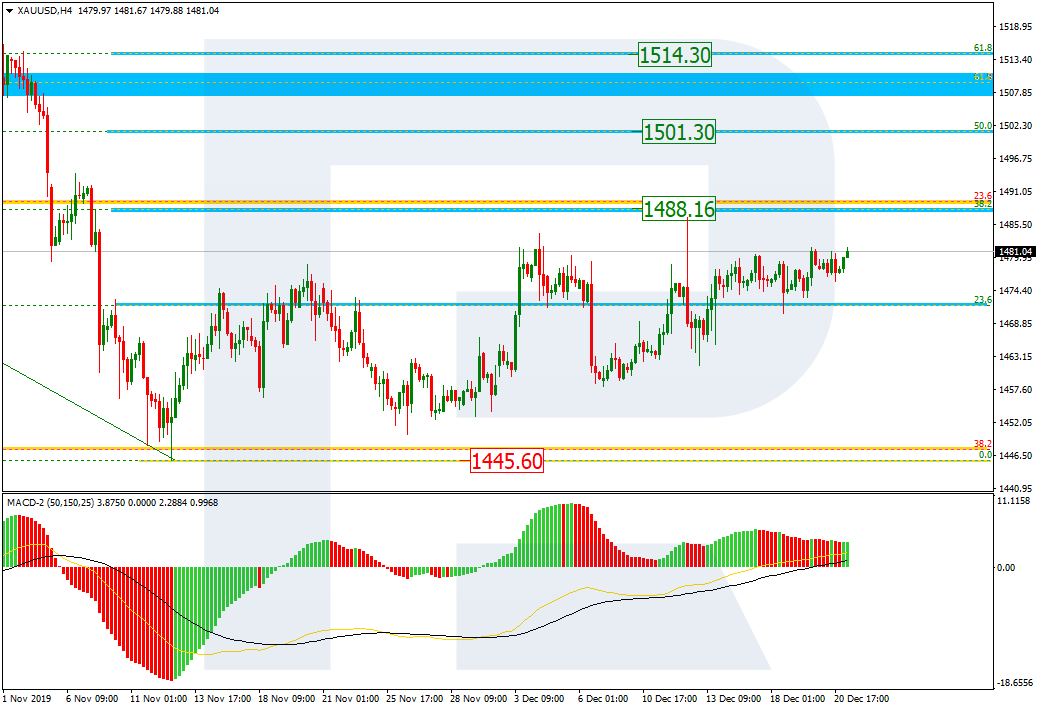

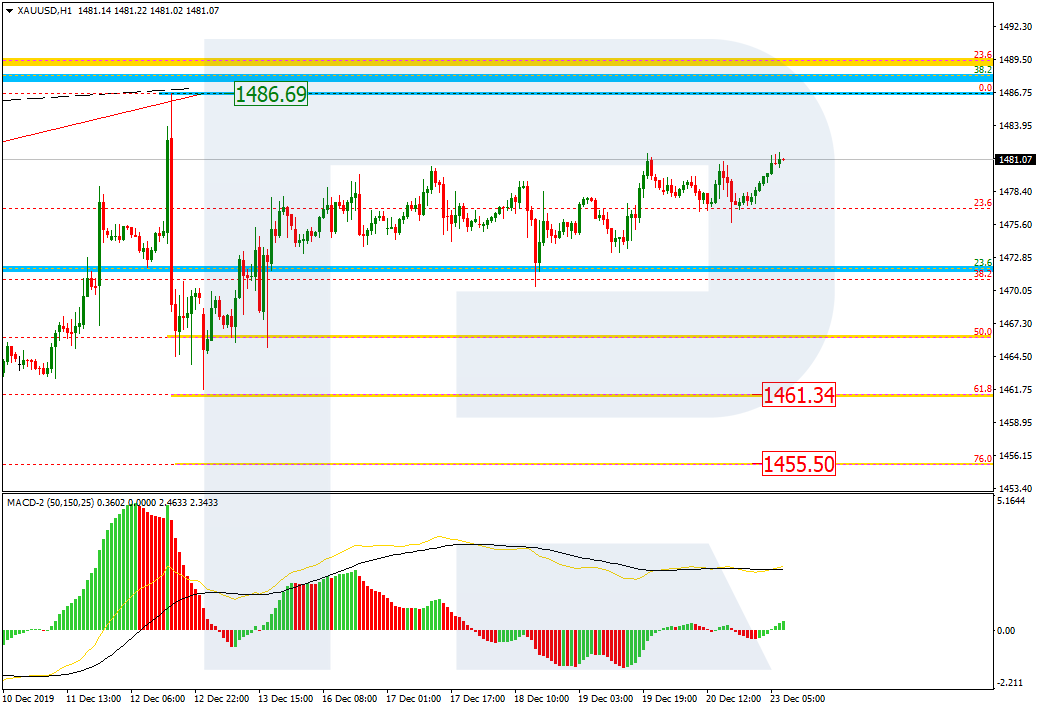

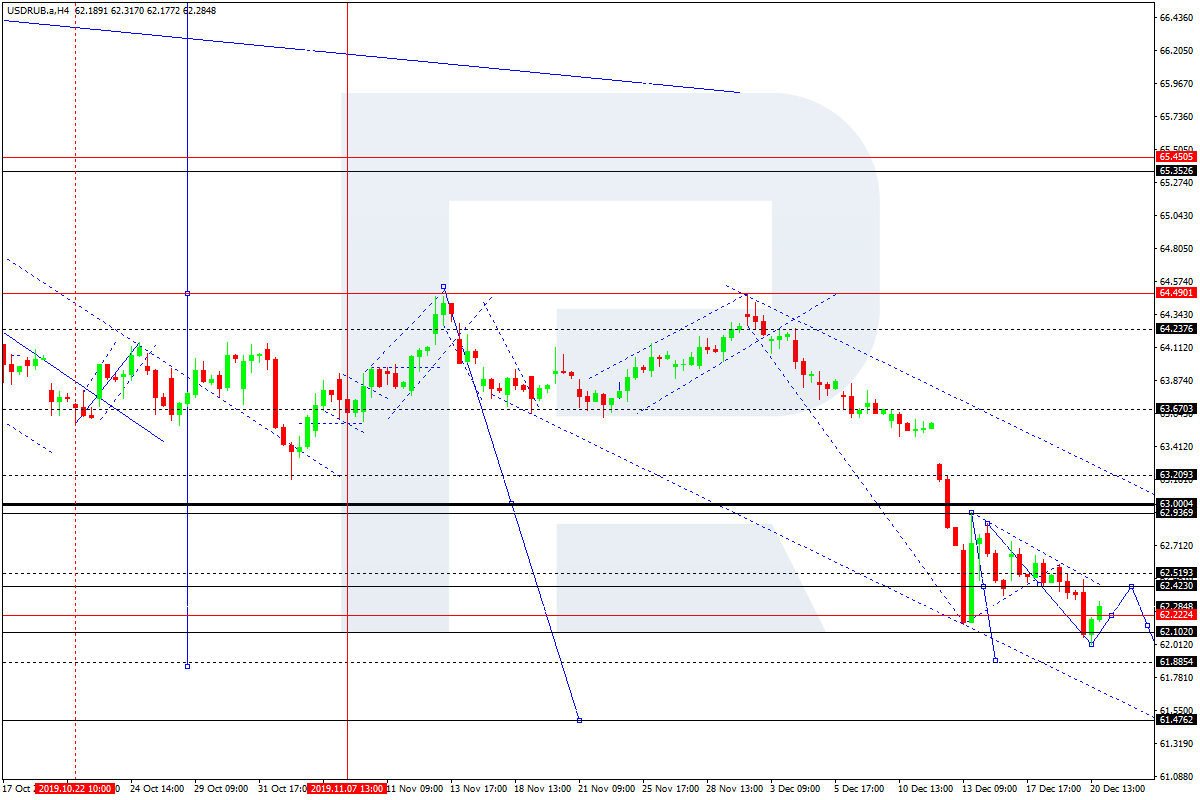

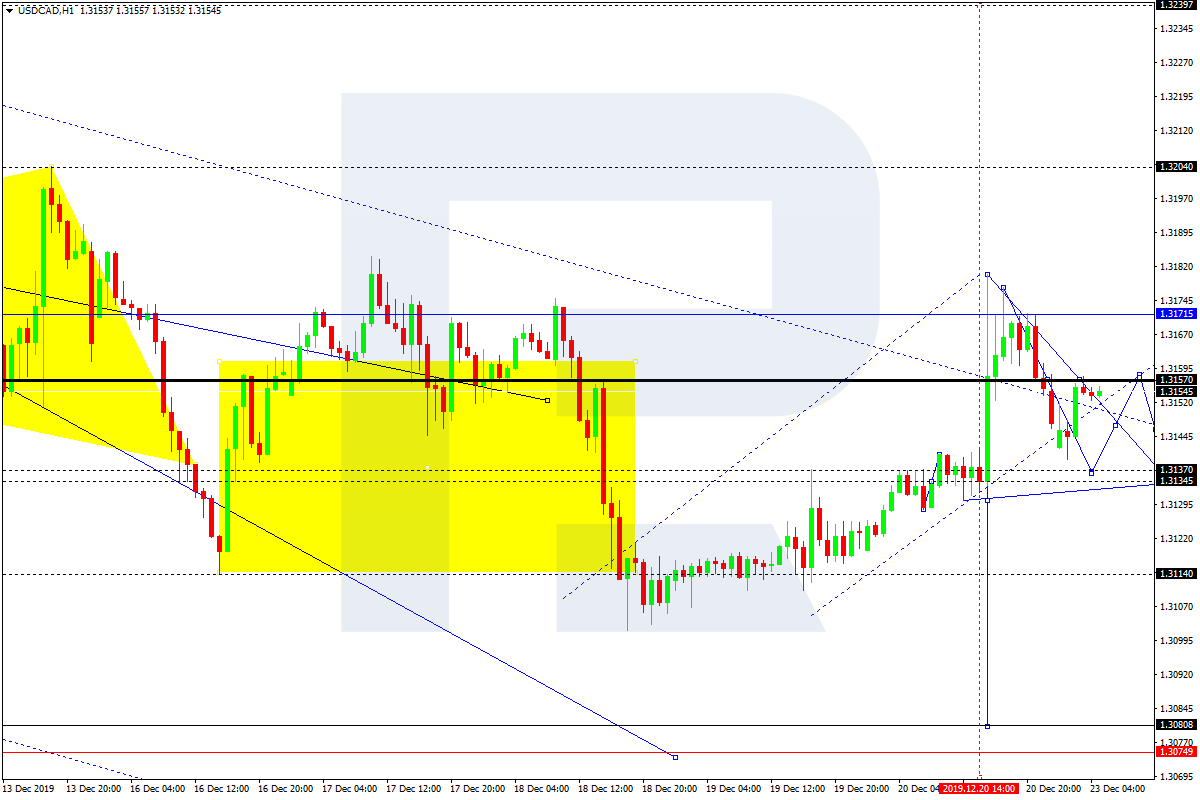

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is trading at 1.3155; the instrument is moving below Ichimoku Cloud, thus indicating a descending tendency. The markets could indicate that the price may test the cloud’s upside border at 1.3165 and then resume moving downwards to reach 1.3025. Another signal to confirm further descending movement is the price’s rebounding from the descending channel’s upside border. However, the scenario that implies further decline may be canceled if the price breaks the cloud’s upside border and fixes above 1.3220. In this case, the pair may continue growing towards 1.3305. After breaking Triangle’s downside border and fixing below 1.3110, the price may continue moving downwards.